Well, old chap, it seems the world of cryptocurrency has gone utterly barmy! Bitcoin, Ethereum, and XRP are rallying like a trio of tipsy thoroughbreds, with the top three cryptos climbing higher than a giraffe on stilts. And why, you ask? Why, it’s all thanks to the Trumpster’s tariff tussle, of course! 🤪

It appears that institutional investors are accumulating the largest crypto like a bunch of eager beavers, and rising capital inflows are making further gains in the top three cryptos as likely as a sunny day in July. So, if you’re a trader or investor sitting on the sidelines, twiddling your thumbs, you might want to consider opening long positions in the top three cryptos, pronto! 📈

Now, let’s take a gander at the table of contents, shall we?

Bitcoin hits new all-time high, $130K in sight 🚀

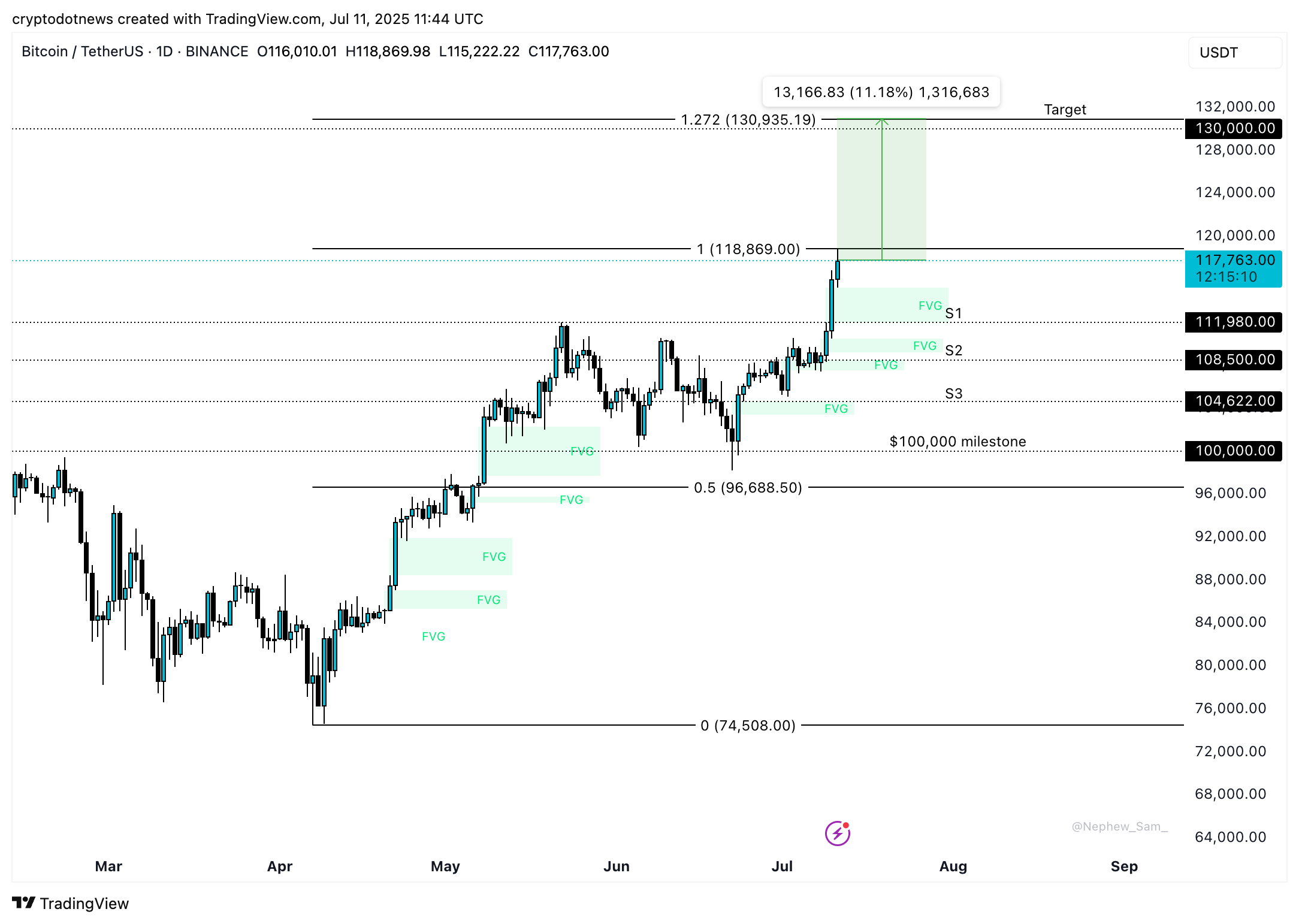

Bitcoin, the big cheese of cryptocurrencies, hit a new all-time high on Wednesday, July 9, like a hot air balloon soaring into the stratosphere. And now, it’s entered price discovery, inching closer to the $120,000 level like a sneaky snake slithering through the grass. The next target, old bean, is the 127.20% Fibonacci retracement level of the rally from the April low of $74,508 to the July all-time high of $118,869. Bitcoin is currently trading 11% away from the target of $130,935, so it’s anyone’s game, really! 🤔

A key momentum indicator, the MACD, is flashing green histogram bars above the neutral line, indicating underlying positive momentum in Bitcoin’s price trend. But, oh dear, the RSI shows BTC is currently overvalued, so traders should keep a weather eye open for a trend reversal. If RSI slips back under 70, it could generate a sell signal, and we wouldn’t want that, would we? 😬

Ethereum and XRP price rally 🎉

Ethereum and XRP, those plucky altcoins, are rallying alongside Bitcoin like a pair of synchronized swimmers. Ethereum rallied past the psychologically important resistance at $3,000 on Friday, and XRP climbed to a peak of $2.70 on July 11, the highest level for the altcoin in nearly four months. Ethereum’s next target is the $3,500 level, above the resistance at $3,478, the 23.6% Fibonacci retracement of the drop from the December 2024 peak of $4,122 to the April low of $1,391. And XRP, well, it’s trading above key resistance at $2.70, at $2.77 at the time of writing, so it’s all systems go, old chap! 🚀

XRP has yielded over 20% gains for holders, and it’s been rallying consecutively for six days, like a champion thoroughbred on a winning streak. So, if you’re feeling lucky, you might want to consider jumping on the XRP bandwagon, but do remember, old bean, the cryptocurrency market is as unpredictable as a tipsy uncle at a wedding reception! 🤪

Top 3 cryptos on-chain analysis 🔍

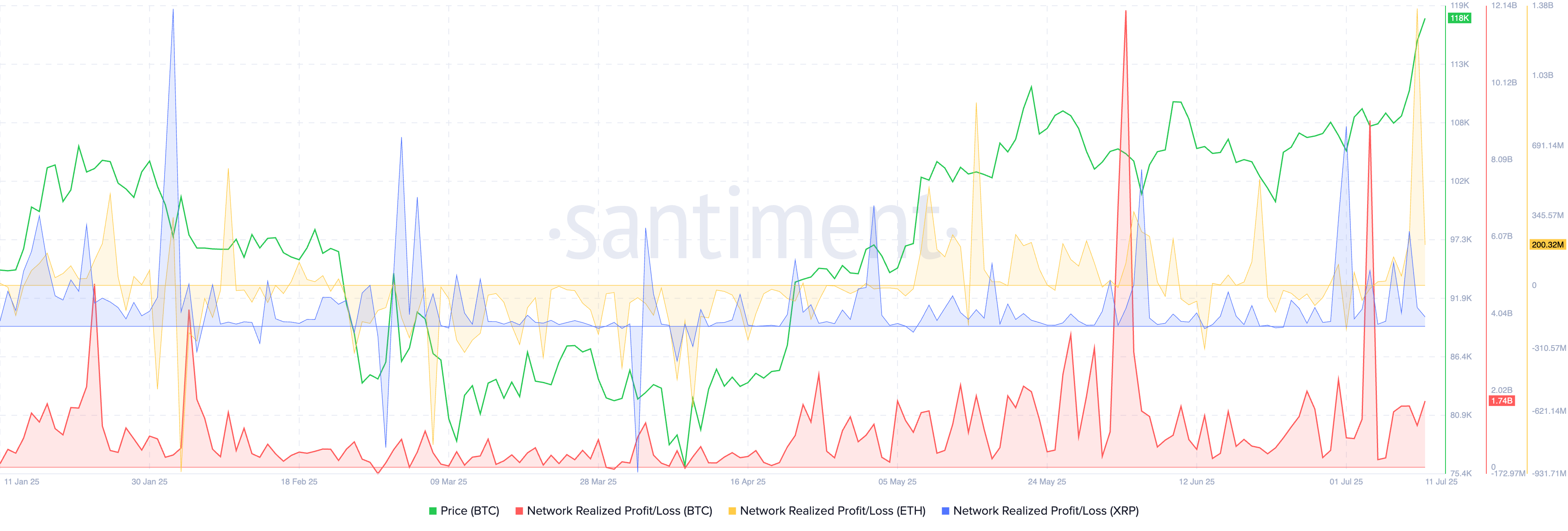

The network realized profit/loss metric helps track whether traders are taking profits, and it seems Bitcoin traders are consistently taking more profits on their holdings as BTC rallies higher. Ether recorded a large spike in profit-taking, and XRP traders are taking profits at a slower pace compared to June 2025, as seen on Santiment. So, it’s all about the Benjamins, baby! 💸

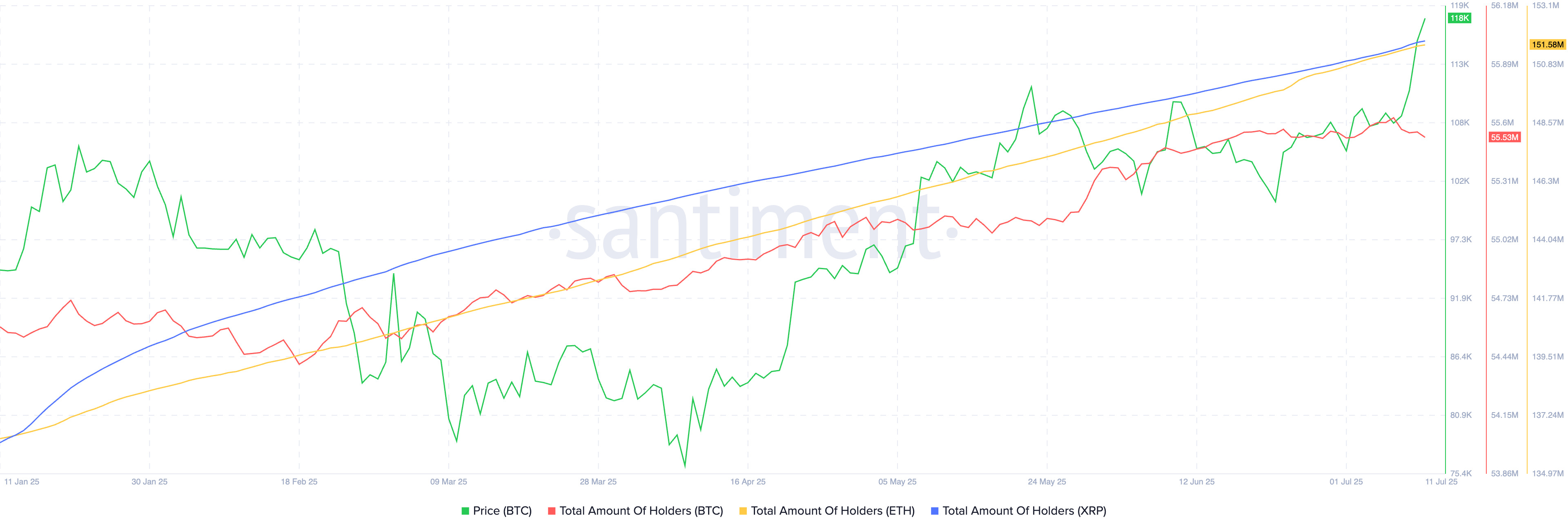

Bitcoin has recorded a decrease in the number of holders, while Ethereum and XRP have noted an increase in 2025, as seen on Santiment. The decrease in Bitcoin’s holders corresponds to the increase in price, meaning traders are likely redistributing their holdings, while large wallet holders and institutions are accumulating further. It’s all a bit of a puzzle, old chap, but someone’s got to keep the cryptocurrency market on its toes! 🤔

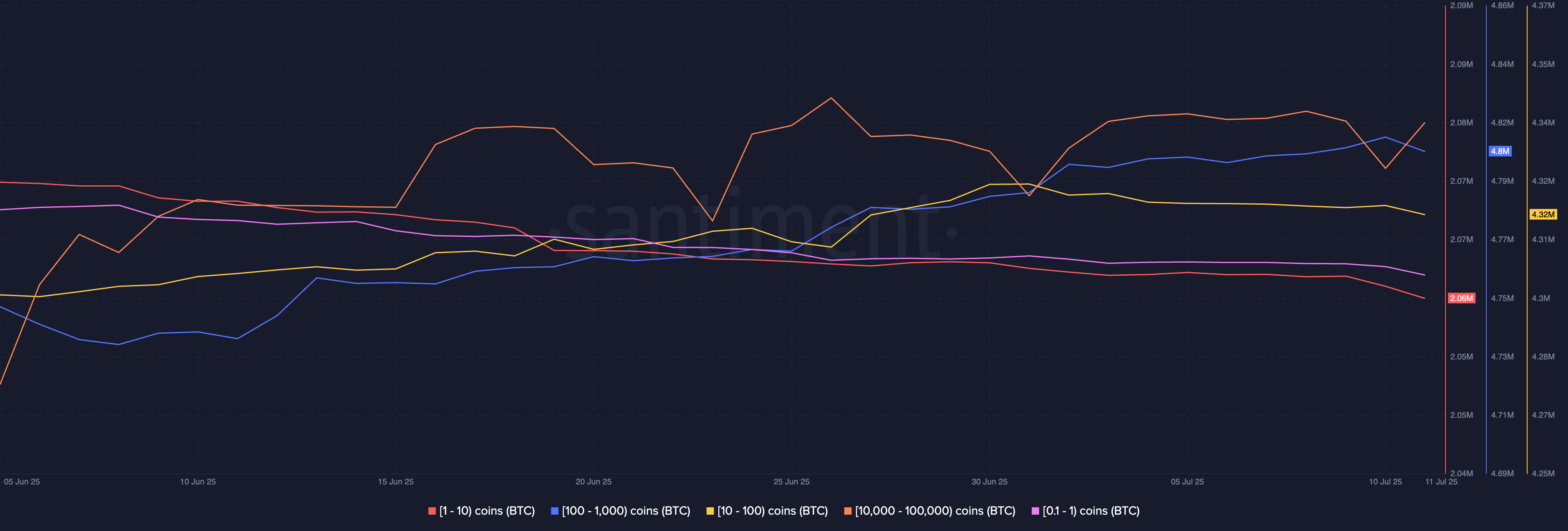

Bitcoin’s retail traders holding less than 1 BTC have shed their holdings, while traders with 10 to 100 and 100 to 1,000 BTC have increased their exposure. BTC whales are scooping up more Bitcoin, while small wallet investors and retail traders distribute their holdings. It’s a bit of a game of musical chairs, old bean, but someone’s got to keep the music playing! 🎶

Trump effect on Bitcoin, Ethereum and XRP 🤔

Trump administration officials had initially suggested that the U.S. would strike several deals with trade partners by Wednesday, July 9, but instead of announcements, the President set new rates for different countries while delaying the imposition of tariffs until August 1, the next key date for crypto traders to watch. It’s all a bit of a kerfuffle, old chap, but the Trump effect has certainly sent the cryptocurrency market into a tizzy! 🤯

Japan, South Korea, and several other nations face at least 25% tariffs starting from August; Brazil faces 50% tariffs, among others. The country has warned of reciprocal tariffs, with no further measures for now. The U.S. is imposing 35% tariffs on Canada, starting August 1, and Southeast Asian countries face between 30% and 40% tariffs. It’s all a bit of a trade war, old bean, but someone’s got to keep the cryptocurrency market on its toes! 🤔

Stock markets responded positively to the news, and the Trump effect pushed Bitcoin to a new peak. So, it’s all good news for cryptocurrency enthusiasts, but do remember, old chap, the market can be as unpredictable as a tipsy uncle at a wedding reception! 🤪

Expert commentary 💬

Petr Kozyakov, co-founder and CEO at Mercuryo, told Crypto.news in an exclusive interview:

“Bitcoin has surged past $118,000 to a new all-time high amid sustained institutional demand for the biggest cryptocurrency, which has been such a driving force in this current market cycle. While altcoins are also in the green with Ethereum spiking past the $3,000 mark, the underlying ‘orange pill’ narrative remains steadfastly in place. Bitcoin’s growing status as a store of value is one that more and more big players and institutions are simply unable to ignore. This is evidenced by sustained inflows into spot bitcoin ETFs this week.”

Nick Jones, founder and CEO of Zumo, added:

“With Bitcoin setting a fresh record high, the market is booming. The rise is underpinned by increasing institutional adoption and resurgent retail demand, reflecting confidence that crypto has arrived in the mainstream and is now reshaping finance.”

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-07-11 20:53