What to know:

- Fundstrat’s Head of research Tom Lee, calls for end of year target for bitcoin between $200,000 to $250,000

- Tom Lee sees a potential short-term correction based on Fibonacci levels for bitcoin as low as $70,000.

The ongoing price range of bitcoin (BTC) between $90,000 and $100,000 influences the emotions of investors, fluctuating between apprehension and optimism.

On Monday, the value of bitcoin dipped under $90,000, but by Tuesday, it had surpassed $96,500 – an increase of over 8%. Bitcoin optimist Tom Lee, head of research at Fundstrat, said on Monday that this recent dip in bitcoin is typical.

“Bitcoin is down 15% from its highs for a volatile asset, which is a normal correction,” he said.

According to Glassnode’s analysis, this ongoing bitcoin cycle has experienced shallower declines of approximately 15% to 20%, a significant reduction compared to the steep drops of 30% to 50% seen during previous bull markets. This suggests that bitcoin is maturing as an asset.

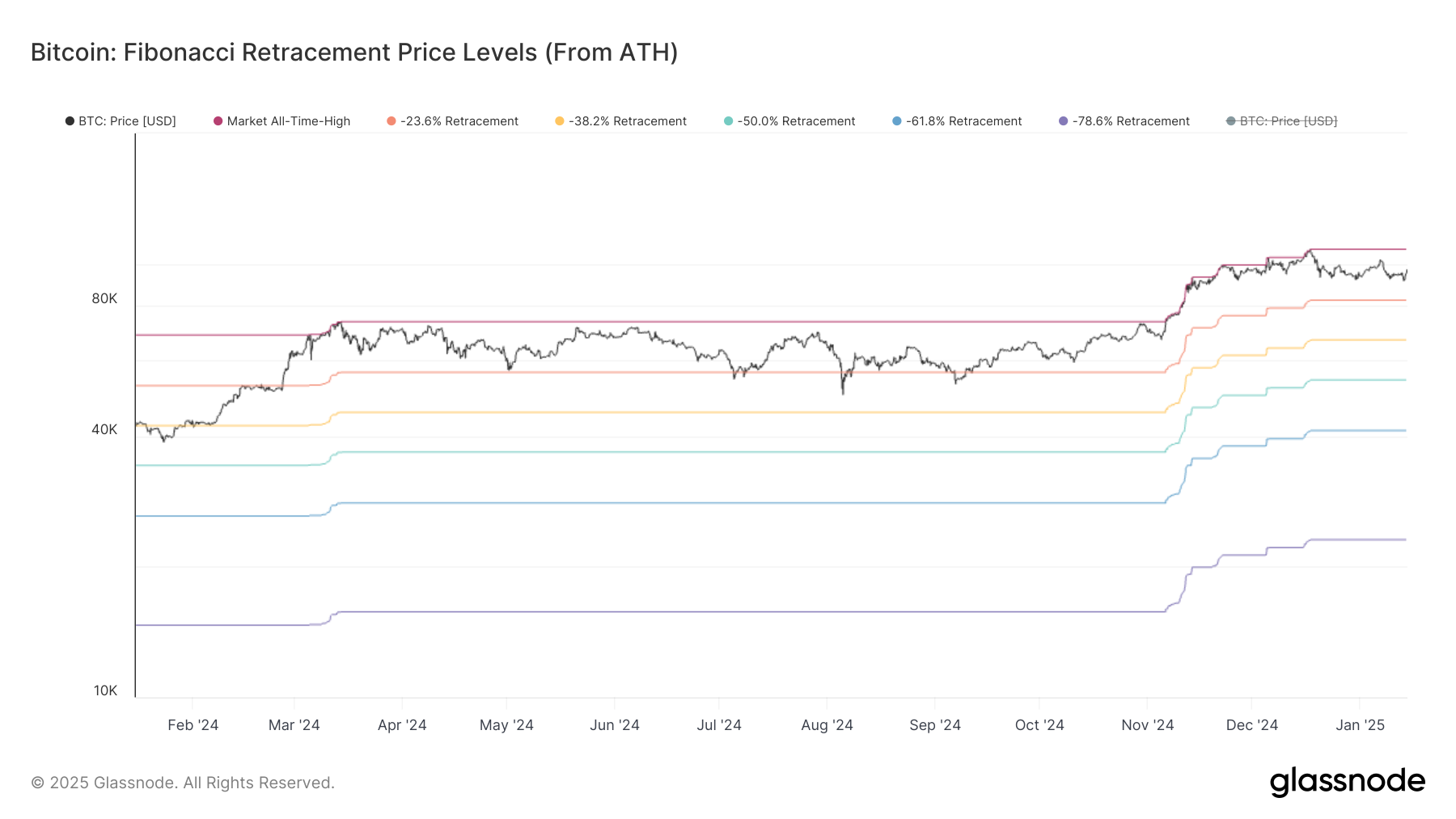

As Lee explains, a key threshold is the $70,000 mark, which he considers a robust support level. This concept is based on a technique known as Fibonacci levels or retracement periods, where bitcoin tends to retreat from its initial surge point. If the $70,000 level fails to hold, Lee anticipates that the $50,000 level might be retested. Significant Fibonacci levels analysts often scrutinize, starting from the all-time high, include 23.6%, 38.2%, 50%, and 61.8%.

Although there’s a temporary dip, Lee continues to believe that Bitcoin will shine as a top performer in 2025. He stays optimistic about his year-end predictions, which range from $200,000 to $250,000.

Or:

Lee sees a temporary setback, but he’s confident that Bitcoin will be a star investment in 2025. He maintains his positive outlook for year-end prices between $200,000 and $250,000.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-14 15:09