Ah, the dance of the derivatives! While Bitcoin’s spot price lingers near $113,500, a mere whisper away from its $126,000 crescendo, the traders-those eternal romantics of risk-are frolicking in the fields of futures and options. 🕺💹

Futures Frenzy: CME, the Tsar of Trades

The markets, they whisper, are alive with positioning-a cautious optimism, like a lover hesitating at the door. Bitcoin futures open interest (OI) stands at a staggering $73.8 billion, according to coinglass.com. Traders, it seems, are anything but indifferent, even as the spot price takes a modest bow. 🎭

The CME, that grand old maestro, conducts the orchestra with $16.79 billion in OI, a regal 22.7% of the total. Binance follows, a dutiful second with $12.69 billion, while OKX, Bybit, and Gate trail in a tightly contested race. The rest-Kucoin, Bitget, WhiteBIT, BingX, and MEXC-are the chorus, adding their voices to this financial opera. 🎻

In the past 24 hours, most exchanges saw modest OI contractions, a wave of profit-taking, perhaps. But BingX and MEXC, those rebels, defied the trend with jumps of 28.5% and 5.25%, respectively. Ah, the speculative spirit lives on! 🔥

Since June, Bitcoin futures OI has climbed steadily, mirroring last year’s bullish symphony. The metric’s ascent alongside price reflects a market thick with conviction-and leverage. Traders, they lean into the volatility, awaiting the next move from the macro catalysts and the Fed’s enigmatic baton. 🦹♂️

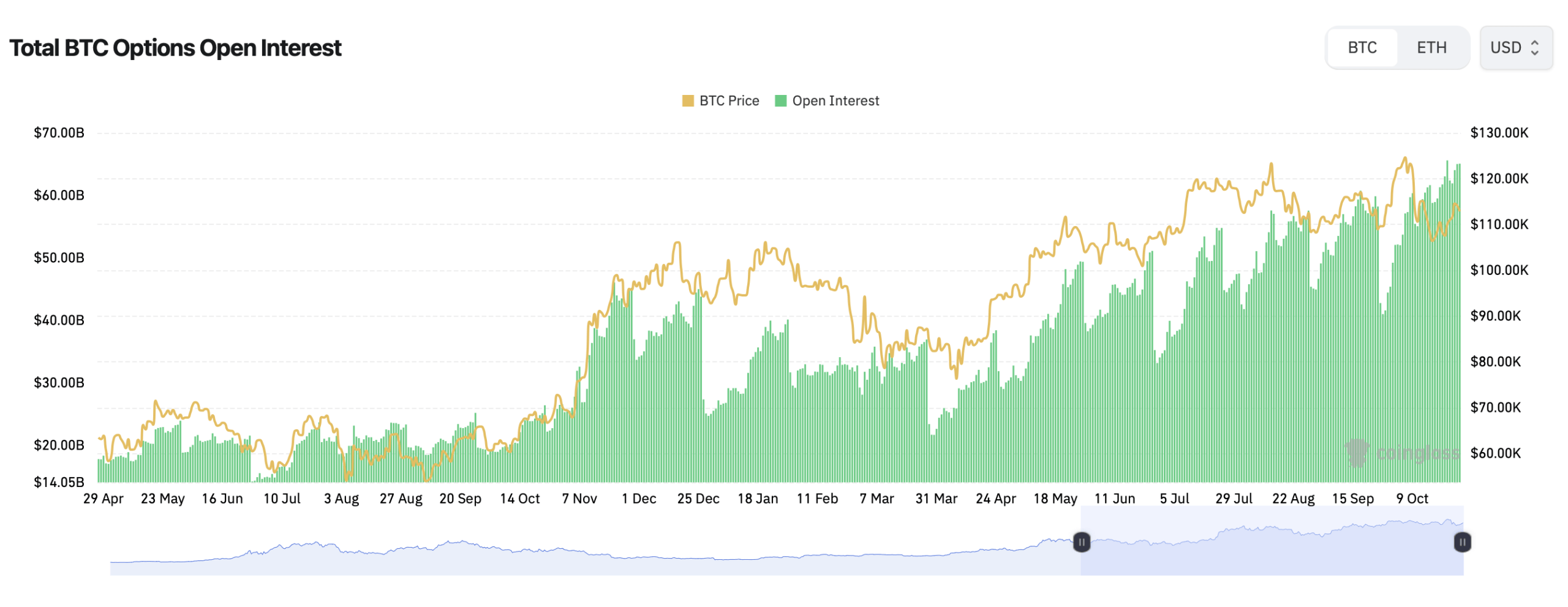

Options Open Interest: A Lifetime High, A Heart Full of Hope

The options market, that playground of dreams, has reached an all-time high of $65 billion in notional OI. Deribit, the undisputed monarch, commands over 90% of this realm, with a healthy tilt toward calls (60.2%) over puts (39.8%). Traders, it seems, are betting on the sun rising rather than setting. 🌅

In simpler terms, a call is a bullish contract that profits if Bitcoin climbs, while a put is a bearish one that gains if prices drop. The ratio suggests a bullish lean, but not without caution-traders still hold roughly 200,000 BTC worth of puts, a hefty hedge in case the rally fizzles. 🛡️

The biggest bets are stacked far into the future, with contracts expiring in December 2025. Traders are eyeing price targets as high as $140,000, $150,000, and even $200,000 per coin-clear signs that some market heavyweights are thinking long term. 🌌

The single most popular bet is the $140,000 call option on Deribit, accounting for more than 12,000 BTC in open interest. In plain English: big players are positioning for the next major rally, not just the next week’s bounce. 🚀

On the other hand, shorter-term activity shows strong volume around $114,000 to $118,000 calls, hinting that traders are positioning for a possible rebound before the month closes. 🏃♂️💨

Bitcoin’s max pain hovers around $114,000-the price where option buyers lose the most and sellers (usually the institutions) benefit. That’s just about where spot prices are coasting, implying a battle of wills between bulls defending the $113K range and option writers smiling all the way to expiry. 😈

Bitcoin may be off its highs, but its derivatives ecosystem is hotter than ever. Futures positions remain near record territory, and options traders are loading up on long-term calls like they’re collectibles. Whether Bitcoin’s next move is up or down, one thing’s certain-Wall Street and crypto natives alike are neck-deep in the derivatives arena. 🌪️💰

FAQ 🧠

- What is Bitcoin’s total futures open interest right now?

Bitcoin futures OI is roughly $73.8 billion across all exchanges, led by CME and Binance. 📊 - Why are options OI levels important?

They show how much capital is tied up in Bitcoin’s options market-a key gauge of speculative activity and sentiment. 🔍 - What does “max pain” mean in Bitcoin options?

It’s the price level where most options traders lose money at expiry, and market makers tend to profit. 😢💸 - Are traders more bullish or bearish right now?

Overall sentiment leans bullish, with about 60% of open options being calls betting on higher prices. 🐂

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- James Cameron Gets Honest About Avatar’s Uncertain Future

- Code Vein II shares new character trailers for Lyle McLeish and Holly Asturias

- YouTuber streams himself 24/7 in total isolation for an entire year

- Amanda Seyfried “Not F***ing Apologizing” for Charlie Kirk Comments

- Zombieland 3’s Intended Release Window Revealed By OG Director

- The dark side of the AI boom: a growing number of rural residents in the US oppose the construction of data centers

- Now you can get Bobcat blueprint in ARC Raiders easily. Here’s what you have to do

2025-10-29 17:48