bitcoin-usd/”>BITCOIN‘S BUBBLE BURSTS?

The Bottom Line: Bitcoin’s got a bad case of the Mondays, folks.

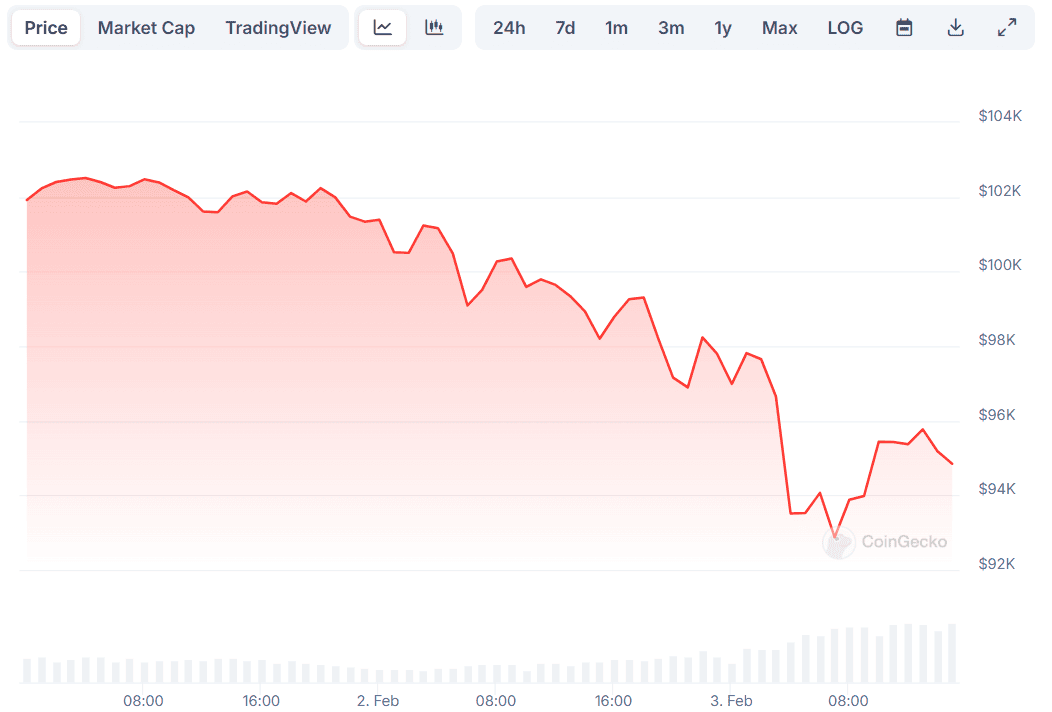

- Bitcoin’s taken a 10% tumble since the start of February, and analysts are warning that things could get worse before they get better.

- Some folks think Trump’s tariff policies might just be the thing to drive demand for BTC as a hedge against inflation and currency devaluation.

The Correction Might be Just Starting

January was a wild ride for Bitcoin, with prices soaring to a new all-time high of almost $110,000 just before Donald Trump’s inauguration. But February’s been a different story, with the price tumbling from around $102,000 to less than $92,000 in just three days.

Now, some folks are saying that February’s not looking so hot after all. In fact, one analyst is warning that if key support levels fail, Bitcoin’s price could drop all the way to $74,400.

But wait, there’s more! Some are saying that Trump’s tariff policies might actually be good for Bitcoin in the long run. Because, you know, inflation and currency devaluation are just the things to drive demand for a cryptocurrency.

“You don’t need to deploy all your money here, let the situation fold out. Stay safe,”

Ali Martinez, the analyst in question, thinks that breaking below $92,180 could lead to a massive crash to as low as $74,400. But others are saying that the tariff war might just be the thing to drive demand for Bitcoin.

Pain Only in the Short Term?

Jeff Park, the Head of Strategy at Bitwise, thinks that the tariff war might have a positive effect on Bitcoin in the long run. He’s got a few ideas about how this might play out, including the Triffin dilemma and Trump’s economic plans.

The Triffin dilemma is an economic paradox that arises when a national currency also serves as the world’s reserve currency. And Trump’s team might just be using tariffs as a short-term tactic to push nations to reduce their US dollar holdings and shift investments away from America’s debt.

“As the world enters a sustained tariff war, the demand for bitcoin will skyrocket. Both US investors and foreign market participants will flock to bitcoin for different reasons, but the outcome remains the same – higher prices, and at an accelerated pace,” he concluded.

Read More

- Best Crosshair Codes for Fragpunk

- Monster Hunter Wilds Character Design Codes – Ultimate Collection

- Enigma Of Sepia Tier List & Reroll Guide

- Hollow Era Private Server Codes [RELEASE]

- Wuthering Waves: How to Unlock the Reyes Ruins

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Ultimate Tales of Wind Radiant Rebirth Tier List

- Best Crossbow Build in Kingdom Come Deliverance 2

- Best Jotunnslayer Hordes of Hel Character Builds

- Skull and Bones Timed Out: Players Frustrated by PSN Issues

2025-02-03 17:56