Ah, Bitcoin once soared like a proud falcon, touching the divine height of $122,054. Yet, as with all things grand and glorious, there comes a gust of wind—profit-taking, skepticism, and perhaps a dash of market mischief. The cryptoverse now whispers of a cooling appetite among the titans of finance, a sort of “even giants get tired,” if you will.

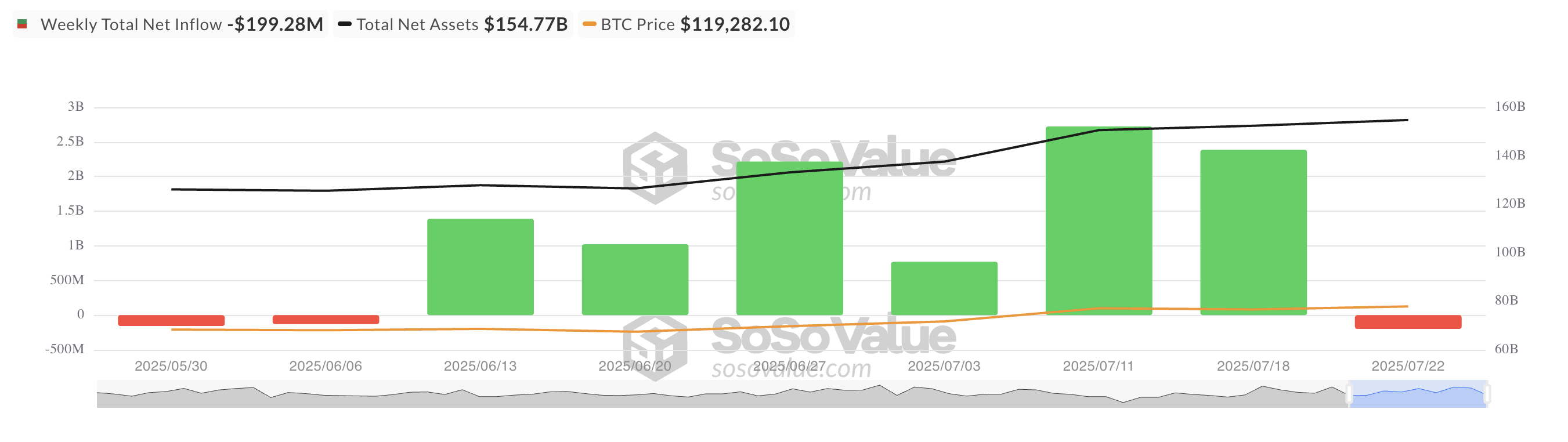

After an impressive six-week binge of inflows into the US-listed spot Bitcoin ETFs, a sudden reversal has swept across the landscape. Funds, those daring explorers who once gladly threw their gold into the cryptic depths, are now retreating, outflows mounting like an unwelcome tide.

Institutional Investors Pull $199 Million From BTC ETFs — Like a Bad Breakup 💔

According to the ever-reliable SosoValue (who probably have more tea than the local gossip), those ETFs that once shined like stars in a clear sky have suddenly decided they prefer a darker night. Outflows of $199 million this week mark a mood swing more rapidly than a fashion trend. Meanwhile, the noble institutions, once so eager to accumulate BTC as if it were the new Holy Grail, now seem to be reconsidering—perhaps realizing that chasing tops might not be the best idea after all.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter—where the secrets of the cryptoverse are spilled faster than you can say “to the moon.”

This reluctance follows Bitcoin’s dramatic leap to a staggering $122,054—putting all the doubters in a spin, and maybe giving some old hodlers the courage to cash out before the ship sinks. Those who had their eyes gleaming at the thought of piercing through the $120,000 barrier suddenly decided to lock in their gains, perhaps with a smirk of justified cleverness.

Indeed, ETF flows are the market’s pulse—when they slow down or reverse, one could wonder if confidence is evaporating faster than ice cream in July. The seasoned “diamond hands” of yore are now seeming a bit more… human, retreating to save what’s left in the tank.

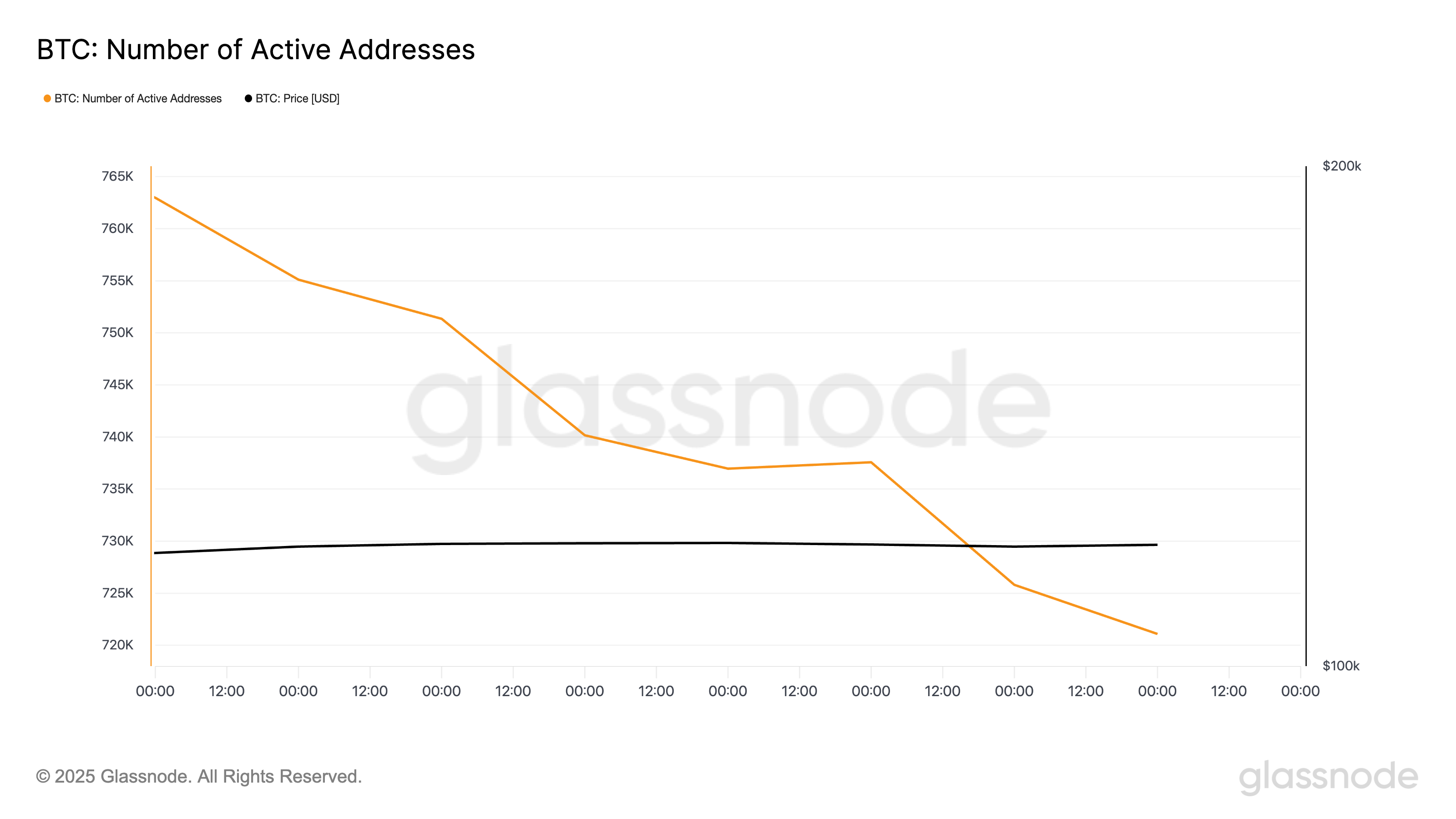

Moreover, the wise folks at Glassnode report a decline in on-chain activity—an ominous whisper of possible downside. The number of active addresses tumbled to a low of 721,086 yesterday, a digital ghost town where once lively trade thrived. That’s the kind of dip that usually makes traders nervous, like an ominous cloud forming over a sunny picnic ☁️🌭.

When the institutional giants retreat and the retail crowd shrinks faster than a snowman in summer, the whole market seems to hit pause—like a tired bear yawning after a long winter. The risk of a short-term correction becomes as palpable as forgetting your umbrella on a rainy day.

BTC Aiming for $120,000, but Like a Butterfingers, Might Drop It 💸

The one-day charts look as cautious as a cat eyeing a lemon—a rangebound dance since the July high. Resistance sits stubbornly at $120,811, while support is a fragile line at $116,952. A failure to hold might see Bitcoin testing the support at $114,354—probably not the kind of party people want to attend.

But hey, if demand somehow sparks back to life like a phoenix from the ashes, Bitcoin might just smash through that resistance barrier and make another run at glory. Until then, it’s a game of patience—like waiting for your coffee to brew while checking the price ticker every five seconds.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- All Songs in Superman’s Soundtrack Listed

2025-07-23 14:09