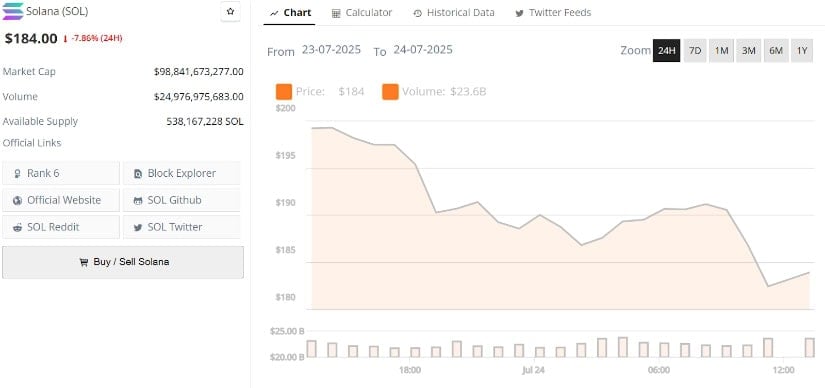

Ah, Solana, darling, back in the spotlight once more! Bulls and bears are engaged in a most dramatic pas de deux near the $177 to $190 range, leaving us all on the edge of our velvet-upholstered seats. After a rather exuberant leap to $206, followed by a graceful cooldown, the market darlings are now whispering sweet nothings about the next grand jeté. 🌟

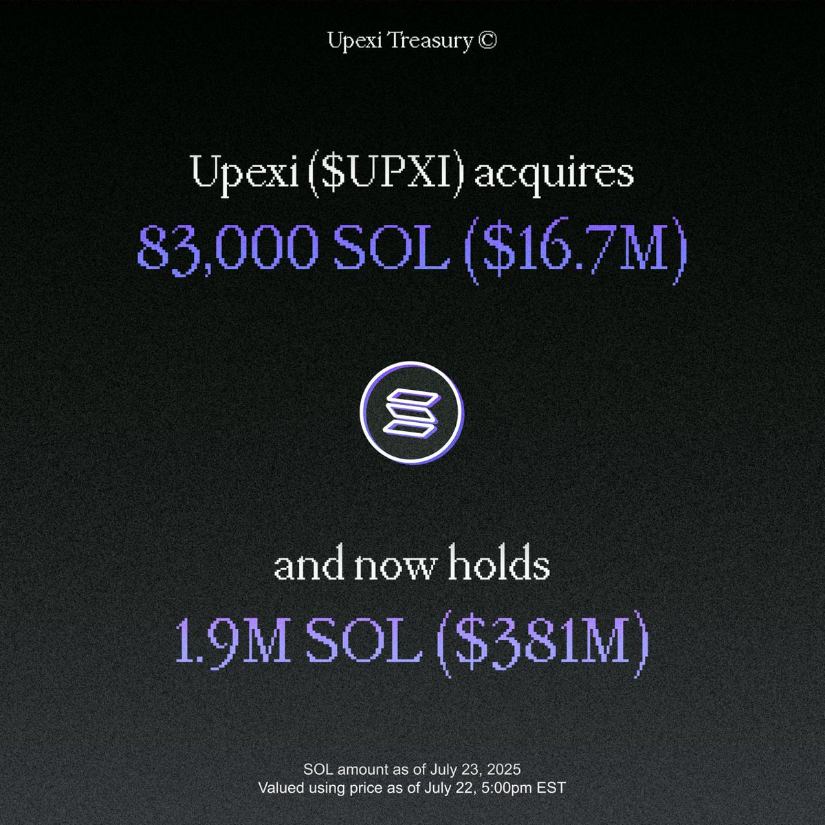

Upexi Treasury: The Patron of the Solana Ballet 🎭

In a move that screams “I’m here for the long haul, darling,” Upexi Treasury, the grande dame of Solana holdings, has tossed another 83,000 SOL (a cool $16.7 million) into its already overflowing coffers. This brings their total to a staggering 1.9 million SOL, or $381 million. SolanaFloor, ever the astute critic, believes this is a strategic pirouette, a long-term positioning that whispers of unshakable confidence. While the market dithers and recalibrates, Upexi’s accumulation is the standing ovation that steals the show. 🤑

With Solana trading in a supportive range, this $16.7 million injection is the equivalent of a prima ballerina getting a fresh pair of pointe shoes—just what’s needed to establish a new base. 🩰

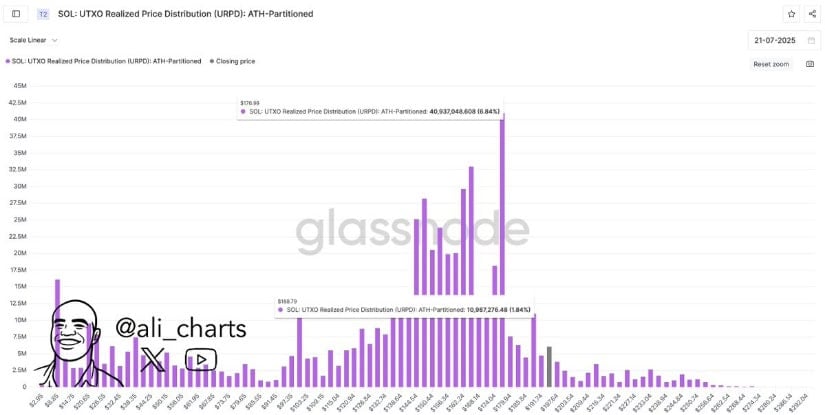

On-Chain Whispers: The Technical Tango 🕵️♂️

Ali Martinez, the Sherlock Holmes of on-chain data, has added a technical flourish to Solana’s narrative. According to the UTXO Realized Price Distribution (URPD), major transactional volume is clustered at $189 and $177, marking these zones as the velvet ropes of short-term support. These levels are backed by a high concentration of wallet activity, the financial equivalent of a standing-room-only crowd, providing a cushioned landing for any retracements. 🛡️

Technically speaking, this suggests Solana isn’t spiraling into a breakdown but rather taking a controlled intermission. With institutional inflows and URPD-backed support, the stage is set for a stabilization before the next act. 🎭

Sam North’s Chart: The Battle for the Ballet Floor ⚔️

Sam North’s latest chart reveals Solana testing a historically significant zone—the $186 to $190 range. This area has flipped roles more times than a prima donna in a soap opera, acting as both support and resistance. Now, it’s being revisited as the price pulls back from recent highs. The number of rejections and bounces off this region underscores its dramatic importance. Is it a retest or a battle for the soul of the ballet? Only time will tell. 🩰⚔️

Structurally, this level aligns with URPD clusters and institutional buy zones, adding a layer of confluence. If buyers defend this region, it could become the launchpad for another ascent to $200+. However, a break below $177 might send us waltzing down to $160. 🌀

Cup-and-Handle: The Grand Finale? 🏆

Chris Paul has spotted a pattern on Solana’s higher timeframe chart that resembles a textbook cup-and-handle formation. If this plays out, Solana could be poised for another breakout once the correction inside the handle completes. From a measured move perspective, a successful breakout could send us soaring toward the $330 to $400+ region, aligning with historical resistance levels from early January 2025. With institutional buying and on-chain support, this setup adds credibility to the idea that Solana’s summer run might still have legs. 🌞

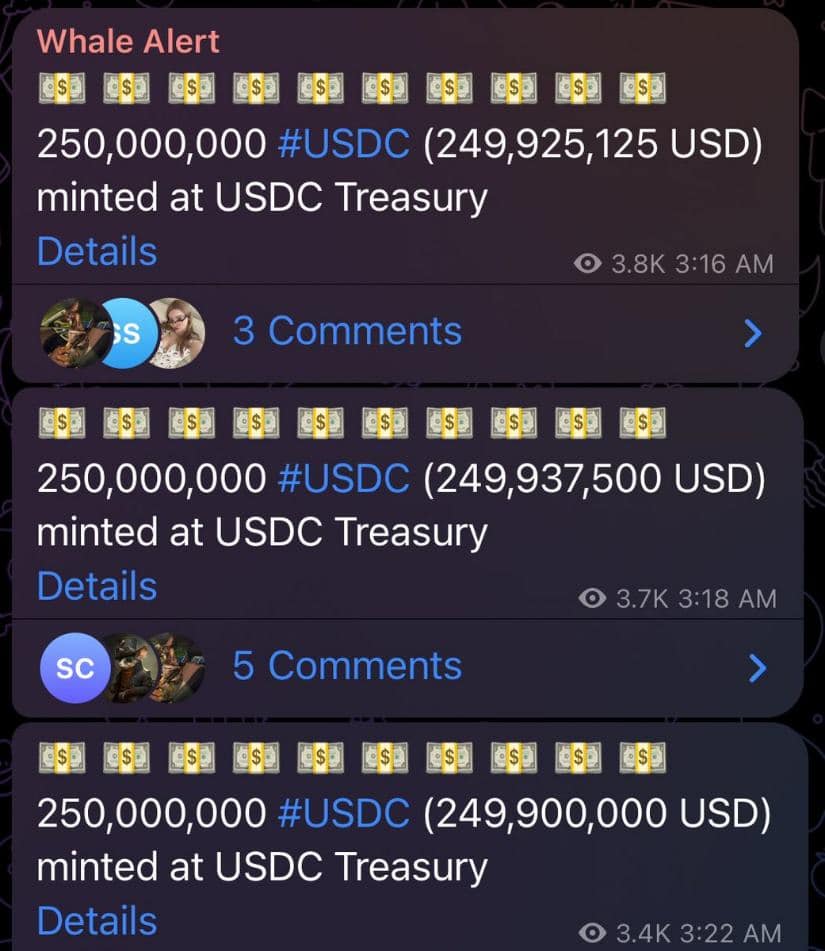

Circle’s USDC Mint: The Encore Performance 🎉

Circle has minted a staggering $750 million worth of USDC directly onto Solana, a move that’s becoming as routine as a curtain call. This reflects deepening trust in Solana as the preferred chain for stablecoin deployment. Paired with institutional accumulation and technical resilience, this backend activity solidifies the narrative that Solana isn’t just riding a hype cycle—it’s maturing into serious infrastructure. 🏗️

Circle mints $750 million USDC on Solana, another major step in the network’s stablecoin dominance. 💪

Final Bow: Will the Bulls Take the Encore? 🎭

Solana’s recent pullback may look like a dramatic fall, but the on-chain support, institutional buying, and backend activity paint a different picture. Key wallet clusters around $189 and $177 are holding firm, historically acting as accumulation pockets during retracements. Technically, the structure remains bullish as long as the price holds above the $177 to $180 support block. If buyers flip $190 into support, the next logical resistance is $206, beyond which the cup-and-handle breakout toward $330 to $400 becomes increasingly plausible. 🌟

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- All Songs in Superman’s Soundtrack Listed

2025-07-24 16:22