Oh, darling! It seems the Bitcoin bulls are out in full force, and the markets are simply abuzz with excitement! 🚀 This week, the cryptocurrency has reached dizzying new heights, with traders positively giddy about its prospects. And why not, my dears? After all, this is Bitcoin’s strongest weekly breakout since November 2024, when it surged a whopping 50%! 🤯

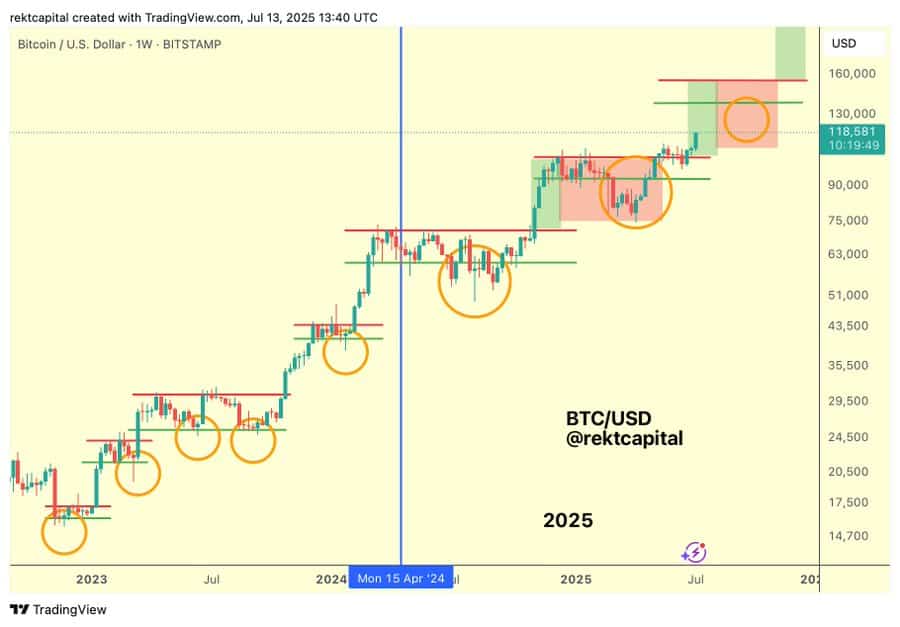

Analyst Rekt Capital, that clever chap, has taken a step back to gaze at the bigger picture. He reminds us that Bitcoin is merely wrapping up week one of its “Price Discovery Uptrend 2.” Ah, but what does that mean, you ask? Well, my lovelies, it means that if history is any guide, Bitcoin’s current bullish momentum might still be in its early stages. How thrilling! 🎉

Of course, not everyone is sipping champagne and dancing on the tables. That old skeptic, Peter Schiff, has taken to social media to urge caution. He thinks Bitcoin’s latest high is the perfect opportunity for holders to cash out and switch to silver. Oh, Peter, Peter, Peter… always so gloomy! ☹️

Arthur Hayes, co-founder of BitMEX, has also introduced a note of caution, pointing to broader market conditions influenced by macroeconomic factors. Ah, but we won’t let that spoil the party, will we, darlings? 🎉

Now, here’s a curious thing: despite Bitcoin smashing record highs, retail investors have largely remained on the sidelines. Google search interest for “Bitcoin” remains muted compared to previous cycles. How very… human. 😏

Google Searches for Bitcoin are over 60% down since November’s peak, source: Google

It seems retail investors might perceive current prices as prohibitively expensive, believing they’ve “missed the boat.” Ah, but have they, really? 🤔

Bitcoin commentator Lindsay Stamp thinks retail investors often dismiss Bitcoin as an opportunity once the price exceeds certain psychological thresholds. And Cedric Youngelman, host of the Bitcoin Matrix podcast, concurs, predicting that retail investors might remain hesitant for some time. How very… predictable. 😏

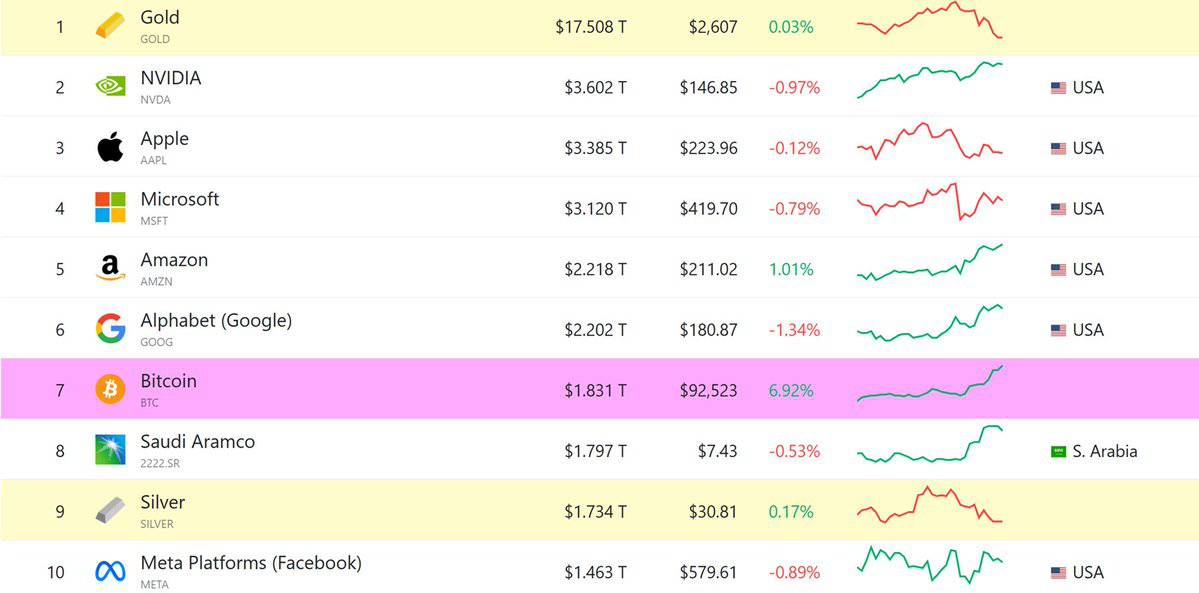

So, darlings, what’s the takeaway from all this? Well, it seems that institutions continue to demonstrate strong confidence in Bitcoin, while retail investors remain skeptical. But historical data shows that buying Bitcoin after it reaches new all-time highs often proves advantageous. And with institutional support firmly entrenched, macroeconomic tailwinds, and clear skies ahead, Bitcoin presents a compelling case for investors. 🚀

So, if you don’t own Bitcoin, now might be a good time to buy some and take advantage of the current bull market. After all, as the saying goes, “fortune favors the bold.” 💪

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Basketball Zero Boombox & Music ID Codes – Roblox

- Come and See

2025-07-14 01:47