On a Thursday much like any other, Bitcoin, the digital prodigal son, continued its upward march, reaching new all-time highs as the world of risk assets found itself in a celebratory mood. This latest surge was not without its companions: the S&P 500 and Nasdaq Composite were also basking in record closes, while gold futures reached a historic high of $3,370 per ounce. The Federal Reserve, ever the cautious guardian, maintained its steady hand on the monetary tiller, allowing the market to breathe a sigh of relief and continue its dance.

Earlier in the session, Bitcoin had dipped below $109,000, a momentary stumble that seemed to echo the stronger-than-expected U.S. employment data. The June non-farm payrolls, which had increased by 147,000—far above the forecasted 110,000—raised eyebrows and whispers of potential interest rate hikes. Yet, the market, with its characteristic resilience, absorbed the news and Bitcoin quickly climbed back to fresh intraday highs, as if to say, “Is that all you’ve got?”

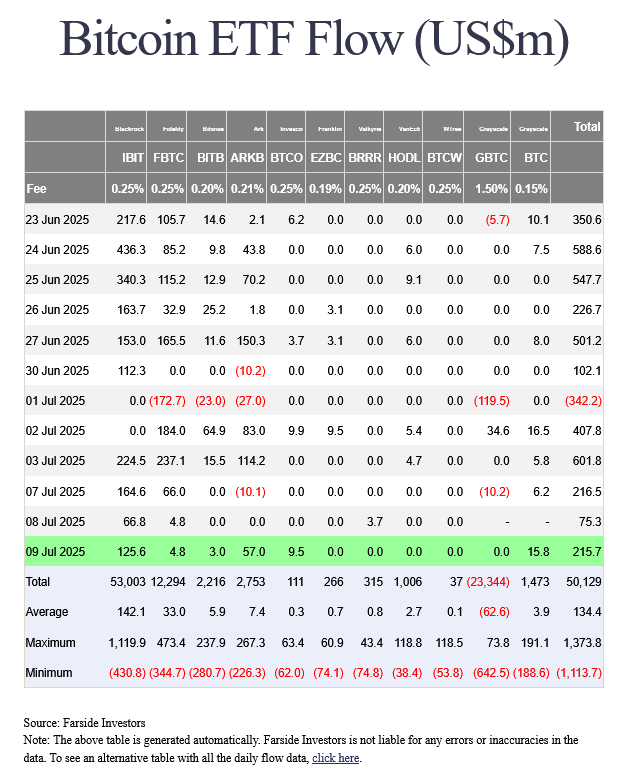

The gains were not just a fleeting flirtation with fortune. Institutional adoption, the backbone of Bitcoin’s rise, continued to strengthen. Cumulative flows into U.S. spot Bitcoin ETFs have now surpassed $50 billion, with July marking another strong month for inflows. Analysts, with their usual air of authority, noted that this consistent demand from institutional investors is providing a safety net during price corrections and solidifying Bitcoin’s role in diversified investment portfolios. 📊

Corporate treasuries, led by the ever-ambitious MicroStrategy, Tesla, and the recently bitcoin-obsessed GameStop, are buying up coins at a pace that would make a gold rush look like a leisurely stroll. This insatiable appetite has created a vacuum where every dip below six figures is instantly gobbled up, a testament to the drying liquidity and soaring demand from traditional finance. 🚀

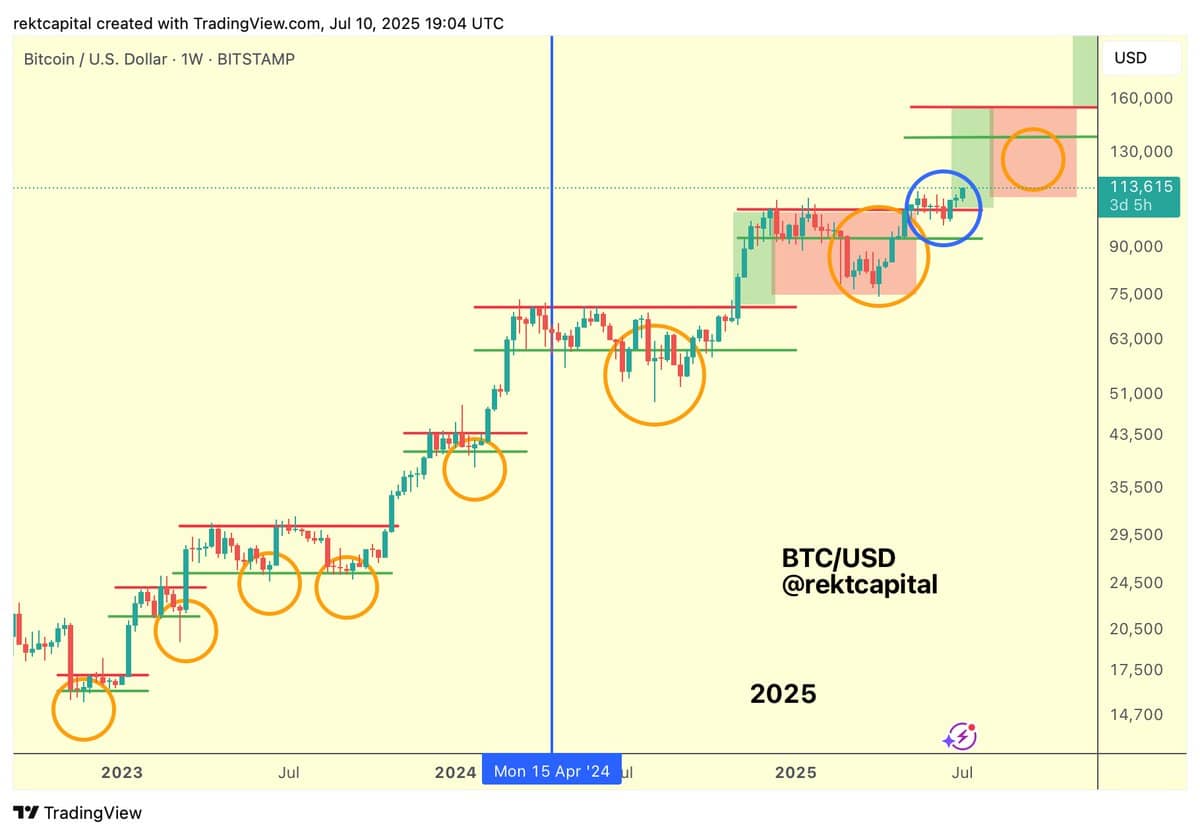

Bitcoin’s technical breakout is further supported by this structural demand, with traders pointing to a combination of bullish chart patterns and growing capital inflows as key factors in the recent price strength. With the asset now trading in uncharted territory, market participants are watching closely to see whether momentum can sustain through the second half of the year. 📈

Bitcoin is now in price discovery mode, source: Rekt Capital

Altcoins: still lagging, but at least they showed up

After months of trailing behind Bitcoin like a forgotten sibling, major altcoins finally caught a bid:

| Token | 24 h move | Comment |

| ETH | ≈ 3.2 % | Post-Pectra upgrade tailwind |

| SOL | ≈ 2.7 % | ETF rumor mill bubbling |

| DOGE | ≈ 3 % | Elon tweeted a Shiba GIF—seriously |

| ADA | ≈ 6 % | Cardano maxi hopium lives |

| XRP | ≈ 4.7 % | Betting on a spot-XRP ETF (!?) |

| LTC | ≈ 2.8 % | Grandpa’s still hanging around |

Nice, but let’s be realistic: ETH/BTC is still near cycle lows, and most alt projects are under-performing plain-vanilla Bitcoin ETFs on a risk-adjusted basis. If history rhymes, real alt-season doesn’t begin until BTC cools off or retail leverage returns. Neither is obvious today. That said, with Bitcoin now in clear price discovery mode, it is a good time to buy Bitcoin and now could also be the time to buy crypto assets to position for big altcoins moves in the near future. 🤔

Wall-Street crypto proxies: a split tape

While the meme-miners you mentioned (Marathon and Riot) put in decent single-digit pops, the headline winners were:

- Coinbase +5.4 % — Wall St. finally values regulated on-ramps.

- MicroStrategy +4.7 % — Michael Saylor’s leveraged digital-gold trade keeps printing.

Macro backdrop: risk-on, but fragile

Nasdaq breaking its own records, Nvidia flirting with a $4 T market cap, Treasury yields ticking lower, and the Fed murmuring rate cuts—this is the Goldilocks cocktail fuelling every risk asset, crypto included. But Goldilocks stories end the moment inflation roars back or geopolitics flips. Keep one eye on the VIX and the other on the 10-year. 🌪️

Bitcoin’s latest milestone is a perfect storm of supply-squeeze economics, ETF-driven demand shock, and a classic short burn. Fun to trade, but far from a guarantee of a straight line to $140 K. If you’re a long-term hodler, pop the champagne and tighten your ledger security. If you’re momentum-hunting, remember: parabolas end with gravity, not with tweets. Long term, however, if you don’t own some, now is the time to buy Bitcoin and Crypto. 🍾

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-07-11 03:25