As a seasoned analyst with over two decades of experience navigating financial markets, I’ve seen my fair share of bull runs and bear markets. However, the recent surge in Bitcoin and the digital asset class has left me more than just intrigued – it has piqued my curiosity to a level that even the most enticing Wall Street cocktail parties could not match.

Over the past few weeks, the digital asset world has been a rollercoaster ride. The milestone of Bitcoin reaching $100,000 might have felt like popping the cork on champagne, but there’s been plenty more to celebrate and ponder since the Federal Reserve began its easing cycle on September 18, and especially since the U.S. election.

The appointment of fresh leadership at the SEC and other regulatory bodies, along with blockchain-knowledgeable cabinet members, a proposed “AI and Crypto Governor,” and frequent discussions about Bitcoin and cryptocurrency by the President-elect, all suggest a more positive stance towards the industry from the U.S. government.

Having Bitcoin ETFs and ETF index options easily accessible via brokerage accounts provides investors, both individual and institutional, with advanced risk management tools. These tools attract investors who require more complex risk management strategies, while simultaneously offering another pathway for boosting the market liquidity of Bitcoin.

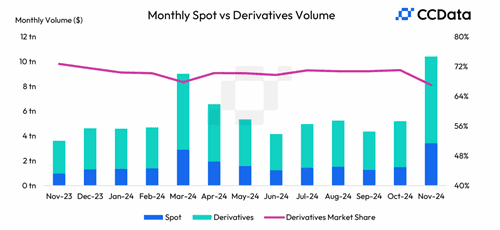

Tracking transaction and derivative volumes on international digital asset trading platforms, surpassing $10 trillion in November, serves as a reminder that the dynamics of these markets extend beyond U.S. ETF investment trends. In fact, the vast global crypto market is taking notice and seems to be impressed by what it’s witnessing.

A reasonable optimism for both the short-term and long-term can be justified, considering the favorable conditions such as regulatory improvements (more beneficial, robust, and user-friendly regulations), an economic landscape that is easing but with a potential for inflation, a thriving industry filled with abundant talent, global competition, and a smooth 2024, and the emergence of institutional acceptance (over $100 billion in Bitcoin and Ethereum ETFs, along with MSTR‘s balanced financial position).

Regarding timing – be it in markets, regulations, or broader economic trends – it’s rarely straightforward. However, here are some forecasts for the upcoming months and quarters in the digital asset sector:

Prediction 1: bitcoin adoption momentum will persist

Currently, among digital assets, Bitcoin has the most comprehensive regulatory backing in various forms across the United States. This can be achieved through direct ownership, futures contracts, exchange-traded funds (ETFs), asset management products, or options. Interestingly, Bitcoin might be least impacted by stricter digital asset regulations in the U.S. However, its popularity and potential for growth remain robust.

Prediction 2: lower bitcoin volatility lies ahead

As more people invest in Bitcoin and a wider variety of financial tools emerge to track its price, Bitcoin’s volatility is expected to decrease, making it resemble average equity (or at least certain types of equities) to some extent. The introduction of options for Bitcoin ETFs in the U.S. will offer advanced and accessible risk management tactics. This has two significant impacts:

Prediction 3: greater sustained breadth will spotlight the “5%-er conundrum”

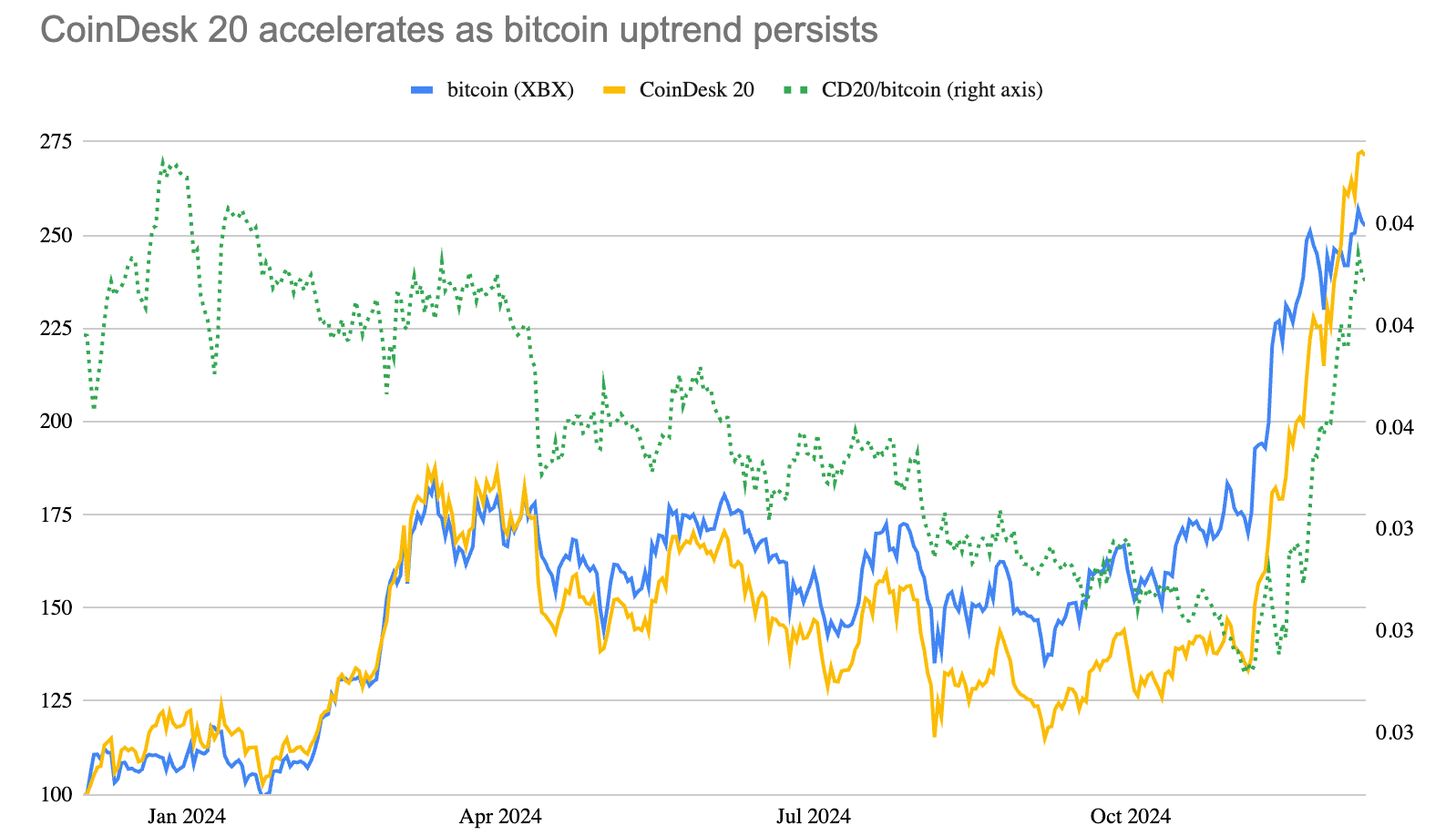

Since the U.S. election a month ago, the CoinDesk 20 Index has almost doubled, surpassing bitcoin’s impressive gains. The ratio between the CD20 and bitcoin has significantly increased as well, signaling renewed interest in other blockchain assets like Ethereum, due to expectations of more favorable and practical digital asset regulation under the incoming U.S. administration in 2025. We anticipate this trend to persist, as the CD20’s focus on leading digital assets mirrors the dual growth potential of cryptocurrencies – both their role as a growing market sector and bitcoin’s status as a store of value.

For individuals who fall into the “5%-ers” category, investing in digital assets beyond Bitcoin poses a challenge because they don’t have the time or expertise to delve into specific sectors, select stocks, or consider market timing. In traditional asset classes, indexing is often used as a solution, offering access, diversification, and automatic rebalancing. We anticipate (and hope!) that regulatory bodies will allow such benefits to be accessed through user-friendly investment vehicles.

The opinions presented in this article belong to the writer and may not align with those held by CoinDesk, Inc., its stakeholders, or their associates.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-11 19:33