If you were hoping Bitcoin would just keep skyrocketing forever—like an elevator with a broken cable and no brakes—hold onto your towel. BTC has recently staggered breathlessly into the $106K resistance level and, much like a marathon runner who realizes he accidentally signed up for a triathlon, is suddenly quite interested in a nice sit down.

Remember that heroic rally from mid-April? It’s pushed Bitcoin straight into the nosebleed section of overbought indicators, particularly on those higher timeframes beloved by technical analysts and over-caffeinated YouTubers. Momentum, which was roaring along like an enthusiastic Vogon poet at a disinterested book club, has finally decided to stop for tea.

The Daily Chart

Somewhere on the daily chart—which is the chart you look at if you want to feel either very rich or slightly nauseous—BTC pole-vaulted itself from the $90K breakout, leapt over the $98K hurdles, and is now peering sheepishly at the $106K supply zone, wondering if it can ask to use the bathroom.

The mighty Relative Strength Index (RSI), which was recently behaving like a sugar-crazed child at a birthday party, is now sobering up and heading for a nap. Early weakness detected, panic hats not yet required—unless you want to set a trend.

The price is still lounging well above its 100- and 200-day moving averages, basking luxuriously in the $90K spa zone. That’s a good sign for the macro trend, but even the most excitable of parabolic moves occasionally needs to lie down, have a few grapes, and call its mother. If buyers can’t conquer $109K, we might all be waiting a bit longer for our next trip to the moon.

The 4-Hour Chart

Zoom in, and the 4-hour chart reveals its dramatic true nature—imagine a soap opera where candlesticks overact. BTC shot skywards in an enthusiastic yet poorly thought-out surge before being rebuffed below $109K, probably due to existential dread or a misplaced decimal. RSI, meanwhile, has crash-dieted from an enthusiastic 75 to a sulky low-50s, suggesting the bulls have misplaced their motivation or, possibly, gone off to lunch.

For now, $101K–$102K is bravely playing the part of support—though if that turns into a trapdoor, you can expect the entire drama to fall to the $97K–$98K basement. On the other hand, a heroic reclaim of $104K–$105K would have analysts dusting off their “TO THE MOON!” memes once again.

On-chain Analysis

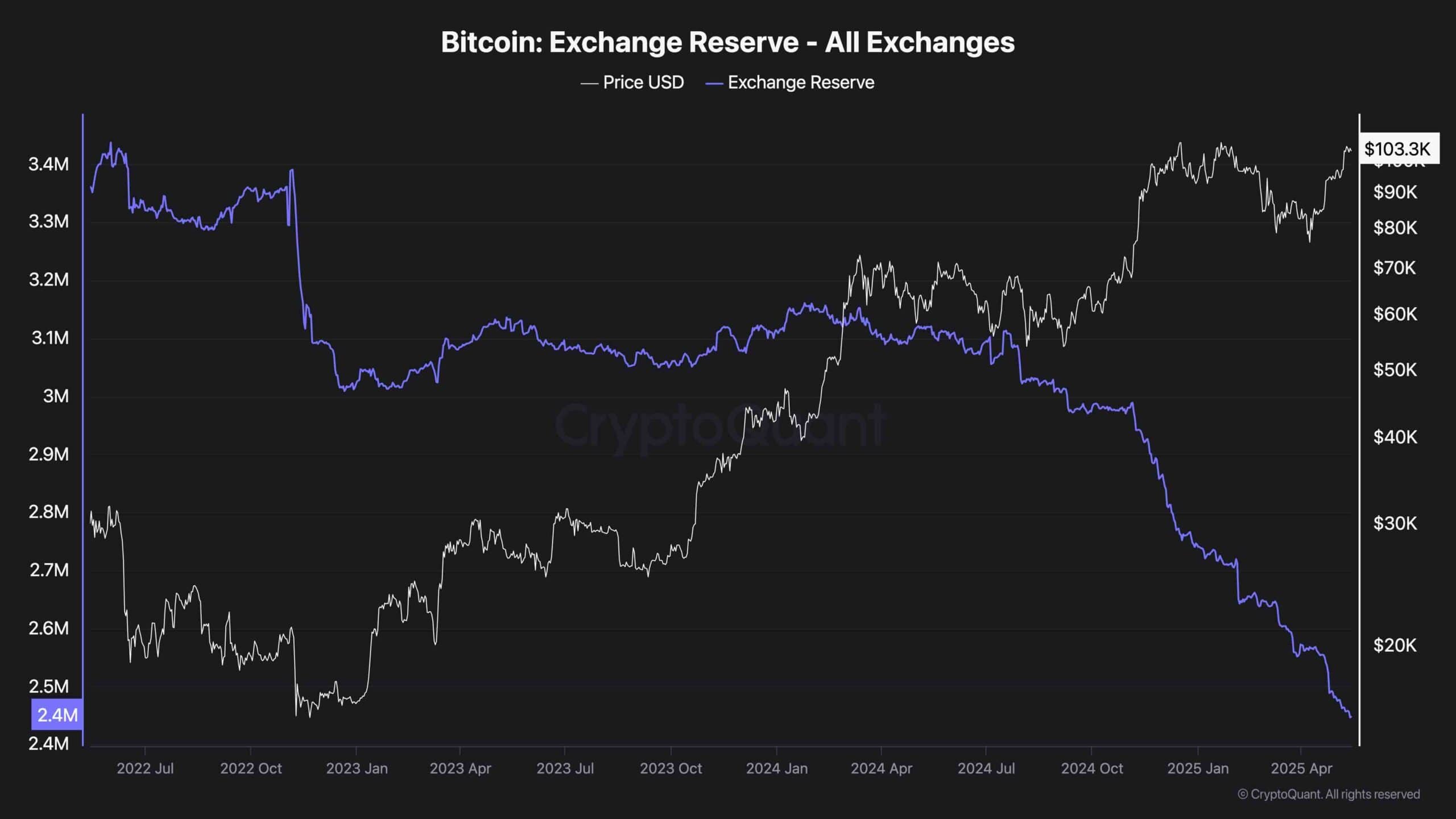

Exchange Reserve

On-chain data, for those who enjoy peering into the machinery of the universe, presents an unusually chill picture. Exchange reserves are declining, meaning Bitcoin owners are too attached to let their coins go, even if the price rises the way a balloon fears sharp objects. This, in theory, is bullish—unless, of course, nobody else shows up at the party.

The decline, however, has hit the snooze button. While coins aren’t stampeding to exchanges, new buyers aren’t exactly clawing at the door, either. In short: everyone has wandered into the kitchen looking for snacks, and we’re all waiting for a reason to care again. Stay tuned, and don’t panic—unless you enjoy a bit of Saturday night drama.

🚀🍵 Beware: Bitcoin may require frequent cooling, gentle encouragement, and possibly a stiff drink.

Bitcoin Bounces Into Resistance: Is Satoshi’s Favorite Toy Out Of Batteries?

Secure your internet browsing with a NordVPN subscription. [Learn more](https://pollinations.ai/redirect/432264)

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 50 Goal Sound ID Codes for Blue Lock Rivals

- How to watch the South Park Donald Trump PSA free online

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

2025-05-14 16:26