On Tuesday, Bitcoin Exchange Traded Funds (ETFs) brought in a total of $609 million, making it their sixth consecutive day of investments and setting a new record for daily volume. Similarly, Ether ETFs continued their positive trend, recording a fourth straight day of gains with an inflow of approximately $587,000.

Bitcoin ETF Surge Drives Daily Volume to $7.5 Billion

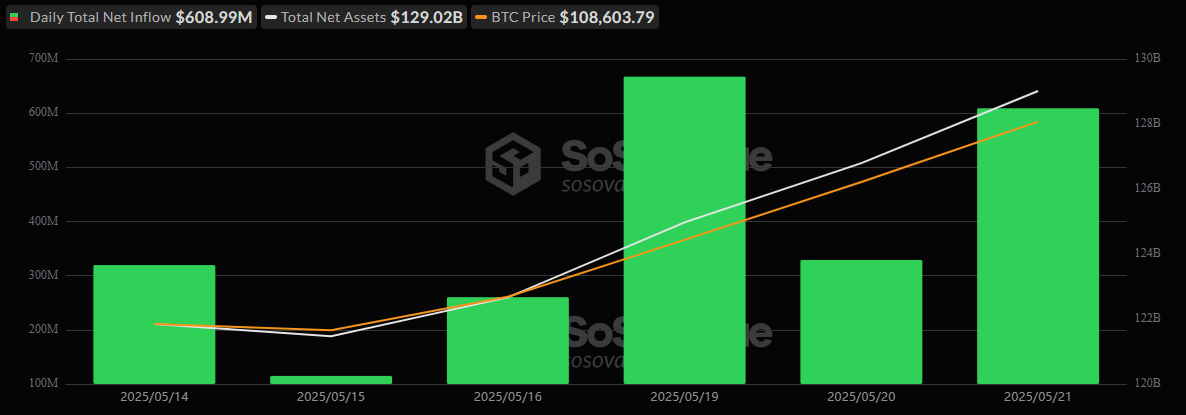

Momentum isn’t just alive in crypto exchange-traded funds (ETFs), it’s surging. Bitcoin ETFs clocked a staggering $608.99 million in net inflows on Tuesday, May 21, notching their 6th consecutive day in the green and registering $7.64 billion in total value traded, levels that were last seen in February 2025.

Once more, Blackrock’s IBIT led the pack, taking in a massive $530.63 million, representing the majority of the day’s investments. Fidelity’s FBTC came in second with $23.53 million, while Grayscale’s Bitcoin Mini Trust and Bitwise’s BITB trailed closely behind with approximately $22.14 million and $20.49 million respectively.

Smaller but notable contributions came from Vaneck’s HODL ($6.09 million), ARK 21Shares’ ARKB ($4.29 million), and Valkyrie’s BRRR ($1.83 million). Remarkably, no outflows were reported across the 12 bitcoin ETFs, signaling continued investor confidence. Total net assets rose to $129.02 billion.

Ether ETFs also kept pace, albeit with more modest movement. A net inflow of $587,130 was recorded, marking the 4th straight day of inflows. While Blackrock’s ETHA brought in $24.86 million, it was nearly offset by Fidelity’s FETH, which saw $24.28 million in outflows. Still, the balance tilted positive. Ether ETFs saw $657.66 million in trading volume, with net assets closing at $8.74 billion.

With both bitcoin and ether ETFs in extended inflow territory, institutional enthusiasm is proving anything but fleeting.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Lottery apologizes after thousands mistakenly told they won millions

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- J.K. Rowling isn’t as involved in the Harry Potter series from HBO Max as fans might have expected. The author has clarified what she is doing

- Mirren Star Legends Tier List [Global Release] (May 2025)

2025-05-22 23:16