What to know:

- A bull flag is emerging on XRP‘s daily chart, signaling continued bull run ahead.

- The $5 call option stands out on Deribit in terms of trading volume and open interest, suggesting a bullish sentiment.

As a seasoned researcher with a knack for deciphering market trends and a penchant for cryptocurrencies, I can confidently say that the bull flag emerging on XRP’s daily chart is a sight to behold. The $5 call option on Deribit, with its impressive trading volume and open interest, serves as an unmistakable beacon of bullish sentiment in the market.

It appears that XRP is currently experiencing heightened interest, suggesting a potential surge in value could be imminent based on its price trend and activity in the options market.

The payments-focused cryptocurrency is down 10% this week. The pullback, however, has taken the shape of a bull flag. This technical analysis pattern usually slopes in the opposite direction of the preceding sharp uptrend and, more often than not, recharges bulls’ engines for further gains.

According to Charles Kirkpatrick, a recognized market technician and president of Kirkpatrick & Company, Inc., we should anticipate a continuation of the current trend’s direction if it is strong and sudden, as stated in the book “Technical Analysis: The Definitive Resource for Financial Market Technicians.

Kirkpatrick noted that flags which increase by 90% or more rarely experience failures, and on average, they yield a return of 69%.

In simpler terms, XRP’s price has surged approximately 500% over the past four weeks, reaching about $2.9 by December 3. If this trend continues with a potential breakout, we could see further growth up to $5. This projected level is calculated using a method called the “measured height” in technical analysis, which involves adding the height of the previous uptrend to the breakout point, currently around $2.5.

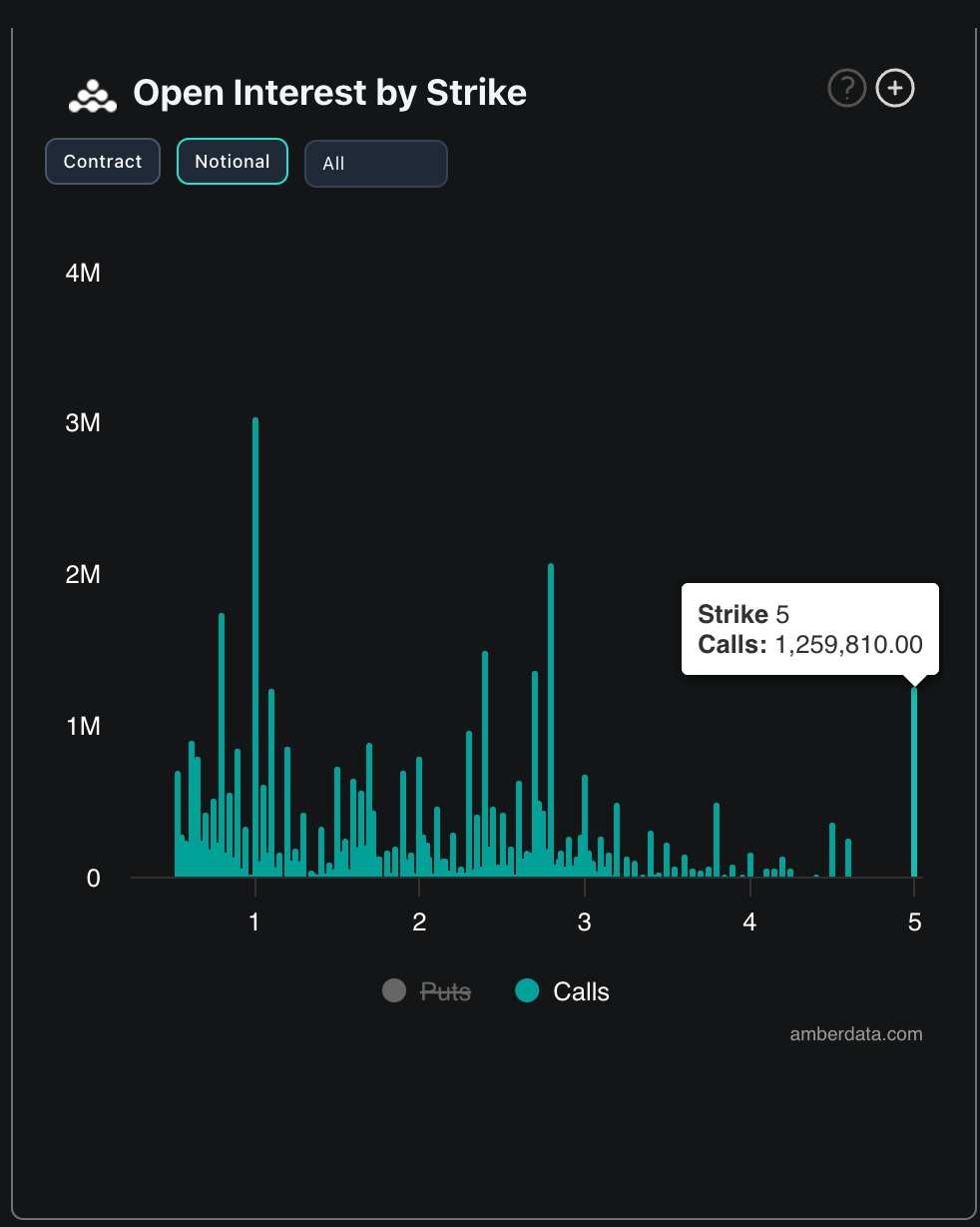

It’s worth noting that there’s increasing action in the $5 call options for Deribit, providing a favorable, disproportionate payoff to buyers if the price surpasses that point.

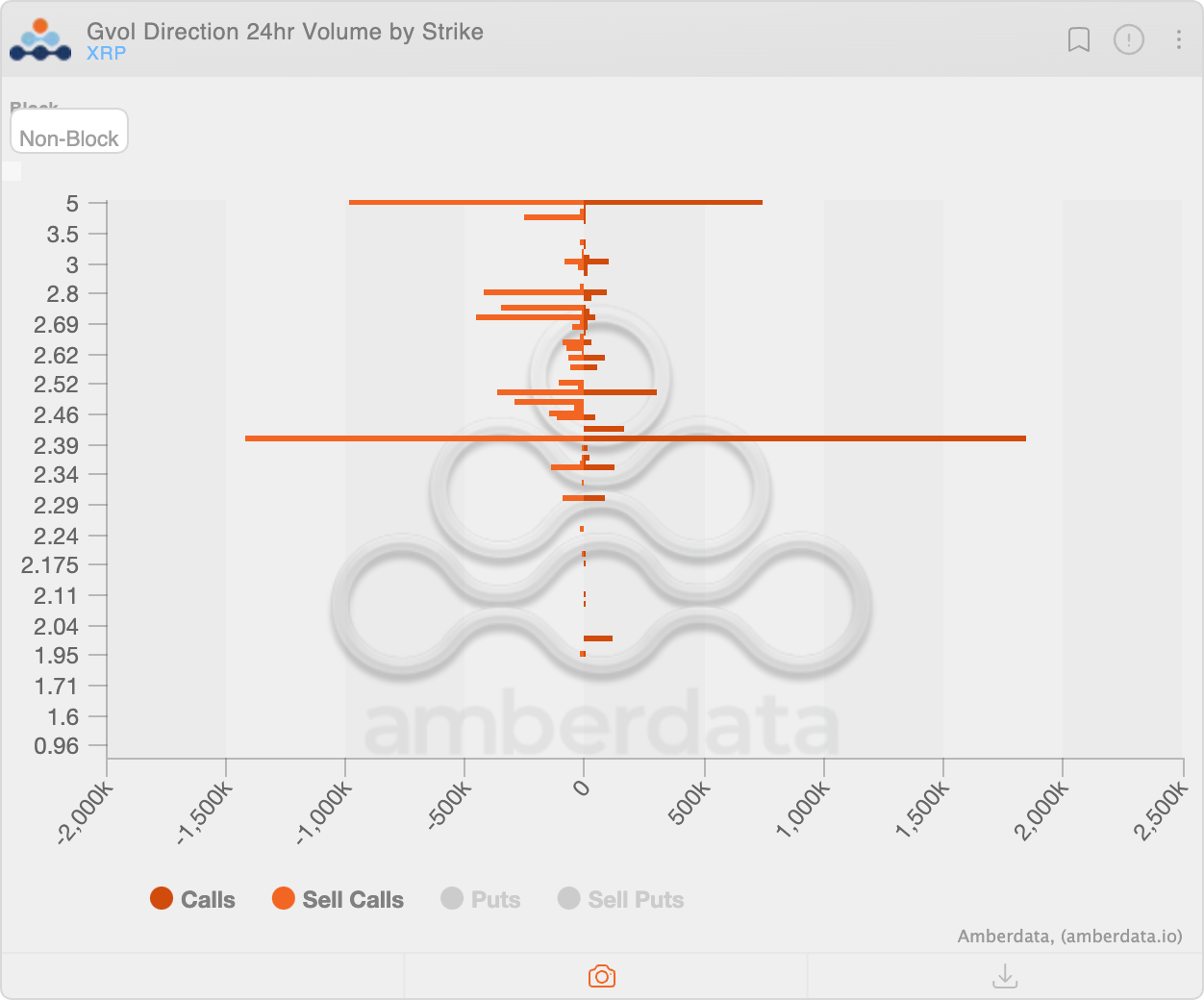

In the last 24 hours, the XRP option with a $5 strike price is the second-most actively traded among all options, as reported by Amberdata, with a total of 1.7 million contracts being exchanged (each contract equates to 1 unit of XRP).

It’s worth noting that Deribit data indicates the $5 call is the most frequently traded out-of-the-money or higher strike call option, with an open interest of approximately 1.25 million. This heightened activity suggests a bullish sentiment among traders, provided these trades are not being made by market makers.

Still, readers might want to note that technical analysis patterns do not always work as intended, and options market positioning can flip quickly per evolving price trends. As such, tracking the broader market sentiment is pivotal.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-11 17:00