What to know:

- Bitcoin dipped below $98,000, while the broad-market CoinDesk 20 Index tumbled 10% on Thursday.

- The Federal Reserve on Wednesday projected only two rate cuts for 2025, disappointing investors and rattling markets.

- Crypto prices had enjoyed a relentless rise recently, so a “pullback like this feels healthy,” said Azeem Khan, co-founder and COO of layer-2 network Morph.

As a seasoned analyst with over two decades of experience in both traditional and crypto markets, I have seen numerous market cycles and learned that such corrections are not only inevitable but also healthy for the long-term growth of any asset class. The recent dip in Bitcoin and other cryptocurrencies should be viewed as an opportunity rather than a cause for concern.

The values of cryptocurrencies dropped on Thursday, extending the downward trend initiated by a widespread market selloff on Wednesday, triggered by Federal Reserve Chair Jerome Powell’s remarks that fell short of investor expectations regarding potential U.S. interest rate reductions in the coming year.

Bitcoin’s (BTC) initial surge to break the $100,000 mark weakened earlier in the day, dipping to the lower $97,000 range during U.S. trading hours. However, it has since made a small recovery and is now hovering around $98,000. Despite this, Bitcoin still shows a 4.8% decrease over the past 24 hours.

During the same period, altcoins experienced significant declines. The CoinDesk 20 Index, which tracks a wide range of these cryptocurrencies, dropped over 10%. For instance, Ethereum’s ether (ETH) decreased by 10.8%, dropping below $3,500. Similarly, Cardano’s ADA, Chainlink’s LINK, Aptos’ APT, Avalanche’s AVAX, and Dogecoin’s DOGE all experienced losses ranging from 15% to 20%. It is worth mentioning that Solana (SOL) reached its lowest price since November 7, almost completely undoing the gains it made post-election, following a 26% fall from its recent high.

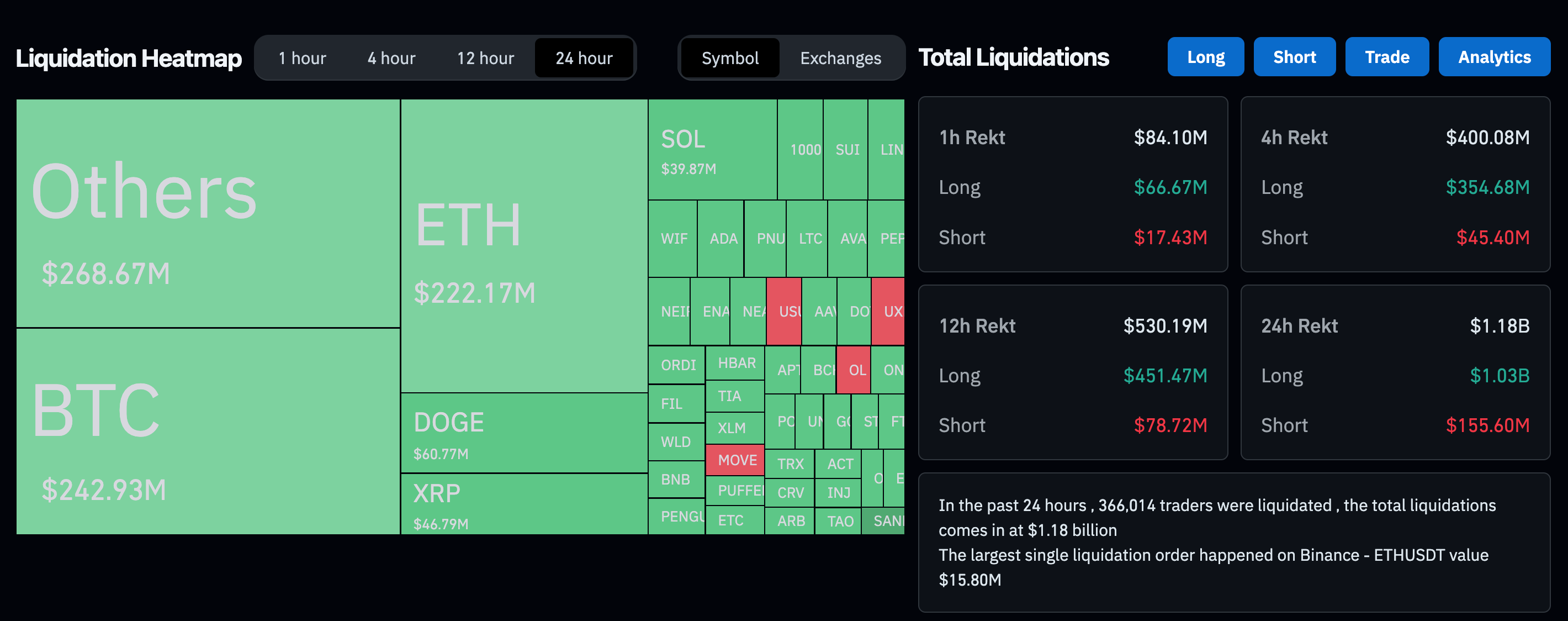

During the last 24 hours, approximately since the Fed’s rate decision yesterday, there has been a total liquidation of around $1.2 billion in leveraged crypto derivatives trading positions across all assets, according to data from CoinGlass. Out of this sum, over $1 billion were long positions, which means they were bets that the prices would increase.

In conventional markets, U.S. stock indexes experienced a slight rebound from their losses on Wednesday, but they ended up giving back some of the gains made before trading began during the day. By the end of the session, the S&P 500 and the Nasdaq, which is particularly focused on technology stocks, had risen by 0.5% compared to their closing prices on Wednesday.

Since Donald Trump’s election as president in early November, cryptocurrency prices have climbed sharply, driven by expectations of favorable policies for crypto from his administration. However, the Federal Reserve’s prediction for slower rate cuts next year and Chairman Powell’s hawkish comments on rising inflation concerns surprised many investors, leading to a widespread sell-off in the crypto market as well as stocks and gold.

In simple terms, the U.S. Dollar Index (DXY), a measure used to evaluate the strength of the U.S. dollar against a group of other global currencies, climbed above 108 – its most powerful position since November 2022. Simultaneously, the yield on 10-year U.S. Treasury bonds increased significantly, reaching over 4.6%, which is its highest point since May.

According to market strategist Joel Kruger from LMAX Group, the crypto market has been anxiously waiting for a potential correction after the significant increase in Bitcoin‘s price over $100,000. However, this anticipated event occurred due to developments in traditional markets, particularly the aftermath of the Federal Reserve’s decision on Wednesday, which proved too substantial to disregard.

Speaking about long-term perspective, Azeem Khan, co-founder and COO of Morph – a layer-2 network, noted in an email to CoinDesk that a dip like this seems beneficial for growth.

“It’s also worth noting that, historically, year-end selloffs in securities can occur as investors offset losses against gains to lower their tax liabilities,” Khan added. “While it’s hard to say how much of this is driving the current trend, it could be a contributing factor.”

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-19 22:56