It’s been a right old snooze-fest for Binance Coin (BNB) lately, with the price barely budging more than 1% over the past month. But, as any good Ankh-Morporkian knows, the most interesting things in life are often the ones that are hiding in plain sight.

On-chain data is whispering sweet nothings in our ear, hinting that this sideways structure might be nearing a turning point for the BNB price. And, if the right triggers align, it could be a wild ride 🎢.

The People are Revolting (in a Good Way)

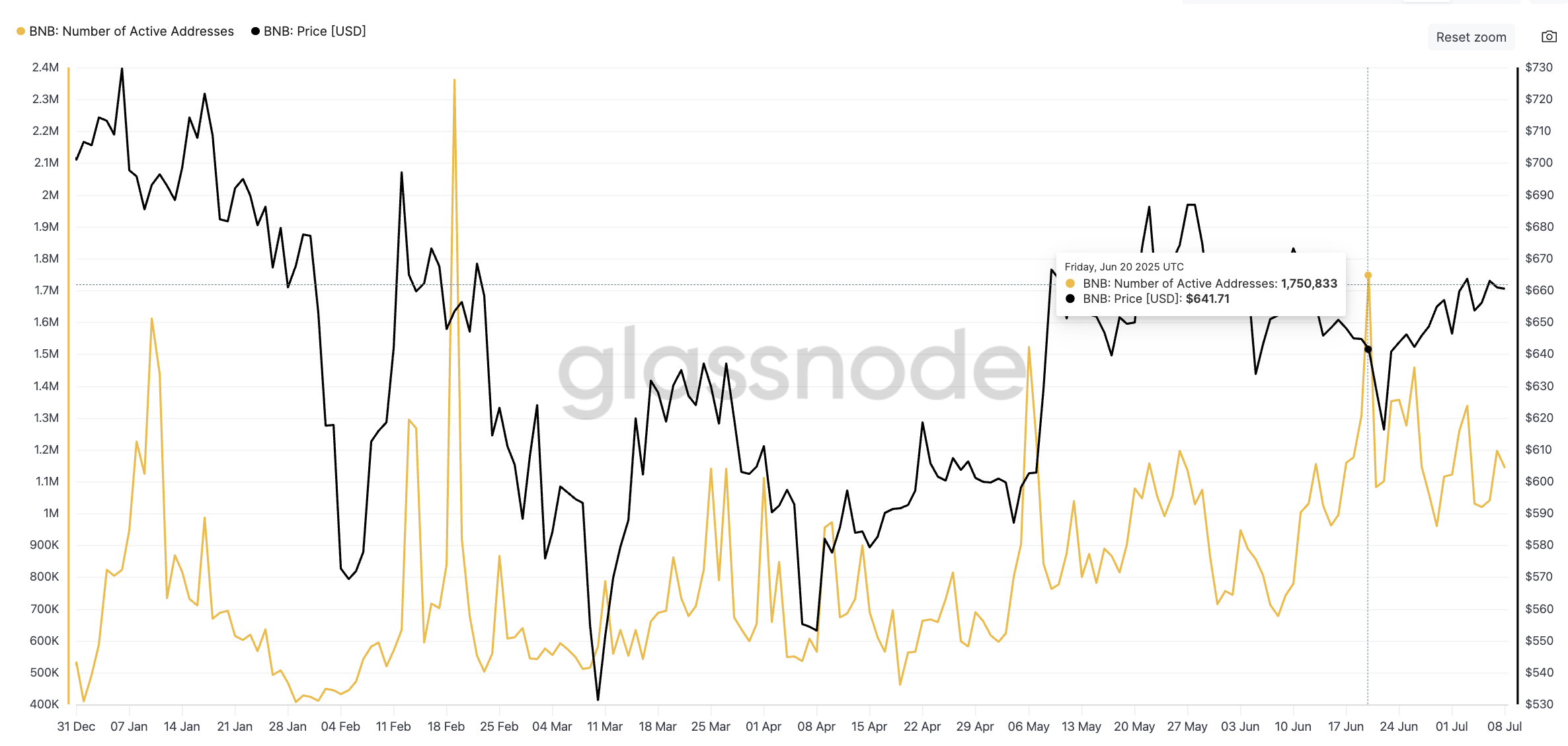

BNB’s active address count has been on the up and up since early May, which is a jolly good sign. After a bit of a slump in March and April, participation began recovering, with a major higher high marked on June 20, reaching over 1.75 million daily addresses 📈.

This isn’t just a bunch of numbers, my friends. A rising count of active addresses suggests that people are actually interested in BNB, which is often the foundation for more sustainable price movements. It’s like a big, digital game of “Follow the Leader” 🎉.

The Whales are Circling (Quietly)

Glassnode data has revealed something rather intriguing: a double spike in the percentage of supply held by BNB’s top 1% of addresses 🤯. These two surges, on June 21 and June 28, mark the only significant upticks in 2025.

These top 1% holders, typically whales or institutional addresses, had been flatlining for months. The sudden moves could point to silent OTC buys or redistributions. These wallets usually don’t chase rallies — they build positions when the price is quiet, like a sneaky little ninja 🕵️♀️.

The “top 1%” metric tracks the total BNB supply held by the largest addresses. A spike here signals accumulation by the biggest holders, which can precede a move, if it’s sustained. Think of it like a big, digital game of ” Musical Chairs” 🎶.

The Chart is Getting Interesting (Finally)

On the daily chart, BNB continues to respect an ascending triangle pattern, with strong horizontal resistance at $665–$693 🔒.

This pattern typically signals an upcoming breakout, but it’s only valid if the structure holds. So far, BNB is trading near $661, staying just under the immediate yet strong resistance level of $665. If BNB price manages to break this level, it would also mean a pattern breakout 🎉.

However, as the ascending triangle pattern has a broad upper trendline, made possible by multiple horizontal support and resistance lines, the BNB price would require more firepower than just a single resistance breach 🔫. Here’s where it gets interesting. From April 7 to June 22, the BNB price made higher lows, while RSI made lower lows; a classic bullish divergence 📊.

This divergence hints at weakening bearish momentum even as the price holds steady. RSI has since turned back upward, validating the triangle and adding strength to the breakout case 🚀. If the current sentiment holds and participation stays high, BNB could eye a move toward $686, $696, or even the longer-term ceiling at $733 🤑.

All this bullish structure hinges on one level: $635 🔴. A breakdown below this would invalidate both the triangle and the RSI divergence, and would likely come with a drop in active addresses or a reversal in whale holdings. That’s your red flag zone ⚠️.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Basketball Zero Boombox & Music ID Codes – Roblox

- Umamusume: Pretty Derby Support Card Tier List [Release]

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- League of Legends MSI 2025: Full schedule, qualified teams & more

2025-07-10 01:01