As evening shadows crept silently over the Russian steppe—wait, pardon me; over the digital wasteland that is the current crypto market—Bitcoin approached a resistance that looked less like a mere ceiling and more like the gloomy stare of an unamused landlord. Ah, the fate of our beloved BTC, condemned to circle the $98,000 mark, snared beneath a web of trendlines and Fibonacci retracements, which might as well be the ghosts of short sellers past whispering “not so fast, comrade.”

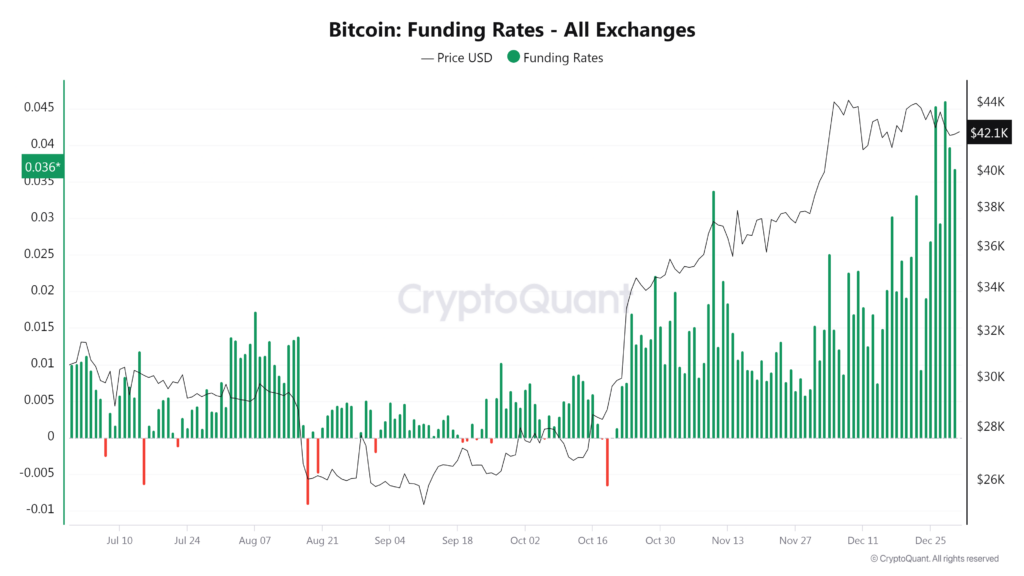

And just as the Russian spring cannot help but bring out the peasants into the fields (boots caked in hope and mud), so too do positive funding rates call forth the crypto speculators, those tireless pilgrims, to throw their rubles upon the altar of perpetual futures. The result? An inflating sense of euphoria—or perhaps just hot air, destined to be pricked by the sharp quill of market reality.

Key technical points

- Current Price: BTC lingers suspiciously near $96,250–$97,800, as if waiting for an unforgiving babushka to chase it off her property.

- Funding Rates: Every exchange now sings a cheerful kazachok for the longs, suggesting the bears might be out hunting mushrooms instead of shorting.

- Price Structure: The recent short squeeze resembles a drunken Cossack’s dance—lively, reckless, and with every chance of ending in tears.

One must, of course, ponder the meaning of funding rates. In the world of these eternal futures contracts, traders pay each other not in potatoes, but in funding. When funding is positive, the longs pay the shorts—a tradition older than my Aunt Olga’s suspicion of running water.

A bullish funding rate means folks are literally ponying up for the privilege of chasing the next candle higher. If funding becomes a bit too enthusiastic—like a provincial actor at his first Chekhov audition—expect the unexpected. The market, being the capricious sort, may suddenly recall its hangover and punish the overleveraged with the ruthlessness of a Siberian winter.

For now, our Bitcoin heroes are paying extra to hold their longs, flush from the recent short squeeze (or is that the blush of impending doom?). But without fresh volumes of cold, hard spot buying, someone may soon be left holding an empty samovar.

Market implications

That menacing $98,000 resistance hums with all the tension of a Dostoevsky dinner party. Should BTC, with a stoic sigh, settle above it, perhaps Satoshi himself will smile down and grant us a run to $100,000 and beyond. But if the price slips, expect the leveraged masses to vanish faster than vodka at a village wedding.

The funding rates—those fickle cousins of the price chart—remain worth watching in the gloom. As long as BTC treads water above $96,200 and isn’t abandoned by volume, the saga may yet continue. But if funding stays high while the price sulks below resistance, brace yourself: a sudden flush lower could be nigh. In other words, strap in, make yourself a cup of tea, and avoid taking financial advice from mysterious figures walking along moonlit riversides.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

- MrBeast removes controversial AI thumbnail tool after wave of backlash

- KPop Demon Hunters: Real Ages Revealed?!

2025-05-02 21:07