In this fleeting twilight, our beloved Bitcoin has once again stumbled below the fabled $75,000 threshold, perhaps tripping on a loose shoelace. Presently, it hovers around $74,800—fondly summoning echoes of that wistful November 2024. 🤔

The coin’s melancholic dip of 7% today seems matched only by the soaring trading volume, up over 200%. It’s as though the sellers have rallied to declare, “Why hold on when you can let it all go?” Indeed, such a concerted push downward may pave the way for new lows—like an overzealous poet searching for the depths of human despair. 🥀

Bitcoin Futures Show Traders Pulling Out, But Bulls Aren’t Letting Go

Our bearish hero ambles through the futures market, dragging open interest (OI) down to a somber $51.88 billion—a 1% drop in the last day. One imagines traders scurrying for the exits, perhaps hoping to salvage their pride—or their last morsel of crypto fortune—before slamming the door behind them. 🏃

The crumbling OI speaks of a diminished crowd at the party: fewer souls willing to place fresh bets on this waltzing coin. Yet amidst this forlorn exodus, a flicker of hope beckons. After all, even a storm cloud can sometimes produce a rainbow—albeit one covered in Bitcoin logos. 🌦️

Meanwhile, curiosity persists as the funding rate, perched at 0.0060%, smiles defiantly—luring the bullish at heart to keep dancing, even as the music appears to fade.

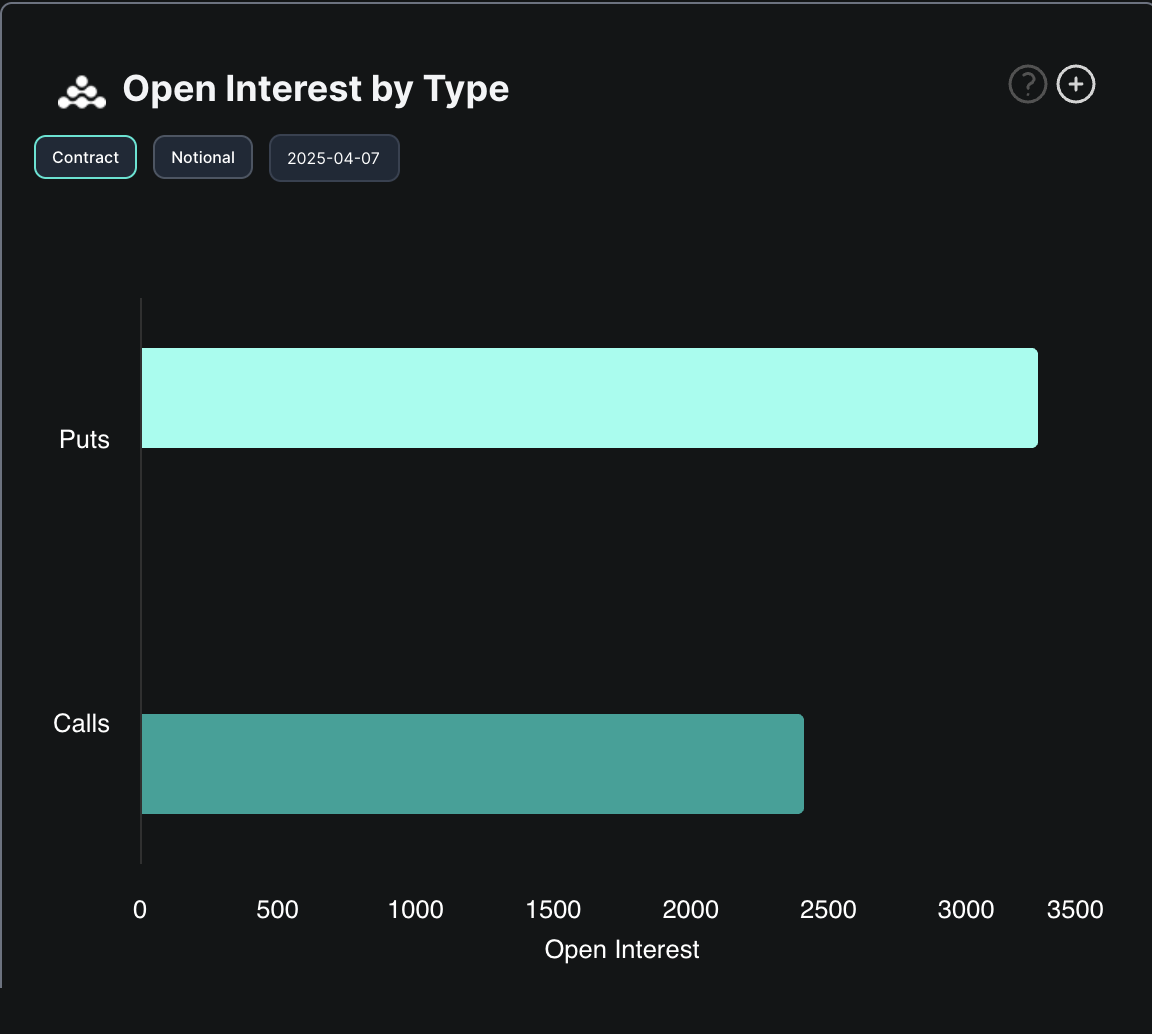

put contracts outnumber calls, and the town criers whisper that faith in a swift rebound remains ever out of reach. 💀

One might say these signals—rosy funding, downcast options, and emptying OI—tell a tale of internal strife: a market caught in the throes of contradiction, weighed down by ominous sighs yet weirdly buoyed by halfhearted optimism. Proceed with caution, dear traveler—though at least you can do so with a sly grin and a mischievous emoji. 😏

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Basketball Zero Boombox & Music ID Codes – Roblox

- Lottery apologizes after thousands mistakenly told they won millions

- Umamusume: Pretty Derby Support Card Tier List [Release]

- KPop Demon Hunters: Real Ages Revealed?!

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-04-07 10:22