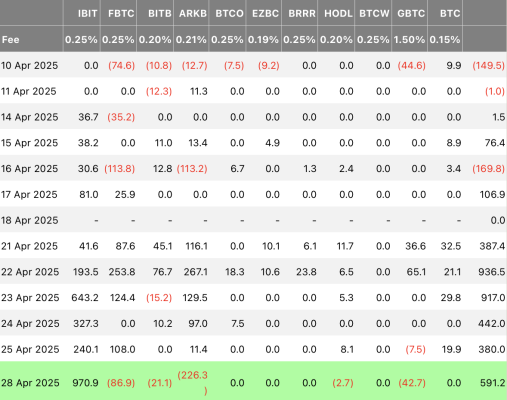

Ah, the world of bitcoin ETFs—an arena where the real action is measured in millions and the drama unfolds in less-than-dramatic ways. BlackRock’s IBIT, the undisputed king of the spot bitcoin ETFs, has once again proved its might. With a whooping $970.9 million in inflows, it’s like the financial equivalent of winning a gold medal. But don’t get too comfortable, other ETFs—there’s competition.

Meanwhile, Ark and 21Shares’ ARKB decided to go in the opposite direction, pulling in a lovely $226.3 million in outflows. Nothing like losing a quarter of a billion to keep things exciting. Fidelity’s FBTC wasn’t much better, shedding a modest $86.9 million. Truly, a dramatic reversal of fortune, wouldn’t you say? 😅

And yet, the chaos doesn’t stop there. Grayscale’s GBTC, Bitwise’s BITB, and VanEck’s HODL all registered their own little tragedies with net outflows. Honestly, at this point, it’s less of an investment market and more of a soap opera for the financial world. 📉

However, despite all the excitement (or maybe because of it), trading volume across the 12 ETFs took a dip. It fell to a mere $2.4 billion—down from $3.3 billion on Friday. No need to panic, though! The cumulative net inflows for all spot bitcoin ETFs have now reached a record-breaking $39.02 billion, the highest since February 24. Perhaps there’s still hope for those who find this all… just a bit too entertaining. 🤔

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- KPop Demon Hunters: Real Ages Revealed?!

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- How to Cheat in PEAK

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- Pacers vs. Thunder Game 1 Results According to NBA 2K25

2025-04-29 12:39