Oh, the grandeur of Nano Labs, a Chinese Web 3.0 infrastructure and product solution provider, has once again graced us with its wisdom! Today, they have announced the acquisition of $50 million worth of BNB, the native cryptocurrency of the BNB Chain. 🎉

After this grand transaction, the company’s total digital asset reserves, including Bitcoin (BTC) and BNB, amount to approximately $160 million. A fortune indeed, but will it bring them the glory they seek? 🤔

Nano Labs Buys $50 Million in BNB: A Tale of Ambition and Folly

According to the press release, the company acquired 74,315 BNB at an average price of $672.45 per coin. The transaction was executed through an over-the-counter (OTC) deal, a move that surely will be the talk of the town. 📰

The $50 million BNB acquisition marks the first step in Nano Labs’ broader goal of building a $1 billion BNB reserve. In line with this, BeInCrypto reported earlier that the firm launched a $500 million convertible notes offering. The notes can be converted into Class A shares at $20 per share, a price that might as well be written in the stars. 🌠

“Over the long run, Nano Labs intends to hold 5% to 10% of BNB’s total circulating supply,” the press release reads, as if they were declaring a new era of prosperity. 📜

Meanwhile, Nano Labs is not alone in using BNB as a reserve asset. Earlier this year, Bhutan’s Gelephu Mindfulness City (GMC) included BNB alongside Bitcoin and Ethereum in its reserves, a move that surely will bring enlightenment to all. 🙏

This reflects a broader trend where companies are seeking to diversify their reserves beyond the two largest cryptocurrencies. In 2025, assets such as Solana (SOL), XRP (XRP), Hyperliquid (HYPE), and more have attracted institutional interest, with firms increasingly integrating these assets into their financial strategies. A veritable feast of financial wizardry! 🧙♂️

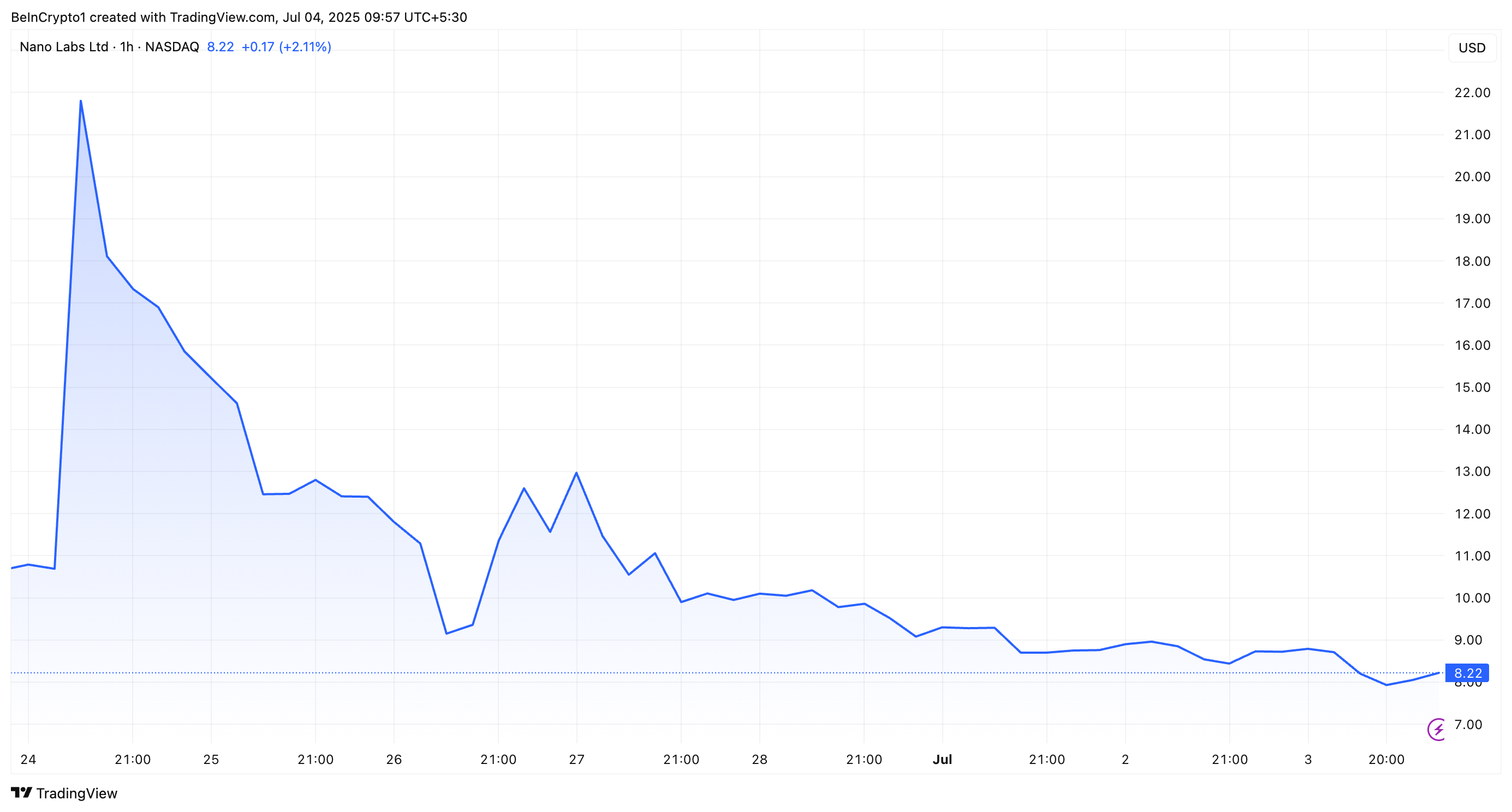

Nonetheless, the Nano Labs’ BNB purchase did nothing to boost the stock prices, which have been falling since last week. While the BNB treasury announcement led to over a 100% surge in value on June 24, NA has shed all of its gains, a true tragedy of the commons. 🎭

According to data from Google Finance, stock prices were down 4.7% at market close. The decline persisted in after-hours trading, with NA falling an additional 2.1%. Despite this, BNB has remained unaffected, a true testament to its resilience. 🛡️

BeInCrypto data revealed that the altcoin appreciated 0.19% over the past day to trade at $661.2. Over the past week, the price has risen 2.6%, a small victory in a sea of losses. 🌊

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

- MrBeast removes controversial AI thumbnail tool after wave of backlash

- Mirren Star Legends Tier List [Global Release] (May 2025)

2025-07-04 08:56