In a turn of events reminiscent of a highly exaggerated melodrama, the price of Solana (SOL) has surged over 14% in the past week, sauntering to the lavish height of $190. Yet, despite this triumphant march, it still lingers nearly 35% below its illustrious peak of $260, like a quirky character in a play who can never quite reach the finale.

To ascend further, SOL must conquer the psychological barrier of $200, a task that seems more monumental than writing a professional email on a Friday afternoon. While price alone may offer a mere sliver of the narrative, on-chain and derivatives data imply that this excitement might just be the prelude to something far more dramatic.

Oh, SOPR! The Harbinger of Investor Confidence

One of the clearest markers of bullish fervor is brought to us by the charming SOPR (Spent Output Profit Ratio) metric. Picture this: SOPR reveals whether selling souls—err, I mean SOL—results in a delightful profit or a dismal loss. When it flourishes above 1, sellers are joyously consuming their profits. Below 1? Well, that’s a party no one wishes to attend.

Craving more nuggets of token wisdom?: Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here, if only to enjoy the irony of cryptography!

In a fascinating plot twist, SOL’s SOPR has taken dives—much like my spirits during Monday morning meetings—only to rebound in synchrony with the price. This healthy “reset” serves as a reminder that short-term profit-taking can happen without throwing the entire production into chaos. Curiously, past dips in SOPR around the blissful value of 1 have often preceded a delightful uptick in price shortly thereafter.

For instance, on June 27, SOPR dipped to 0.97, and the SOL price leapt from $142 to $154 in the blink of an eye. In another theatrical twist, on July 19, SOPR slipped again to 1.007 while SOL waded through the shallow waters of $177. Two days later, as if it were scripted, the SOL price broke through the $190 barrier.

Currently, SOPR lounges around 1.02, suggesting most sellers are comfortably basking in profits but not rushing to throw their SOL into the market like confetti at a wedding. This generally hints that holders are playing the waiting game, expecting the prices to waltz even higher.

Derivatives Market: A Cooling Breeze in the Heat of Battle

Backing up our beloved SOPR signal is the funding rate and open interest data—a riveting duet. Solana’s funding rates are floating at a positively quaint 0.0152. This suggests bullish enthusiasm without raising alarms about an overheated market, akin to a scandal-free evening at the theatre.

When funding rates ascend too high, that’s typically a signal of too many traders caught up in longing, gripping their wallets with sweaty palms and praying for mercy during a price pullback. But fear not, dear readers, for this has not been the case.

More importantly, open interest (OI) has elegantly surged past $9.52 billion, the highest level seen in months. This rise in OI, while the SOL price delicately strolls upward, suggests that fresh investments are entering the fray. Simply put, traders aren’t just enjoying the encore; they’re wagering on an encore of encores.

Spikes in OI devoid of erratic funding rate fluctuations hint at continued jubilations, especially when paired with the delightful consistency of SOPR.

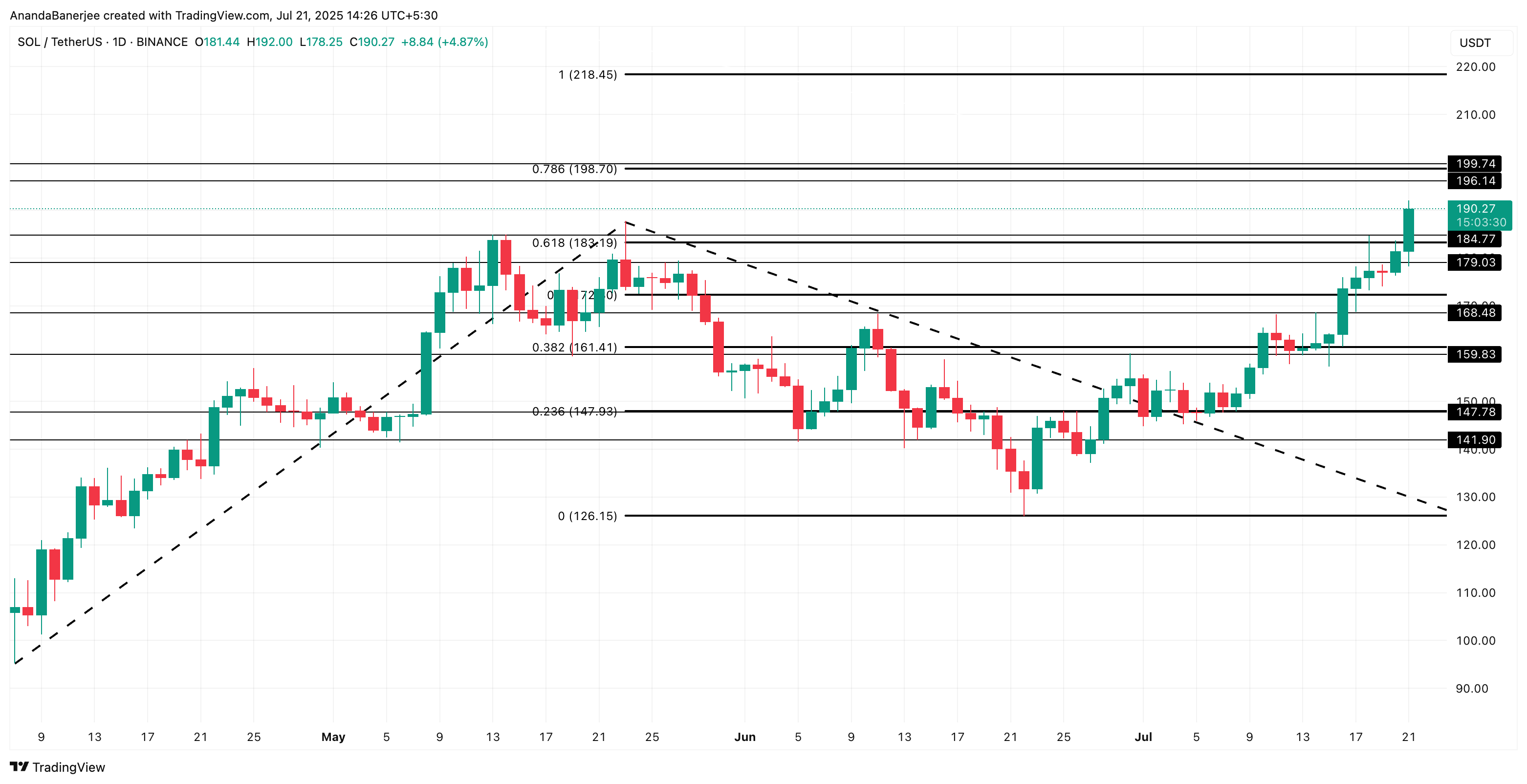

The Solana Price Structure: A Dance Toward $218

The Solana price currently languishes at $190, transforming previous resistance levels of $183 and $184 into places of steady support. Yet, lurking ominously is a formidable resistance at $196, $198, and $199, like the final act in a play where everything hangs in the balance.

If SOL can confidently flip the $196–$199 range into supportive hands, a subsequent challenge awaits around $218—a mere 14.70% leap from these heights. Can the players remain brisk and tactical? Only time will tell!

If SOPR holds steady near 1 and OI climbs the ladder without any overheating drama, the bulls retain dominion. However, a quick correction—a mere dip—may occur, but should the price drop beneath $168, the bullish script could falter momentarily. Moreover, should the price tumble below $161, the entire Solana saga could face unwarranted demise—an unlikely scenario, given the prevailing optimism on the market stage.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- League of Legends MSI 2025: Full schedule, qualified teams & more

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- All Songs in Superman’s Soundtrack Listed

- Lost Sword Tier List & Reroll Guide [RELEASE]

2025-07-21 18:21