Hold onto Your Crypto Hats, Folks!

- OMG! $7.8 billion worth of Bitcoin options are about to vanish on Jan 31st! 💸

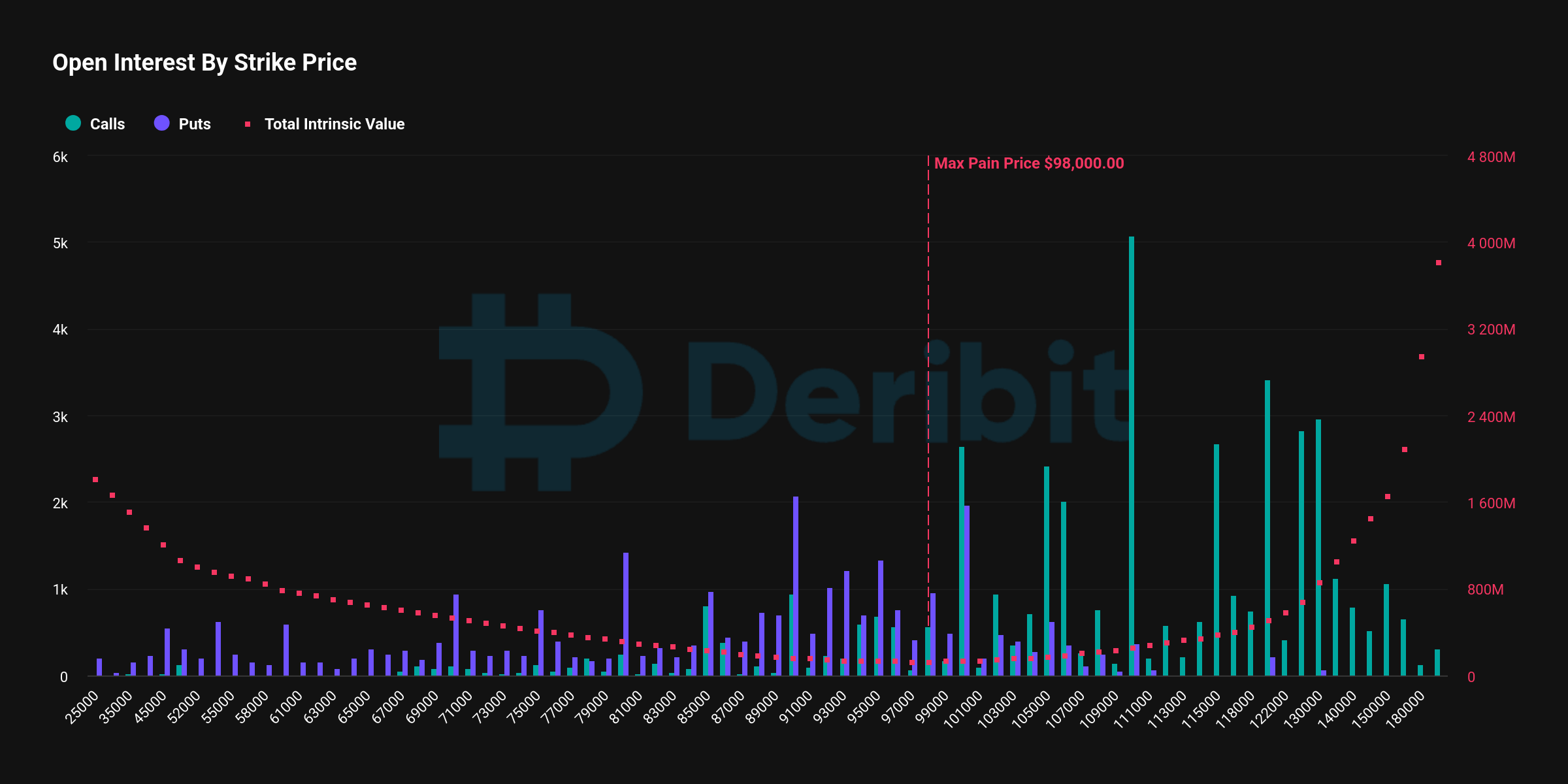

- Bitcoin is chilling way above the “max pain” mark of $98k. 📈😂

Prepare yourselves, dear readers, for a potential Bitcoin price plunge! A whopping $7.8 billion in options are expiring at the end of the month, and with Bitcoin sitting pretty above the so-called “max pain” point, market makers are rubbing their hands with glee. They’re just waiting to push the price down and rake in the sweet, sweet profits! 🤑

Data from Deribit, the options exchange that’s all the rage, shows that a staggering $6 billion in notional value is going to expire OTM (out the money) when the clock strikes 08:00 UTC on Jan 31st. And guess what? A whopping 50% of those are put options, giving holders the option to sell their Bitcoin at a set price before it’s too late. 📉

Now, here’s the juicy bit. Put holders are probably sweating bullets because they’re either trying to protect themselves from a crash or they made some risky bets on the downturn. Either way, the “max pain” price is at $98k, which means that if Bitcoin stays above that level, the option buyers will suffer big-time. 💸💰

“But wait, there’s more!” says Luuk Strijers, the cool cat CEO of Deribit. “Banks can now hold Bitcoin, so get ready for a flood of institutional money. Plus, there are rumors of a ‘bitcoin strategic reserve announcement’ that’s making everyone excited.” 🤪

So, what’s the takeaway, my fellow crypto enthusiasts? Keep your eyes peeled on the price of Bitcoin as we approach expiry day. If it dips below $98k, hold on tight because things could get bumpy! 🎢

“Delta hedging flows” might come into play, which means market makers will buy or sell Bitcoin to neutralize their risk. And remember, Deribit’s IV (implied volatility) is hovering around 60, which is higher than usual. That means the market is expecting some big moves, so buckle up! ⚠️

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-24 16:28