To the casual observer, Bitcoin at present positively exudes bullish vim—like a champion pugilist strutting before the big match. And yet, as often happens with overconfident boxers and dubious soufflés, there are whisperings in the stalls of impending collapse. Our hero of the hour, the rather formidable crypto analyst EDO FARINA XRP (purveyor of prophecies to 167,000 X followers, and perhaps the world’s most fashionable doomsayer), has issued a proclamation so dire it would cause Aunt Agatha to spill her g&t: “Bitcoin to nosedive—an 80% plummet, lurking just around the next bend!”

Yes, yes, Bitcoin has been clambering upward with the persistence of a squirrel after the last acorn—up 3.3% these last 30 days, and now at a wallet-popping $108,161. But, dear reader, beneath the surface, worries brew. Think of it as a posh garden party where everyone’s smiling, but someone’s let loose a skunk in the shrubbery. 😳

Bitcoin Market: Sweating Like a Nervous Butler

According to our Analyst-in-Chief, Bitcoin’s sprightly ascent seems to have misplaced its fundamentals somewhere behind the settee. Following that little dust-up known as the U.S. political shift in November 2024, Bitcoin pirouetted up nearly 60%. Q2 2025 alone was a jolly good quarter—up 29.9%. July? A humble 1%. Not too shabby—unless, that is, the economy’s lurking behind the curtains, twirling its villainous mustache.

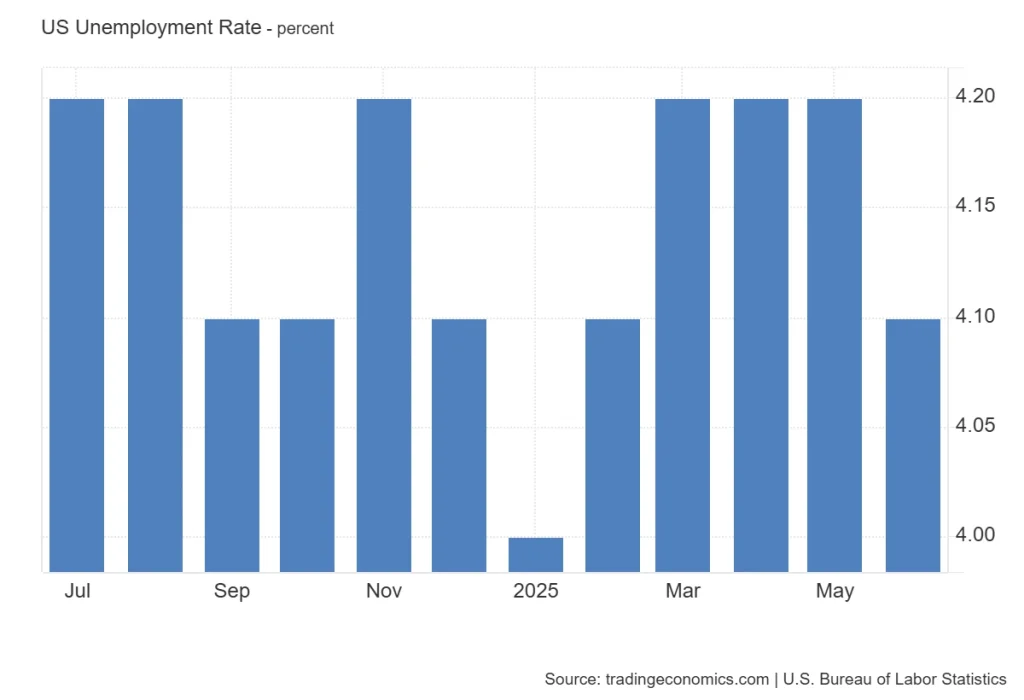

Inflation in America—normally the bogeyman—has decided to behave and sits almost politely at 2.4%. Yet GDP is dragging its heels, forecasted at a less-than-inspiring 1.8% for 2025. Unemployment’s up to 4.1%, and apparently the average consumer is keeping their wallet tucked away like a dowager aunt’s secret stash of sherry. One is forced to ask: does this seem like the makings of rampant crypto celebration or more a recipe for tears in the port?

Missed Out on the Bitcoin Bonanza?

Farina—never one to sugarcoat—remarks that the best time to buy Bitcoin was well before you hit your thirties. In those halcyon days of 2020, you could have picked up a 304.1% return (the sort of thing that makes even the fustiest uncle sprightly). 2021? A pleasantly plump 59.6%. 2022 rather spoiled the fun with a ghastly 64.3% drop—markets do abhor a straight line, after all. But lo! The rebound: a rollicking 115.4% in 2023, and not to be outdone, 121.1% in 2024. 😲

“At today’s prices,” Farina sniffs with the air of someone declining a poorly mixed martini, “long-term gain-seekers may wish to avert their gaze.”

Bitcoin Whales: Flopping About and Causing a Ruckus

Now, onto the whales—those lumbering titans who swan about with Satoshi-era coins jangling in their pockets. Farina alleges they’re hauling their stacks over to exchanges in a manner reminiscent of Bertie Wooster’s annual sock clear-out. Each time Bitcoin edges near the fabled $110,000, it’s smacked down quicker than a tipsy uncle attempting the Charleston at a wedding.

Take May 22: Bitcoin, bold as brass, hit $111,662. By tea time next day—down nearly 4%. June 10: up to $110,266, tumbling over 8% within a fortnight. July 3: a brave surge to $110,681, then—wham—a brisk 1.44% decline before anyone could finish their sandwiches.

If this isn’t whales selling out with the gusto of a schoolboy flogging last year’s conkers, I’ll eat my bowler.

The Real Menace: Trading Volume That Wouldn’t Fill a Thimble

What really sets Farina’s monocle a-quiver is the drought in trading volume. Once, Bitcoin’s bull runs featured every Tom, Dick and Aunt Mildred piling in. Now it’s the domain of a tight-knit club of financial juggernauts. There isn’t enough retail enthusiasm to run a bake sale, let alone hold up a trillion-dollar asset.

Should the whales stage a synchronized sell-off, expect a veritable stampede for the exits, and not enough buyers left to pick up the remnants. The word “cascade” comes up—a charming way of saying your fortune might end up doing a high dive without a splash pool to land in. 🤿

Crash or Chamomile?

In Farina’s rather theatrical estimation, the grand reckoning will come courtesy of a “black swan” event. One moment calm, the next—pandemonium in the cryptoverse. When the tally’s done, there’ll be more bruises than after last season’s Village Cricket Final.

So, is this the hour for panic? The surface looks peachy; underneath, all is treacle and peril. The whiskered whales, exhausted rally, murky economic waters, and barely-there trading volume make for a sticky wicket indeed. Whether the next chapter features a gentle correction or a full-blown crash, keep your wits sharp and your umbrella at hand—there’s weather ahead. ☂️

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- KPop Demon Hunters: Real Ages Revealed?!

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- MrBeast removes controversial AI thumbnail tool after wave of backlash

- Basketball Zero Boombox & Music ID Codes – Roblox

2025-07-05 10:58