What to know:

- Bitcoin fell to the lowest price since the day it broke above $100,000.

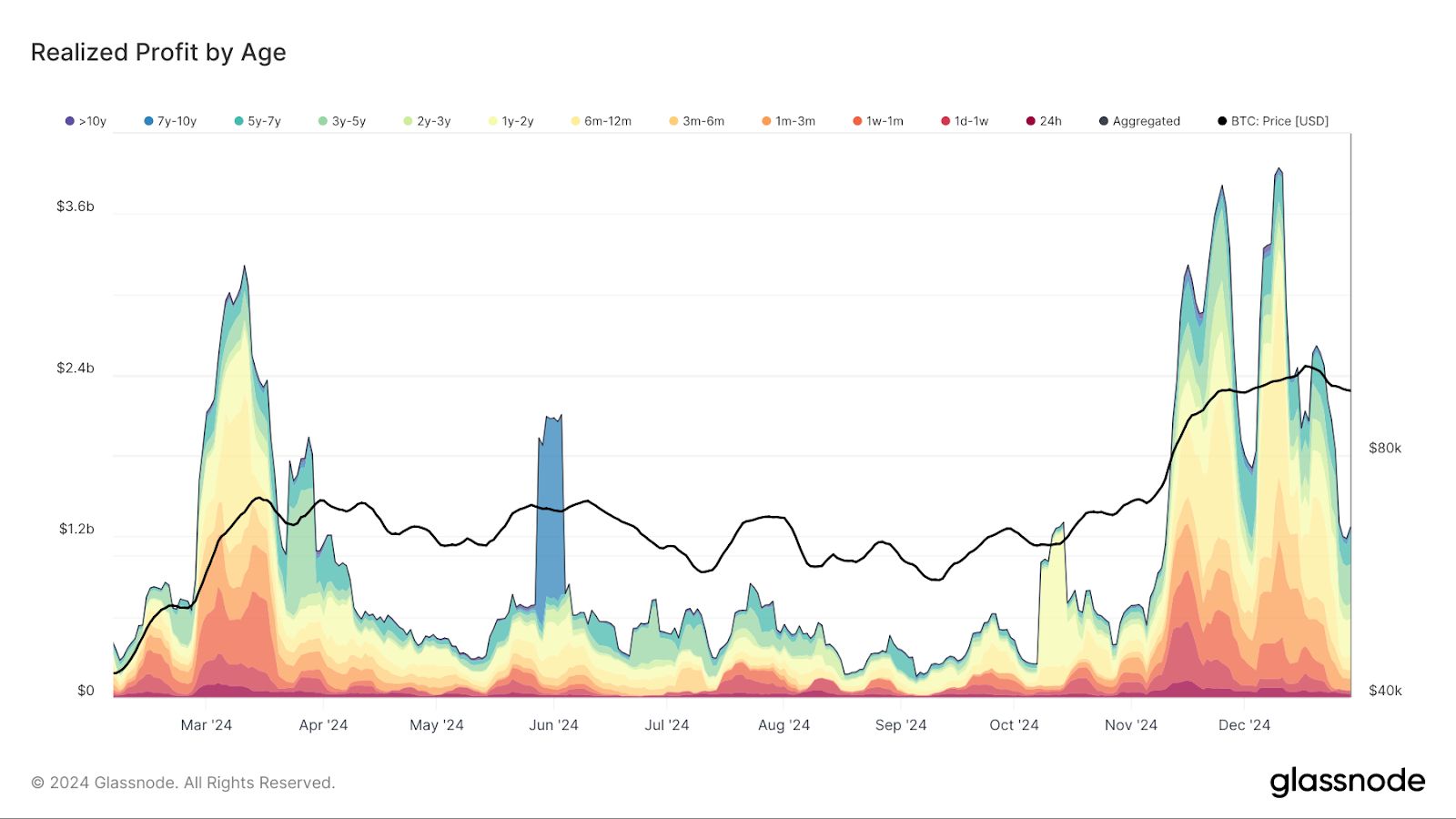

- The slump is partially due to elevated profit-taking.

- Macroeconomic considerations are also weighing on the crypto market.

As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of market fluctuations and cycles. Today’s crypto slump, driven by profit-taking and macroeconomic concerns, is reminiscent of similar situations we’ve witnessed in traditional markets over the years.

While it’s always disheartening to see significant drops in asset prices, it’s important to remember that these corrections are a normal part of market cycles. The current profit-taking exceeding $1.2 billion on a seven-day moving average is not unusual when an asset like Bitcoin surges as dramatically as it has this year.

The macroeconomic considerations are also playing a role, with the U.S. Chicago PMI suggesting an economic slowdown might be underway. Uncertainty around the Federal Reserve’s interest-rate policy and the inauguration of President-elect Donald Trump are additional factors that are likely contributing to this market volatility.

Looking ahead, I remain optimistic about Bitcoin’s future. Its adoption continues to grow, and I anticipate it will generally move in line with traditional markets. However, as Joe Carlasare, partner at Amundsen Davis, rightly pointed out, the path to 2025 may diverge from consensus, as markets often do.

On a lighter note, let me share a little joke to help us all keep a sense of humor during these turbulent times: Why did Bitcoin go to therapy? Because it had a lot of issues with its parents! (I hope that brought a smile to your face!)

crypto prices are facing turbulence on Monday, caused by disappointing U.S. economic reports and widespread selling for profits.

In the past 24 hours, Bitcoin (BTC) has decreased by approximately 1.8%, currently trading at around $91,800. This price level was last observed on December 5, which happened to be the day it surpassed $100,000 for the first time. Since its record high of $108,278 set on December 17, Bitcoin has experienced a decline of over 14%.

Ether (ETH), currently trading at $3,320, has dipped by only 0.7%, but it’s now 17% lower compared to its peak in December, and it hasn’t managed to surpass the record high of $4,820 it reached in 2021. On the other hand, Solana (SOL) is holding up slightly better than Bitcoin, as the SOL/BTC ratio has increased by 0.35% today.

As a seasoned cryptocurrency investor with over a decade of experience in the market, I have seen my fair share of ups and downs. Today, the CoinDesk 20 index, which tracks the top 20 cryptocurrencies excluding stablecoins, memecoins, and exchange coins, is taking a hit, sliding by 3.74%. This downturn has been particularly hard on Ripple (XRP) and Stellar (XRM), with both coins dropping by 6% and 6.3%, respectively. In contrast, Litecoin (LTC) has shown some resilience, only dipping by 1.9%.

I have learned throughout my years in this market that such fluctuations are par for the course, and it’s essential to maintain a long-term perspective when investing in cryptocurrencies. Despite today’s losses, I believe in the potential of these digital assets and remain optimistic about their future growth. It’s important to remember that even the most promising investments will have periods of volatility, but the key is to stay patient and focused on your investment strategy.

The stocks of companies involved in cryptocurrency also experienced a decline. For instance, MicroStrategy (MSTR) dipped by 7%, while Coinbase (COIN) decreased by 5.3%. Notably, significant bitcoin mining firms such as MARA Holdings (MARA) and Riot Platforms (RIOT) saw drops exceeding 7% as well.

The increase in bitcoin’s value this year, which surpassed 117%, has led some investors to sell off their holdings, contributing partially to the current selling pressure. At present, over $1.2 billion is being realized from these sales on a weekly average, although this is lower than its peak of $4.0 billion in December 11th. Nevertheless, it remains significantly higher than typical amounts. Most notably, long-term bitcoin investors are reaping the majority of these profits.

The current state of macroeconomics seems to be affecting markets negatively. Specifically, the U.S. Chicago PMI, a gauge indicating the productivity of both manufacturing and non-manufacturing industries in the Chicago region, has recently shown its lowest values since May. This could imply that an economic deceleration might already be happening.

The lack of clarity regarding the Federal Reserve’s monetary policy up until 2025 is causing some apprehension, as the U.S. Federal Reserve has hinted at halting rate reductions at least until March. Additionally, the upcoming inauguration of President-elect Donald Trump on January 20th could be a contributing factor. As a result, the S&P 500, Nasdaq, and Dow Jones have experienced a decline of over 1%.

Joe Carlasare, a partner at Amundsen Davis, shared his insights with CoinDesk, stating that the market outperformed predictions in 2024, but showed indications of fatigue, necessitating consolidation. Regarding the future, he expressed optimism about 2025, yet warned that the course might deviate from general expectations as markets often do. Bitcoin’s popularity is on the rise, and he predicts its trajectory will align with traditional markets to some extent. If the U.S. manages to steer clear of a major economic slowdown, bitcoin could thrive, although the journey may be more turbulent compared to 2024.

Read More

- Can RX 580 GPU run Spider-Man 2? We have some good news for you

- Space Marine 2 Datavault Update with N 15 error, stutter, launching issues and more. Players are not happy

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Persona Players Unite: Good Luck on Your Journey to the End!

- Streamer Life Simulator 2 (SLS2) console (PS5, PS4, Xbox, Switch) release explained

- DAG PREDICTION. DAG cryptocurrency

- Pacific Drive: Does Leftover Gas Really Affect Your Electric Setup?

- New Mass Effect Jack And Legion Collectibles Are On The Way From Dark Horse

- Record Breaking Bitcoin Surge: Options Frenzy Fuels 6-Month Volatility High

- „I want to give the developer €30 because it damn slaps.” Baldur’s Gate 3 creator hopes Steam adds tipping feature for beloved devs

2024-12-30 20:11