So, Bitcoin’s been chilling at $84,000 like it’s on a beach holiday, sipping a piña colada. No drama, no fireworks—just vibes. But let’s be real, this is crypto. The calm is just the universe’s way of saying, “Buckle up, buttercup.” 🌪️

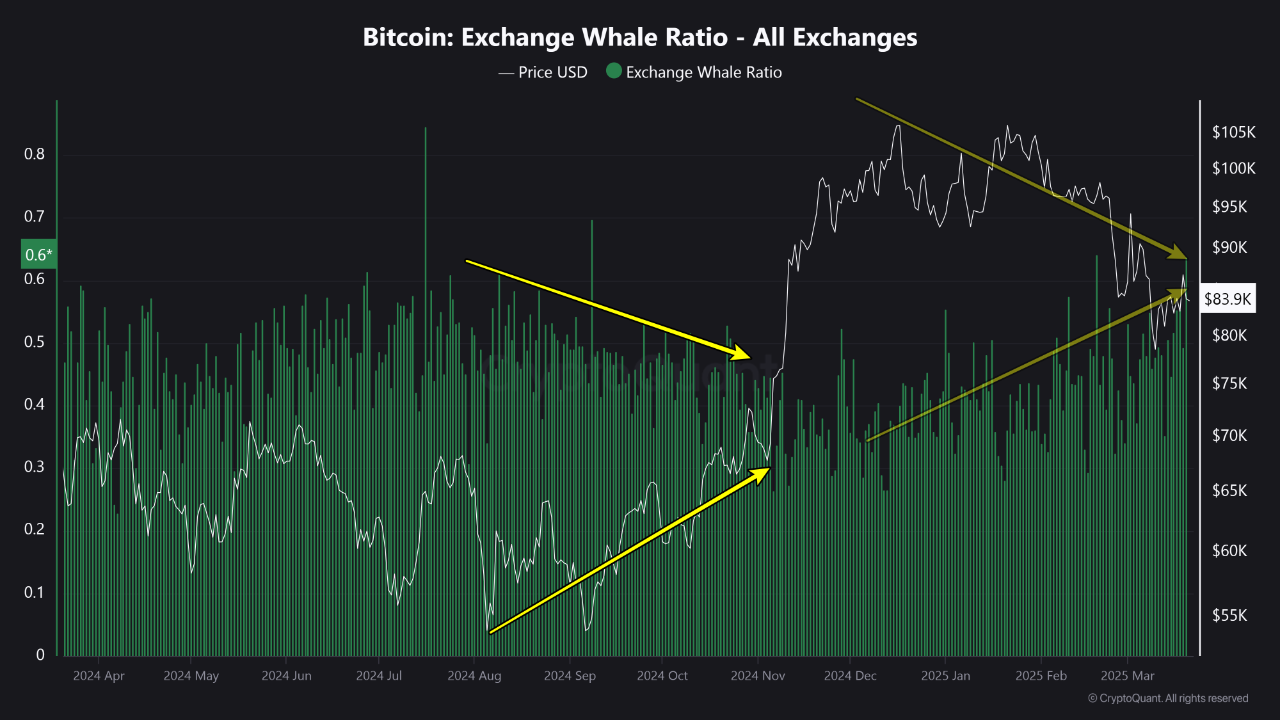

Enter the whales. These big, blubbery creatures of the crypto ocean (metaphorically, of course) are stirring the pot again. According to CryptoQuant, the BTC Exchange Whale Ratio is flashing red like a toddler who just discovered the “on” switch. Translation: the big players are shuffling their assets, and it’s not because they’re redecorating their portfolios. 🐋💸

Meanwhile, the Short-Term Holders (STHs) are drowning in unrealized losses. $7 billion underwater, to be exact. It’s like they’re in a submarine with a leak, but hey, it’s still better than the Titanic-level losses of 2021. Glassnode’s all, “It’s fine, it’s fine,” but let’s be honest, no one’s fine when they’re $7 billion in the red. 🚢💔

The rolling 30-day realized loss for #Bitcoin‘s STHs has reached $7B, marking the largest sustained loss event of this cycle. However, this remains well below prior capitulation events, such as the $19.8B and $20.7B losses in 2021-22:

— glassnode (@glassnode) March 21, 2025

STHs are the first to bail when things get rocky, and right now, they’re holding onto their Bitcoin like it’s a hot potato. If they decide to sell, well, let’s just say BTC might be taking a nosedive. So, grab your popcorn, folks. The crypto circus is about to get wild. 🍿🎪

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- League of Legends MSI 2025: Full schedule, qualified teams & more

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 28 Years Later Fans Go Wild Over Giant Zombie Dongs But The Director’s Comments Will Shock Them

- Pacers vs. Thunder Game 7 Results According to NBA 2K25

- Pacers vs. Thunder Game 1 Results According to NBA 2K25

- Basketball Zero Boombox & Music ID Codes – Roblox

2025-03-22 22:31