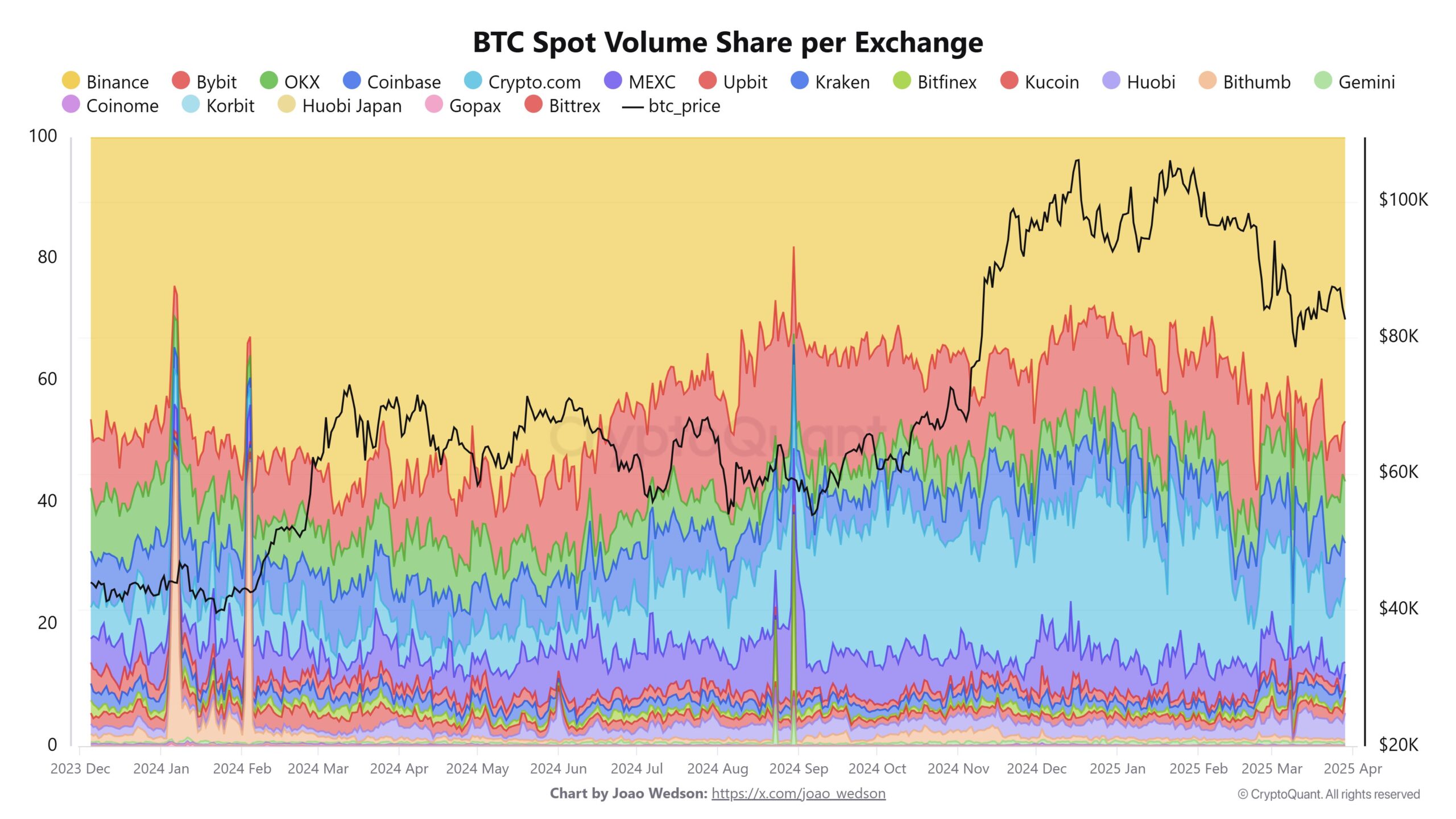

Binance’s spot trading volume has surpassed all other exchanges combined, reaching a staggering market share of 41.87%—the highest in the past 10 months. Imagine that! It’s like having a monopoly on the global supply of chocolate truffles! 🍫

Binance has cemented its position as the leading crypto exchange, but this dominance is not without its fair share of eyebrows being raised. 🧐 Market concentration, anyone? It’s enough to make a person wonder if we’re just trading one overlord for another. 😂

Binance Continues to Lead the Crypto Market

Binance has reinforced its status as the top crypto exchange, with its spot trading volume outpacing all competitors combined. According to Joao Wedson, an analyst who posted on X on March 30, 2025, Binance’s spot trading volume is now eight times larger than that of Coinbase, the largest exchange in the US. That’s like comparing a Ferrari to a tricycle! 🚗ﳫ️

Although this figure has dipped a bit compared to early 2024, it’s still a testament to Binance’s global dominance. Despite the decline in overall spot trading volume across the market, Binance remains the undisputed champion. 🏆

Additional data from a CryptoVerse post on X reveals that Binance’s market share has climbed to 41.87%, marking a 10-month high. This figure is five times larger than Coinbase and nearly six times bigger than OKX, another major player. It’s like Binance is the king of the hill, and everyone else is just climbing. 🏔️

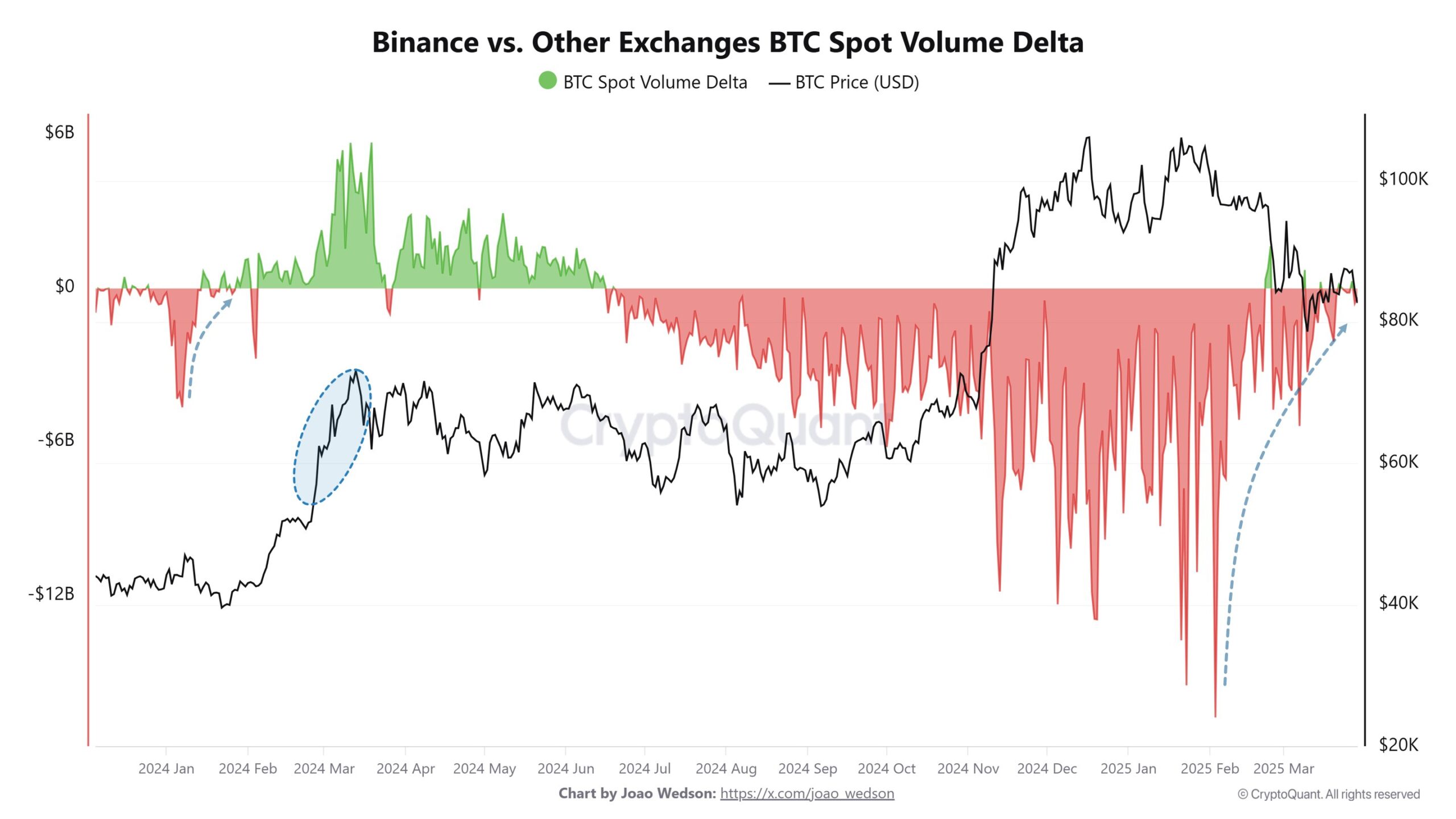

One of the most fascinating aspects of Binance’s dominance is its historical correlation with Bitcoin price movements. According to Joao Wedson, in January 2024, when Binance’s spot trading volume first exceeded all other exchanges combined, Bitcoin’s price rocketed from $42,000 to $73,000 in the following weeks. It’s like Binance has a magic wand or something! 🪄

This pattern is set to repeat in 2025. The Binance vs. Other Exchanges BTC Spot Volume Delta index, which measures the difference in Bitcoin spot trading volume between Binance and its competitors, has once again turned positive. This could signal a bullish trend for Bitcoin in the coming months, even as overall spot trading volume declines. It’s like Binance is the drum major leading the parade. 🎉

The correlation suggests that Binance’s dominance could be a leading indicator for Bitcoin bull runs. The exchange’s ability to attract significant trading activity often reflects heightened market interest and liquidity. This can drive price momentum. It’s like a self-fulfilling prophecy! 🌯

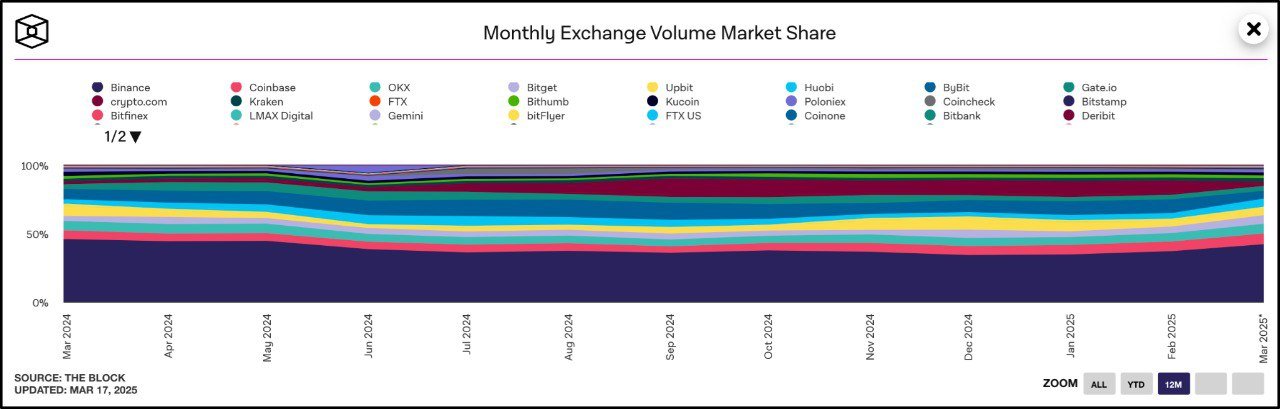

Several factors contribute to Binance’s sustained dominance in the cryptocurrency market. First, its extensive global reach. According to a Binance report, the exchange has served over 250 million users worldwide and consistently reports daily trading volumes exceeding $30 billion. Meanwhile, data from The Block indicates that Coinbase, with 110 million users, handles only around $15–$20 billion daily. That’s a lot of zeros! 🔟

On the positive side, Binance’s high trading volume enhances market liquidity, making it easier for traders to execute large orders without causing significant price swings. It’s like having a smoothie instead of a chunky soup! 🥤

However, Binance’s overwhelming market share raises concerns about centralization. This could make Binance vulnerable to hacks or data leaks. Binance has also been caught up in many accusations related to token listing, causing mixed reactions in the community. It’s like being the most popular kid in school but also the one who gets the most complaints. 🤔

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- How to use a Modifier in Wuthering Waves

- Basketball Zero Boombox & Music ID Codes – Roblox

- Lucky Offense Tier List & Reroll Guide

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- ATHENA: Blood Twins Hero Tier List (May 2025)

- Unlock All Avinoleum Treasure Spots in Wuthering Waves!

- EA FC 25 LaLiga TOTS: Release Date LEAKED! + Predictions!

- Ultimate Half Sword Beginners Guide

2025-03-31 15:21