It is a truth universally acknowledged that a cryptocurrency in possession of good fortune must be in want of a correction. 🎭

What the discerning investor must observe:

- Bitcoin, that most capricious of suitors, has seen its ardent advances cool, lingering near $111,000 like a gentleman caller who has overstayed his welcome.

- The analysts at CryptoQuant and Glassnode-those keen observers of society’s financial machinations-declare the market quite fatigued, with short-term holders trembling at the prospect of losses should Bitcoin descend below $113,000.

- Long-term holders, ever the prudent sort, have begun discreetly selling, while traders engage in the fashionable pastime of hedging-proof that caution is the order of the day.

After months of steadfast ascent to dizzying heights, Bitcoin’s vigor has waned, trading at a modest $111,000 on a Friday afternoon in Hong Kong-a mere 2% increase over the past week, as dutifully recorded by CoinDesk. 📉

The retreat from its recent zenith of $126,000 is marked by momentum stumbling below critical thresholds, as capital flees the spot market and ETFs like guests departing a tedious soirée.

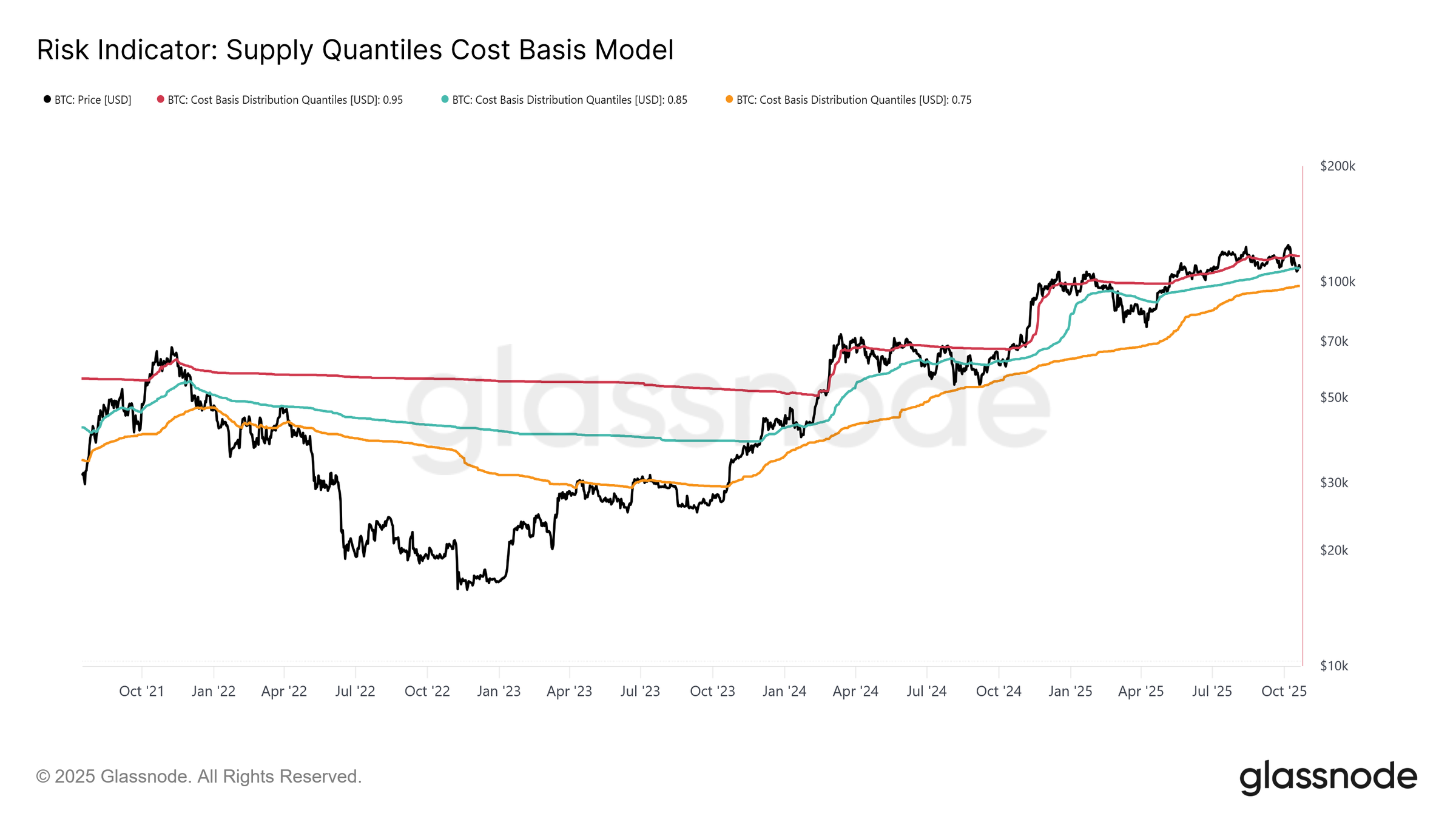

Glassnode, in its latest report, frames these repeated stumbles as evidence of market exhaustion-much like a debutante after one too many quadrilles. Meanwhile, CryptoQuant, in a missive shared with CoinDesk, detects similar distress in shrinking profits and dwindling exchange inflows. How very alarming! 😱

Both firms contend that capital remains within the cryptoverse but has taken to frolicking in derivatives, where volatility itself has become the fashionable commodity. Until equilibrium is restored, rallies shall be met with skepticism rather than enthusiasm-much like an unexpected proposal from an ineligible bachelor.

Glassnode identifies $113,000 as the crucial threshold separating renewed vigor from prolonged stagnation. Should Bitcoin falter below this line, recent buyers-those unfortunate souls-shall find themselves nursing losses, their confidence shaken like a poorly poured cup of tea.

Long-term holders, ever the mercenary sort, have been selling at a rate exceeding 22,000 BTC per day since July-a most ungracious habit that saps momentum and stifles recovery. Should Bitcoin fail to reclaim $113,000, Glassnode warns of deeper losses, plunging toward $108,000-$97,000, where 15%-25% of the supply has historically found itself in the red. A most unfortunate predicament! 💔

CryptoQuant’s findings corroborate this dismal outlook. ETF inflows, once the toast of the town, have cooled, while exchange reserves swell-proof that traders prepare to sell into volatility rather than accumulate, like prudent housekeepers stocking larders before winter.

The firm insists this is merely a rotation of capital within crypto’s grand ballroom, not a full retreat, as liquidity waltzes toward futures and options markets where volatility premiums have surged. A déjà vu of 2021 and mid-2022, when speculative leverage usurped spot conviction with all the grace of an overeager dance partner.

Options data further betray the market’s cautious disposition. Glassnode reports record-high open interest as traders increasingly rely on derivatives to hedge-like ladies clutching their fans at the first hint of scandal-with demand for puts rising across maturities.

Market makers, ever the mediators, have smoothed short-term price action by selling into rallies and buying dips-much like a skilled hostess diffusing tension at a dinner party. Elevated volatility and fervent put demand keep the market restrained, with rallies stifled by hedging flows rather than genuine conviction.

Thus, the market finds itself in a most perplexing limbo, where price action is dictated not by bold direction but by cautious risk management-a state of affairs as vexing as an unfinished novel.

CryptoQuant interprets these flows as consolidation rather than catastrophe, suggesting liquidity remains within crypto’s grand estate, merely shifting between instruments as investors await clearer signals-be it from the Fed or ETF inflows-before committing fresh capital.

Both firms agree that a true recovery shall require renewed spot demand and quieter derivatives activity-conditions that may hinge upon Fed rate cuts or a revival in ETF enthusiasm. Until then, Bitcoin is not so much collapsing as pausing for breath, trading less like a revolution and more like a well-choreographed quadrille.

Volatility may yet reign as the market’s darling, but even the most ardent traders must eventually weary of trading fear. After all, even the liveliest ball must conclude before dawn. 🎩

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- NBA 2K26 Season 5 Adds College Themed Content

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Gold Rate Forecast

- Mario Tennis Fever Review: Game, Set, Match

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- Train Dreams Is an Argument Against Complicity

- EUR INR PREDICTION

- The Abandons: Netflix Western Series Disappoints With Low Rotten Tomatoes Score

2025-10-24 09:23