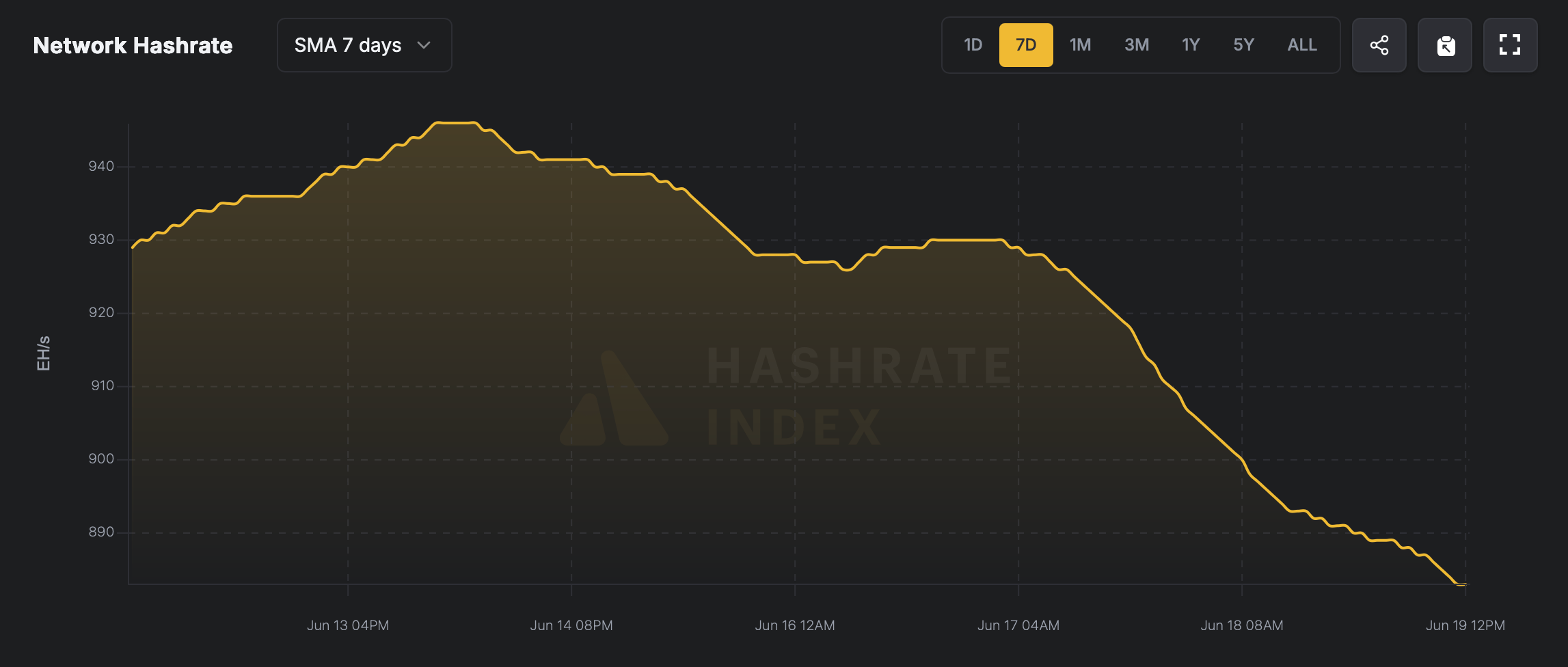

So, Bitcoin hits a high of 946 exahash per second (EH/s), and then—surprise!—it plummets below 900 EH/s. Just like my last relationship, it was all highs and lows, but mostly lows. And guess what? Mining profits are feeling the pinch too. Who could’ve seen that coming? 🙄

Mining Pressure Mounts: Hashrate Drops, Earnings Grow Thinner

By Thursday afternoon, Bitcoin (BTC) was barely clinging to life at just above $104,000. Just days ago, it was riding high, basking in the glory of that 946 EH/s peak. But now? It’s like watching a balloon slowly deflate. 🎈

Since June 14, we’ve seen a drop to 880 EH/s. That’s a loss of about 66 EH/s, or as I like to call it, a whole lot of nothing. You know, like my plans for the weekend. 😒

And why did this happen? Oh, just a little thing called mining difficulty adjustment. You know, the kind of adjustment that’s about as helpful as a screen door on a submarine. A whopping 0.45% decrease—big whoop! 🙃

Now, with block intervals stretching to 10 minutes and 31 seconds, we’re looking at a projected 5.05% reduction by June 28, 2025. But hey, who knows? Maybe it’ll change again. It’s like trying to predict the weather in L.A.—good luck with that! ☀️🌧️

Mining profitability is also taking a hit, coinciding with BTC’s downward spiral. From May 19 to June 19, the hashprice dropped by 4.37%. Now, a petahash is worth about $52.51, down from $54.91. It’s like watching your favorite restaurant raise prices—just when you thought you could afford a nice dinner! 🍽️

So, here we are, folks. Bitcoin’s hashrate and market value are doing the cha-cha, and miners are left to figure out how to dance with this volatility. It’s a tough gig, but hey, at least we’re all in this together, right? Or maybe not. 🤷♂️

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- League of Legends MSI 2025: Full schedule, qualified teams & more

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- All Songs in Superman’s Soundtrack Listed

- Lost Sword Tier List & Reroll Guide [RELEASE]

2025-06-19 21:57