The world of cryptocurrency, never a haven for understatement, has this week discovered yet another excuse for frenetic celebration—or mournful soul-searching, if you’re on the receiving end of a margin call. An additional $350 billion—give or take the odd jet—has been poured into this churning maelstrom, lifting the market to a prodigious $3.25 trillion. Trading volumes have ballooned, up nearly 73%, presumably as garden parties across the Riviera devolve into feverish debates about satoshis and bullish engulfing candles.

As is their tiresome wont, the altcoins, led by Ethereum and XRP (no, really, don’t yawn), have attempted to follow in capricious Bitcoin’s wake. To their credit, Ethereum managed a double-digit shuffle upwards within hours—no small feat, unless one recalls the speed with which it tumbles downwards—and XRP, ever the eager understudy, tacked on a dainty 5% as though to say, “I’m here too, sir!”

Perhaps you, gentle reader, are currently poised with trembling finger above your crypto exchange of choice, brimming with existential uncertainty. Should you invest, or will your retirement be spent reminiscing about that one time Bitcoin hit $103,000? Stay tuned, for what follows is a shameless forecast of imaginary wealth.

$3 Billion in Options—Because Poker Wasn’t Stressful Enough

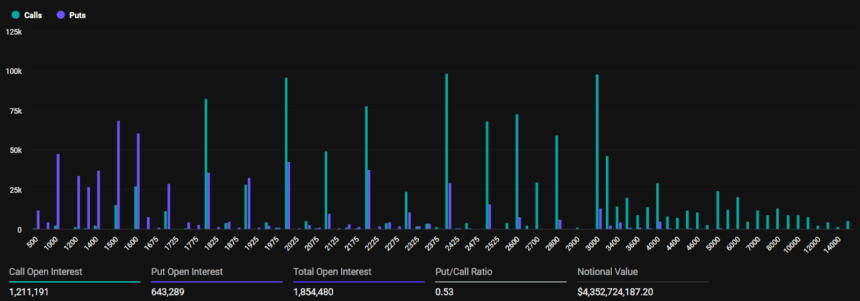

Reports suggest that around $2.65 billion in Bitcoin options are expiring imminently—a number presumably concocted by someone with a penchant for the theatrical. 25,925 contracts (down from last week’s 26,949, pour one out for the missing 1,024) are set to implode, expire, or simply vanish, depending on how one views the passage of time in crypto.

Meanwhile, Ethereum, clearly a glutton for contractual pain, will be seeing off 164,591 expiring options, all worth a paltry $364.06 million. Traders have set the “maximum pain” point at $1,850 (yes, really, “maximum pain”—a term one wishes could apply to the memory of 2022). The put-to-call ratio is 1.43, which, for those unfamiliar, means even the analysts aren’t sure what’s happening but are enthusiastic about assigning numbers.

Bitcoin Grabs Headlines, Marches Upward—Rationality Left for Dead

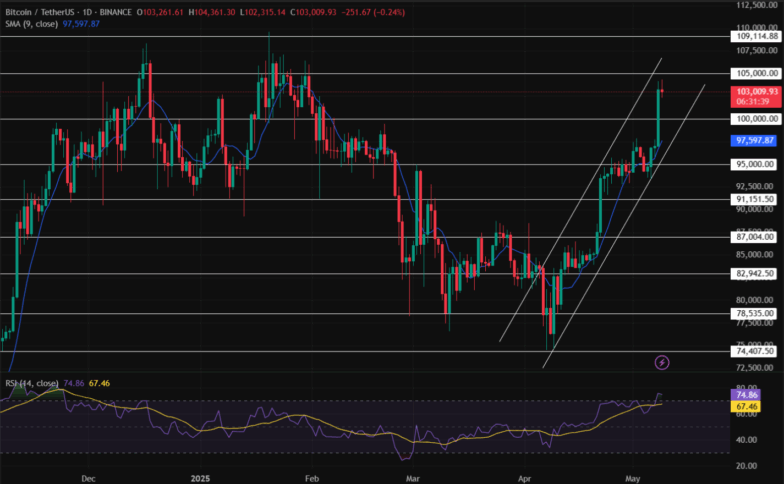

Over the past week, Bitcoin has done what all great celebrities do: staged a dramatic comeback. Up nearly 7%, it’s now flirting shamelessly with $104,000, capturing the imagination of crypto Twitter and probably a few disillusioned ex-bankers. Market cap surges to $2.05 trillion. Its dominance swells to 63%, leaving altcoins in much the same mood as the lesser Mitford sisters.

The Relative Strength Index (RSI) looks overbought—though one suspects it simply cannot take its eyes off itself in the mirror. The SMA indicator, acting like that one reliable chap who always brings the right sports equipment, props things up in the short-term. Bitcoin could, assuming sufficient caffeine intake among retail investors, break $105,000, or even $108,000 for those convinced money grows on digital trees. Or it could collapse (but let’s not spoil the narrative).

Ethereum: Climbing the Greasy Pole to $2,500 and Beyond (Or Below, Who’s to Say?)

Ethereum, much improved by its Pectra upgrade—so say the Ethereum faithful—has managed an ostentatious 25.38% rally. The price breaches $2,300 and eyes previous highs, as though suffering a bout of nostalgia. The market cap now sits at a dignified $280.07 billion, an eighth of the total, a ratio that will likely one day appear in economics textbooks as a “cautionary tale.”

MACD, in its secretive ways, has been green since mid-April, and the moving averages are experiencing crossovers reminiscent of awkward dances at debutante balls. The bullish crowd, always tiresomely optimistic, expects the price to charge towards $2,750, while the bears have their paw prints all over the $2,100 level, presumably waiting for an invitation to the next financial panic.

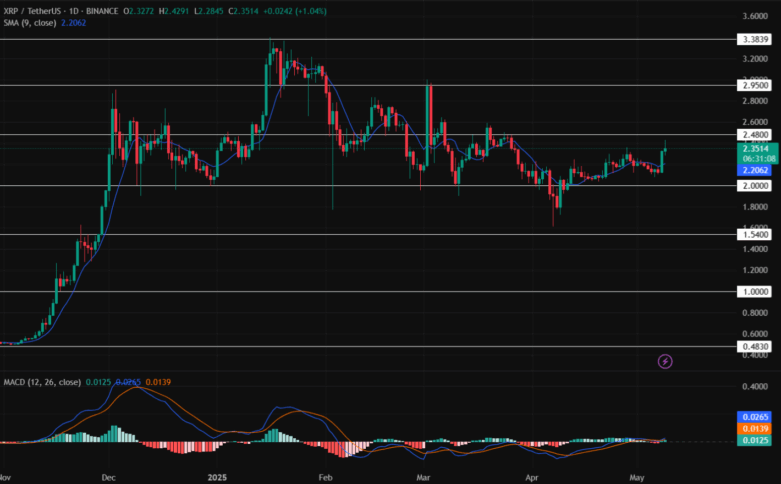

XRP: Still Here, And For Once That’s Not Bad News

Ripple, buoyed by a pat on the head from the SEC (don’t all cheer at once), is up nearly 5% today, cementing its place as the Dowager Countess of Altcoins. Market capitalization, $137.76 billion, puts XRP in fourth position—perpetually the bridesmaid in the crypto wedding.

Technical indicators—SMA, EMA, MACD—are all flashing green, the financial equivalent, one suspects, of jazz hands. Should buyers trample the sellers (a most uncivilized affair), $2.50 might be breached, at which point celebration will no doubt ensue. Conversely, bears may drag the price back to $2.00, accompanied by much gnashing of teeth and heated discourse among anonymous internet avatars.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- All Songs in Superman’s Soundtrack Listed

2025-05-10 00:40