Ah, the joys of cryptocurrency! A truly unhinged dance of dollars, as the once-muted token shimmies along its larger uptrend, leaving all of us wondering: Could it possibly strut its way up to $22? Only time—and some very enthusiastic bulls—will tell. But let’s not get too ahead of ourselves, dear reader. The short-term support must hold, or we might just see some wild swings that’ll leave us questioning our life choices. 😅

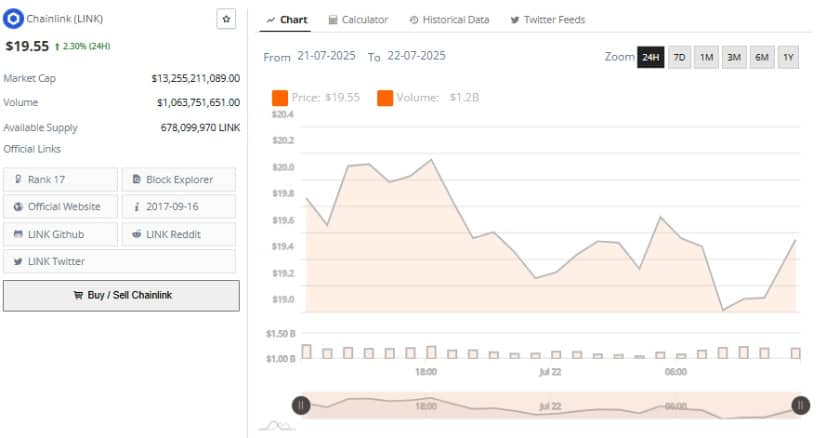

At the moment, the price has recovered from a sharp retracement, with buyers enthusiastically nibbling at those delicious technical zones. Right now, LINK is sitting pretty at $19.55, with a slight 24-hour gain of +2.30%. I know, it doesn’t sound like much, but hey, every little bit helps, right? 💸

Chainlink Price and Volume: A Classic Tale of Accumulation… or Something Else?

In the past 24 hours, LINK has waged a volatile battle, trading between extremes and briefly popping over $20.30 before diving under $19.00 and then clawing its way back to $19.55. A true spectacle! This back-and-forth drama is a prime example of short-term traders making their moves—and honestly, it’s giving me whiplash. 🌀

The psychological $19 level is like the magic number here, as bulls gallantly step in to absorb the selling pressure. It’s almost like a game of musical chairs, except the chairs are made of digital tokens, and someone’s going to end up with a bruised ego. 🪑💥

Speaking of games, let’s talk about trading volume—because what’s a cryptocurrency market without a bit of chaos? The volume surged to an almost heart-stopping $1.2 billion, but currently, it’s resting comfortably at $1.06 billion. Not bad, right? This reflects strong market engagement from both buyers and sellers. It’s like a never-ending tug-of-war. 🤺

Interestingly, the price rebound was accompanied by sustained volume, indicating that we might be witnessing some good old-fashioned accumulation near the $19 level. LINK’s market cap is a respectable $13.25 billion, with 678 million tokens in circulation, keeping it comfortably nestled as the 17th largest cryptocurrency, despite all the drama. Go, LINK, go! 💪

Technical Indicators: Are We Shifting Gears, or Just Stuck in Neutral?

Looking at the daily chart of LINK/USD, one can’t help but admire the broader bullish structure—though let’s be honest, it’s been a bit of a rollercoaster. After rallying from below $15 in late June, it made its way up to a local high of $19.99, only to correct itself to $18.666. Oh, the humanity! 😱 A daily loss of -4.28% is nothing to sneeze at, but the overall trend is still very much in the positive zone. The higher highs and higher lows are like a beautiful symphony… if that symphony were played on a broken piano. 🎹

But, hold your horses—short-term indicators are waving red flags. The MACD line, at 1.400, is still above the signal line (1.009), with a histogram reading of 0.391. While there’s no bearish crossover yet, the narrowing gap between the lines is about as exciting as watching paint dry. 😬

The Chaikin Money Flow (CMF) is also giving us a subtle “meh” with a reading of +0.11. It’s positive, but the money’s trickling in at a snail’s pace. If the buyers don’t come out to play soon, we might be in for a pause—or worse. 🐌

Intraday Charts: Bearish Divergence—Can We Get a Dramatic Twist?

And now, for the pièce de résistance—@olaxbt’s 1-hour chart. It’s a thing of beauty, if your idea of beauty involves bearish divergence and momentum fade. LINK had a solid run from July 15 to July 19, climbing from $16 to over $19.80, but then—oh no!—it broke below the ascending support line, and now it’s hanging out around $19.03. It’s like watching a movie where the hero gets knocked down right before the grand finale. 🎬

Volume analysis is also showing signs of distress, with the Cumulative Volume Delta (CVD) dipping below its 14-period average. Meanwhile, the Money Flow Index (MFI) has dropped to 42.04, confirming that capital inflows are slowing down. It’s like the market is saying, “Okay, that’s enough excitement for one day. Let’s take a nap.” 🛌

All this suggests that the momentum is taking a bit of a breather, though we’re not calling for a full-on reversal just yet. The $19 level is crucial—break above $20.40, and we could see some bullish fireworks. But if it dips below $18.80, prepare for a deeper retracement. 🌪️

So, there you have it. Chainlink’s price action is certainly one to watch. With high volume and a shifting technical landscape, traders will be keeping a very close eye on that $19 support. Will the bulls hold strong? Will the $22 dream become a reality? Grab your popcorn, folks. It’s going to be an interesting show. 🍿

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- League of Legends MSI 2025: Full schedule, qualified teams & more

- All Songs in Superman’s Soundtrack Listed

- Gaming’s Hilarious Roast of “Fake News” and Propaganda

2025-07-23 00:28