Ah, Friday—the day of reckoning for crypto markets. Today, nearly $15 billion in Bitcoin and Ethereum options are set to expire, sending traders into a frenzy of nail-biting, fortune-telling, and possibly prayer. It’s like a high-stakes game of Monopoly, but with more graphs and fewer thimbles.

Analysts, those modern-day oracles, suggest today’s expiring options volume is only slightly lower than last month’s H1 expiry, which clocked in at a staggering $17 billion. So, naturally, everyone is bracing for chaos. Or at least mild discomfort.

$14.59 Billion Worth of Crypto Contracts: Cue the Drama 🎭

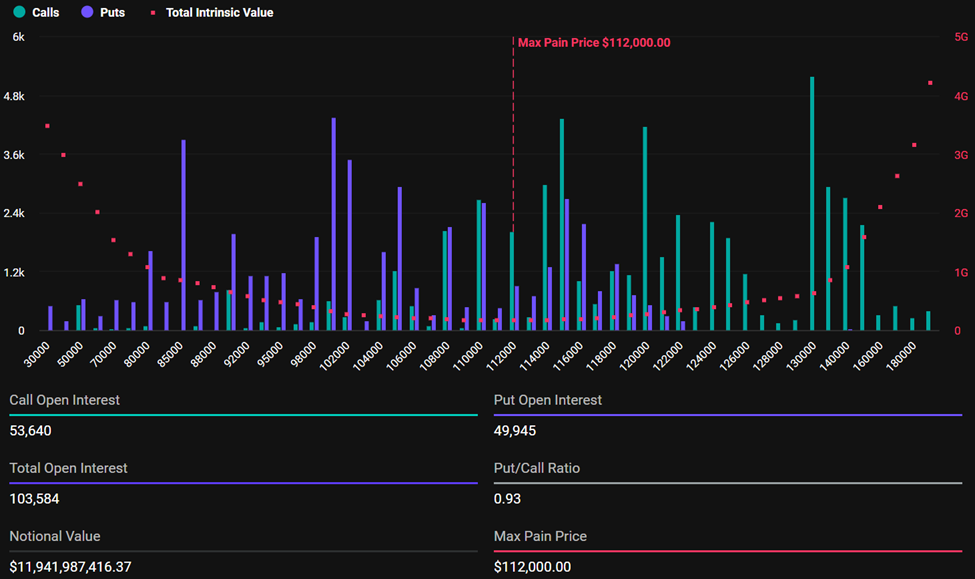

According to Deribit data (the Oracle of Crypto Data™), Bitcoin and Ethereum options worth a cool $14.59 billion will expire today. Bitcoin, ever the attention-seeker, makes up the lion’s share—$11.94 billion of the total—with 103,584 open contracts. Ethereum, not to be outdone, contributes $2.649 billion to the spectacle.

For the uninitiated, the Put to Call ratio (PCR) is a key indicator of market sentiment. Bitcoin’s PCR stands at 0.93, while Ethereum’s is 0.88. Translation: purchase orders outweigh sale orders, suggesting cautious optimism—or perhaps just wishful thinking. Either way, it’s delightful theater.

The “Maximum Pain” levels for these expirations are particularly noteworthy. For Bitcoin, it’s $112,000, and for Ethereum, $2,900. These are the prices where the most options holders will feel… well, maximum pain. One imagines them clutching their pearls (or laptops) in despair.

This week’s expiration is significantly larger than last week’s $5.76 billion event, but that’s because today marks the grand finale of July. As one analyst poetically put it: “Another big expiry. Another big test.” Truly, Shakespeare would have been proud.

Traders Cling to Their Puts Like Life Rafts 🛟

Despite the market’s general optimism, traders are clinging to their put positions as if they were life rafts in a stormy sea. According to analysts at Greeks.live, this behavior persists even amid significant losses. One might call it stubbornness; others might call it masochism.

“Traders holding put positions despite significant losses. Most traders are focused on potential downward moves, with key discussion around volatility levels around 30%,” the analysts noted.

Of course, no crypto story is complete without a cameo from Elon Musk. His SpaceX recently moved $153 million worth of Bitcoin after three years of dormancy, sparking speculation about his crypto strategy. Meanwhile, Tesla’s earnings report came in slightly below expectations, leaving investors to wonder if their enthusiasm was misplaced. Ah, the unpredictability of it all!

“$47M in Net Calls on $TSLA this past Friday. Tesla earnings are on Wednesday.” — Andrew Hiesinger (@AndrewHiesinger)

And yet, here we are, mere mortals attempting to make sense of it all. As options near expiration, volatility is expected to spike, with Bitcoin and Ethereum prices likely gravitating toward their respective Max Pain levels. At the time of writing, Bitcoin is trading at $115,681, and Ethereum at $3,634. Whether these prices hold steady remains to be seen.

But fear not, dear reader. After the dust settles and the options expire at 8:00 UTC on Deribit, the market will stabilize—as it always does. Until next Friday, of course. 🔄

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- All Songs in Superman’s Soundtrack Listed

2025-07-25 09:19