It is a truth universally acknowledged, that a cryptocurrency in possession of a good fortune, must be in want of stability. Yet, the dominant cryptocurrency, Bitcoin, has mostly languished under the sum of 120,000 since its peak of 123,000 on the 14th of July, and even then, the altcoins have struggled to claim their throne.

Even With Bitcoin Flat, Hopes for Altcoin Season Are Fading

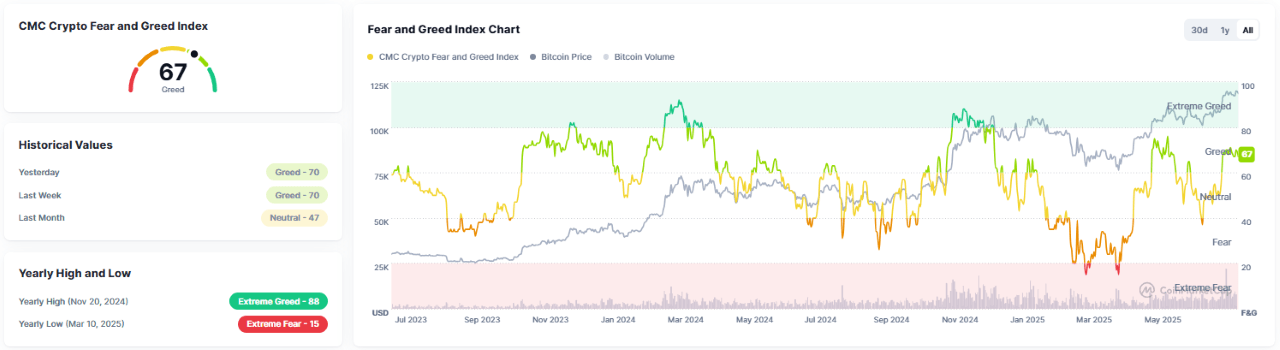

Bitcoin (BTC), the most illustrious of all cryptocurrencies, has been treading water for the past week or so, and despite a relatively bullish sentiment, as measured by Coinmarketcap’s “Greed Index,” the altcoins, at least for now, have failed to topple the king. It seems, dear reader, that the reign of Bitcoin is as secure as Mr. Darcy’s estate at Pemberley.

As recently as Tuesday, the Greed Index was at 70, indicating a rather optimistic mood among investors. This aligns well with another Coinmarketcap metric, the Altcoin Season Index, which reached its zenith at 56 on Monday. Such a state of affairs followed the impressive rallies by the two largest altcoins, ether (ETH) and XRP (XRP), and even more remarkable performances by lesser tokens such as pudgy penguins (PENGU), which has risen nearly 34% for the week at the time of writing. One might say, the market is as unpredictable as a ball at Meryton.

However, even as Bitcoin took a backseat after reaching its own all-time high of 123,000 on July 14, the altcoins have been unable to dethrone the marquee cryptocurrency from the top spot. The Altcoin Season Index has fallen to 40, greed has eased to 67, and perhaps as evidenced by the implosion of the much-hyped PUMP token, which powers the memecoin site pump.fun, hopes for a 2025 altcoin season are quickly fading. It seems, the market is as fickle as Mrs. Bennet’s nerves.

Overview of Market Metrics

Bitcoin was up by a hair at the time of reporting, trading at 118,745.25, an appreciation of 0.82% over 24 hours. The digital asset was also up on a weekly basis, but by an even smaller margin of 0.08%, and traded between 117,247.97 and 119,535.45 since yesterday. A mere trifle, one might say, but enough to keep the market’s attention fixed upon it like a lady of quality awaiting her suitor.

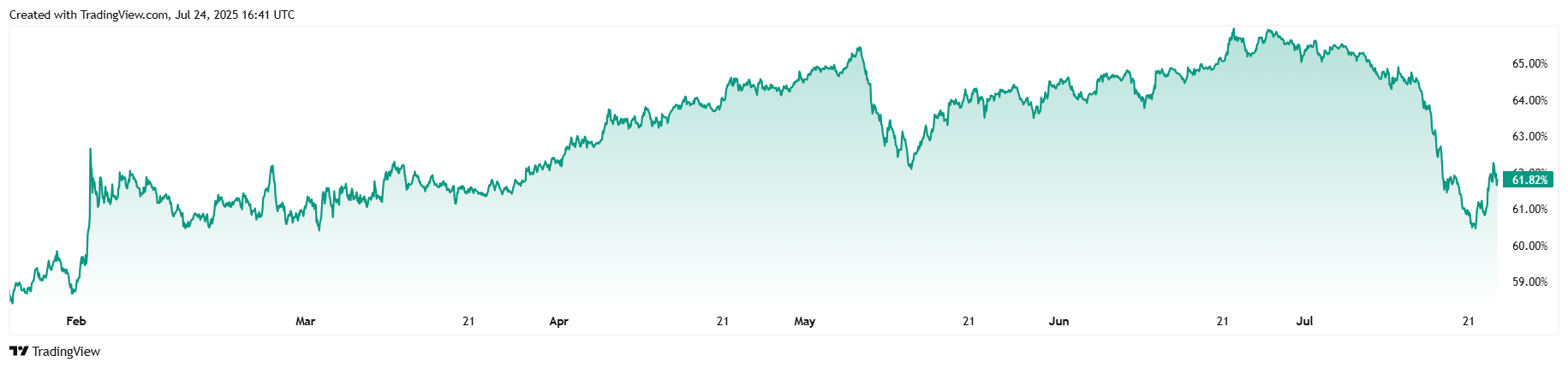

Twenty-four-hour trading volume climbed 9.94% to 74.27 billion, and Bitcoin’s market capitalization inched up 0.65% to 2.35 trillion, while BTC dominance dipped 0.07% and stood at 61.83%. Total Bitcoin futures open interest for the day dropped 1.21% to 83.62 billion, according to Coinglass, and total BTC liquidations for the day came in at 72.56 million. Long liquidations dominated that grand total with 51.03 million wiped out, while short positions had a relatively smaller 21.54 million liquidated. A veritable dance of figures, reminiscent of a quadrille at a grand ball.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- Which Is the Best Version of Final Fantasy IX in 2025? Switch, PC, PS5, Xbox, Mobile and More Compared

2025-07-24 20:59