So, bitcoin. Because what’s a little financial instability, right? It’s like that one aunt at the family reunion – unpredictable, slightly unhinged, and prone to making everyone uncomfortable. But hey, at least it’s interesting. 🤪

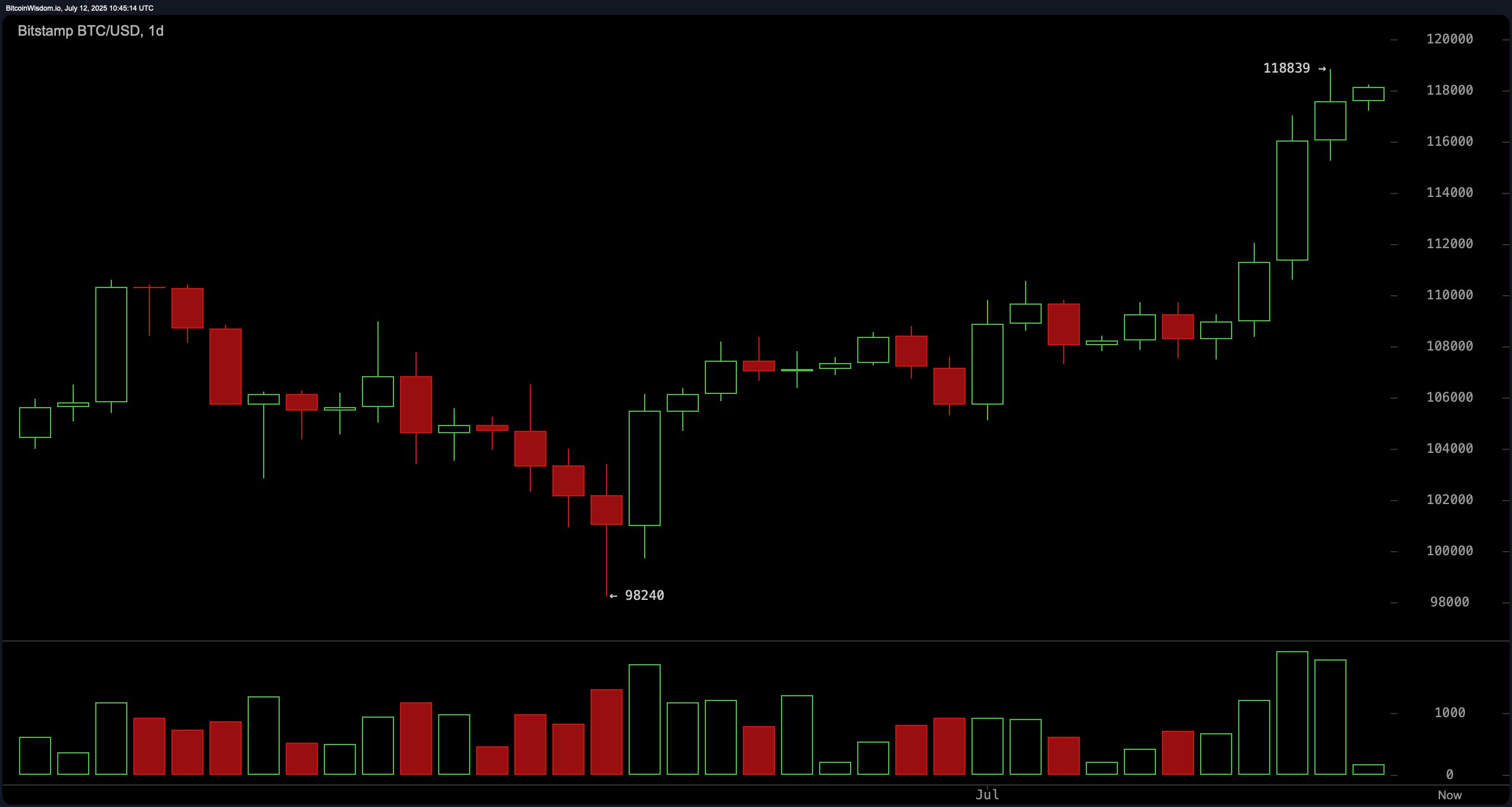

After reaching a new all-time high of $118,839 (because who needs actual money, anyway?), bitcoin’s momentum cooled slightly. But don’t worry, it’s still going strong, like that one friend who insists on doing karaoke at 3 am. The broader trend remains bullish, because why not? 🤷♂️

On the daily chart, bitcoin continues to exhibit strength, like a weightlifter on steroids. The breakout above the prior resistance zone of $110,000 to $112,000 was supported by heightened volume, indicating solid institutional participation. Because who doesn’t love a good game of financial Jenga? 🤯

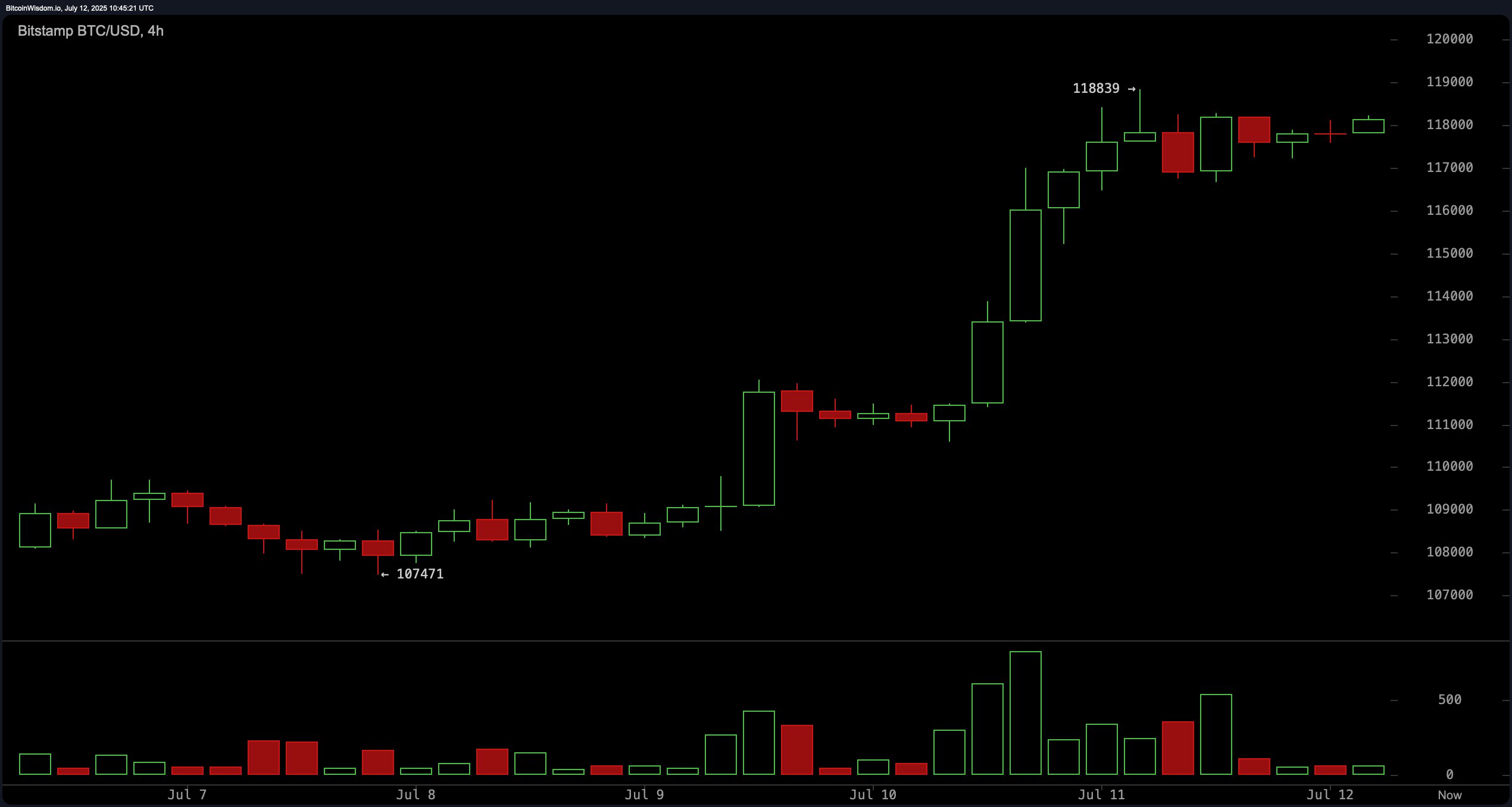

The 4-hour BTC/USD chart shows a stair-step bullish continuation, because why take the stairs when you can take the elevator? Despite consistent bullish candles earlier in the week, recent candlestick formations reflect market indecision, especially within the consolidation zone between $117,000 and $118,000. Volume, which initially spiked during the breakout, has begun to taper, like a party that’s running out of beer. 🍺

On the 1-hour timeframe, bitcoin’s price movement has been confined within a narrow band of $117,500 to $118,500, like a hamster on a wheel. The microtrend leading to the high remains valid; however, a series of doji and small-bodied candles point to market indecision, like a teenager trying to decide what to wear to school. 🤔

Oscillator indicators show mixed sentiment across the board, like a mood ring that can’t make up its mind. The relative strength index (RSI) stands at 74, indicating near-overbought conditions, while the Stochastic oscillator reads 93, also in the neutral zone but trending higher. Because who doesn’t love a good game of technical analysis? 🤓

Moving averages present a unified bullish outlook, like a team of synchronized swimmers. All major timeframes—from the 10-period to the 200-period, both exponential (EMA) and simple moving averages (SMA)—issue bullish signals, like a chorus of “Buy! Buy! Buy!” 🎶

The Verdict:

Bitcoin remains in a robust uptrend, like a runaway train that refuses to stop. While short-term consolidation may persist, the broader structure suggests continued bullish bias, especially if volume reaccelerates on breakouts and support near $117,000 holds firm. Because who needs stability, anyway? 🤪

But, on the other hand, signs of waning momentum, including declining volume and sell signals from the momentum and commodity channel index (CCI) oscillators, raise caution, like a yellow flag waving in the wind. A failure to surpass $118,839 or a break below key support at $117,000 could trigger a short-term pullback toward $114,000 or lower, especially if buyers remain sidelined, like a game of musical chairs where everyone’s waiting for the music to stop. 🎵

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- KPop Demon Hunters: Real Ages Revealed?!

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Basketball Zero Boombox & Music ID Codes – Roblox

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- Come and See

2025-07-12 14:57