So, Standard Chartered, the bigwig bank, has decided to jump on the Bitcoin and Ethereum bandwagon. 🤷♂️ Like, what took them so long? I mean, it’s not like these cryptocurrencies have been around for a while or anything. 🙄

Standard Chartered Finally Gets with the Program

According to a press release that probably took them longer to write than it did to actually launch the service, Standard Chartered is now offering spot trading for Bitcoin and Ethereum. “We’re committed to offering clients safe, trusted, and efficient digital assets solutions,” they say. Yeah, because nothing says “safe and trusted” like jumping into the crypto wild west. 🏭💰

Standard Chartered, a global systemically important bank (G-SIB) based in the UK, is making this move through its UK branch. You know, the one that’s not too far from the pub. 🍺

This is the first time a G-SIB has offered deliverable spot trading services for cryptocurrencies. G-SIBs are those banks that, if they sneeze, the global economy catches a cold. So, for one of these giants to dip its toe into the crypto pool, it’s a big deal. Or is it? 🤔

“Digital assets are a foundational element of the evolution in financial services,” says Bill Winters, Group Chief Executive of Standard Chartered. “They’re integral to enabling new pathways for innovation, greater inclusion, and growth across the industry.” Translation: We’re not just here for the money, we’re here to change the world. 🌍✨

But this isn’t Standard Chartered’s first rodeo in the digital asset space. They’ve got investments in Zodia Custody and Zodia Markets, which offer a range of crypto-related services. So, they’re not exactly newbies. 🤠

“We are applying our global expertise, infrastructure, and risk management frameworks that our clients trust to the digital assets space,” says Tony Hall, Global Head of Trading and XVA, Markets, at Standard Chartered. “Trust us, we know what we’re doing.” 🙏

The new service integrates with the bank’s existing infrastructure, allowing institutional clients to trade Bitcoin and Ethereum through the same FX interfaces they use for other trades. “Clients can settle to their choice of custodian, including Standard Chartered’s secure digital assets custody solutions,” the press release adds. Because who doesn’t love a good choice? 🙃

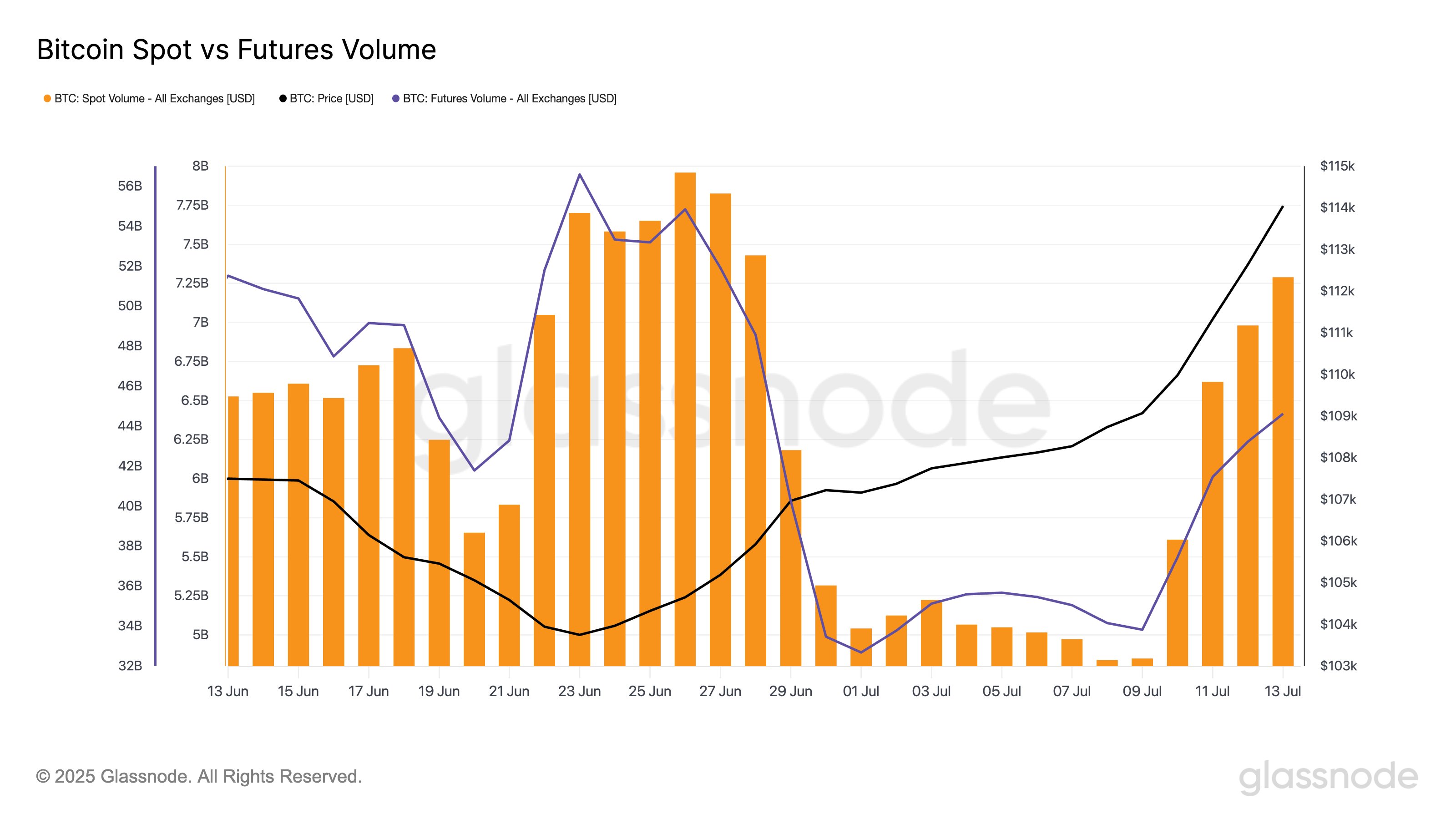

In other news, Bitcoin spot trading volume has seen a revival, thanks to the latest price surge. According to Glassnode, spot volume has increased by 50.3% and futures volume by 31.9% since July 9th. But let’s not get too excited—compared to the year-to-date average, both spot and futures volumes are still down more than 20%. So, it’s a bit of a mixed bag. 🎒

At the time of writing, Bitcoin is trading around $117,000, up over 7.5% in the last week. So, if you’re thinking about buying, now might be a good time. Or not. Who knows? 🤷♂️

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- Basketball Zero Boombox & Music ID Codes – Roblox

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Umamusume: Pretty Derby Support Card Tier List [Release]

2025-07-16 04:13