Bitcoin ETFs, after taking a brutal midweek blow, clawed their way back on Thursday, April 17, hauling in a hefty $108 million. Almost two-thirds of the previous day’s exit scam reversed, thanks to Blackrock and Fidelity throwing money into the ring like it was a barn dance. Ether ETFs? Not a twitch—could have sworn they were frozen solid, no net flows in sight.

Blackrock and Fidelity: The Good Ol’ Boys of Bitcoin ETFs

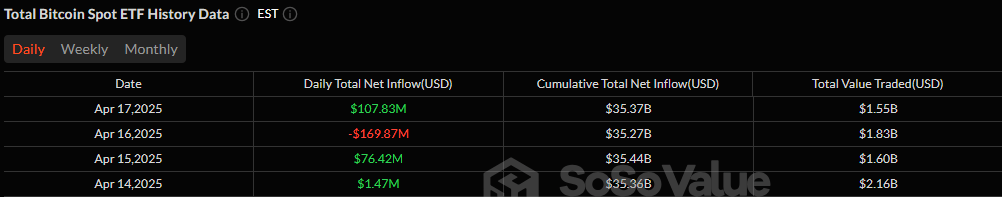

Just a day after bitcoin ETFs bled $170 million like a busted water pipe, they found some grit and pushed back with a spirited $107.83 million inflow. Bulls must be grinning—finally some hope in this market pothole. Out of a dozen U.S. spot bitcoin ETFs, only three bothered to stir; those three did all the heavy lifting like burly farmhands after the rains.

Blackrock’s IBIT strutted its stuff with nearly $81 million fresh off the truck. Fidelity wasn’t far behind, pitching in $25.90 million, shaking off that midweek fiasco like a cowboy dusting off his boots. Hashdex’s DEFI ETF chipped in a shy little $965k—like the quiet kid at the party who managed to bring a six-pack.

The rest of the ETF herd? Sitting like a pack of cows in the midday sun, no nudges at all. Total trading volume clocked a hefty $1.55 billion, with bitcoin ETF assets swelling to $94.51 billion by closing bell—enough to buy a small country, or at least a nice patch of farmland somewhere.

Ether ETFs? Quiet as a graveyard in November. All nine U.S. spot ether ETFs stood like statues, no ins, no outs. Like someone holding their breath, hoping the storm passes. Sure, no losses after a week of watching red is nice—like a dry day in a drought—but it feels more like investors waiting on the porch for something to happen.

As the week moseys toward a close, watchers of capital flows are squinting hard. Bitcoin’s showing some weathered toughness, but ether? She’s just sitting there, staring at the horizon, waiting for a sign.

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Should You Save Vidar Or Give Him To The Children Of Morrigan In Tainted Grail: The Fall Of Avalon?

- Basketball Zero Boombox & Music ID Codes – Roblox

- How to use a Modifier in Wuthering Waves

2025-04-18 23:59