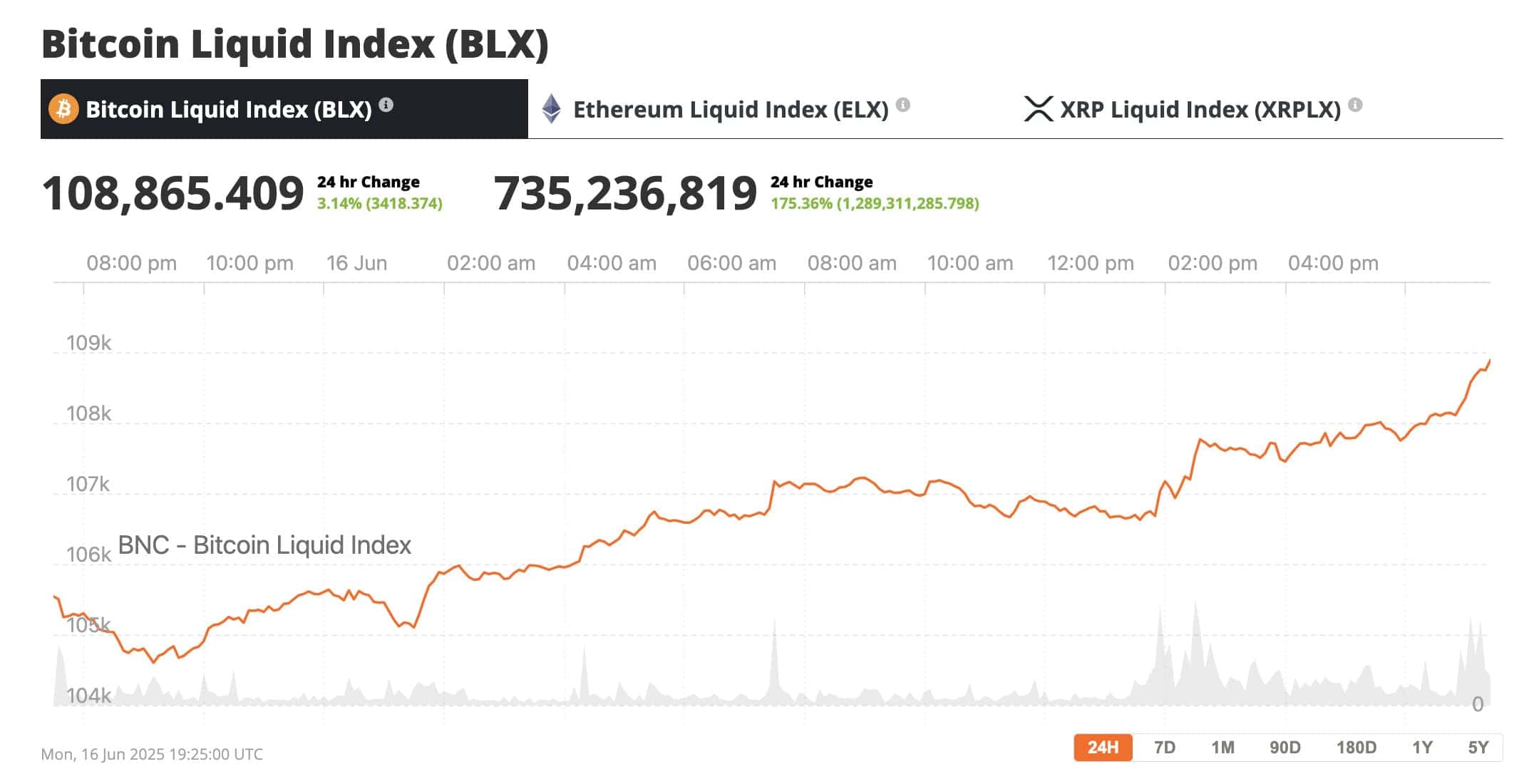

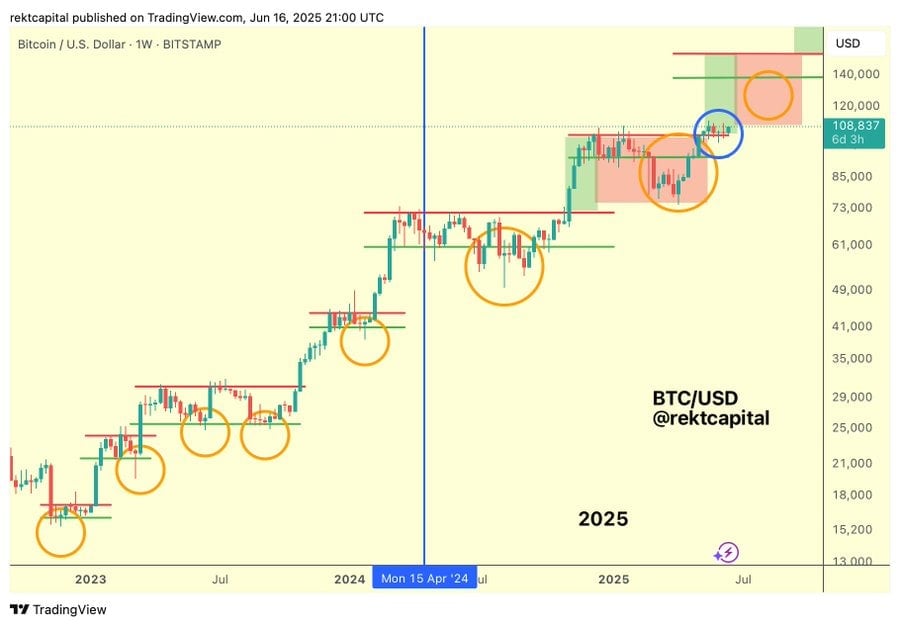

In this peculiar theatre of our global capitalist saga, where coins meet chaos, Bitcoin, that shimmering digital specter, finds itself teetering just a hair’s breadth below its January apex of $110K. The musty air is filled with palpable tension, underscoring tensions between Iran and Israel. Yet, behold! Our fabled Bitcoin holds its ground valiantly at around $105,000 — how audaciously he coolly operates amidst such firestorm! 💪

Trump’s Media Circus Cranks Up the Crypto Gears

In a twist reminiscent of some grotesque carnival attraction, the Trump Media & Technology Group launches into the tumultuous arena of cryptocurrency with all the subtlety of a bull in a china shop. They aim to unleash a spot Bitcoin and Ethereum ETF, slashing capital into a mighty 75% Bitcoin, 25% Ether concoction — a financial cocktail stirred with a spoon of populism and a splash of irony. When did finance become so entertaining? 🎪

Even more amusing, our newfound custodian and market maker, Crypto.com, is wound tightly in this narrative from far-off Singapore. Truly, what a delightful contradiction given Trump’s soaring proclamations of “America First!”🦅

This escapade isn’t mere happenstance; it mirrors the Trump clan’s broader, almost prophetic, blockchain ambitions. Their side venture, World Liberty Financial, predictably dances primarily with Ethereum, parking 96% of its assets there—if only the market could read such wallets! 📈

If the SEC gives a green light—oh, what a delightful chaos awaits! It will join a flooded yet delectable field of ETFs, contending with the titans such as BlackRock and Fidelity. Bitcoin ETFs are now holding over a staggering $131 billion, heralding a new phase of genuine adoption, and wealth moves with a feverish determination.

Ether Struts, Options Prices Soar!

Meanwhile, poor Ether strives for attention in the ETF spectacle, yet options traders fashionably recognize its significance. The widening chasm between ETH and BTC’s implied volatilities points to heightened activity; ETH options are striking up a drama of their own. Traders are gleeful — a ripe time for premium gathering, they proclaim! 🍒

In the depths of the altcoin jungle, laughable antics abound as Meme Strategy—a company forged within the realm of corporate jest—celebrates a 20% share price surging after snatching 2,440 SOL for a mere $370,000. Corporate crypto buying morphs before our eyes, as Solana and XRP enter the fray — warm welcome, indeed!🎉

Yet, not all altcoins embrace jubilation. SharpLink witnessed a catastrophic fall post-ETH purchase announcement. Token unlocks loom like dark clouds threatening to drench the market in despair—those awaiting the deluge from FTN, ZK, ARB, MELANIA, and LISTA had better prepare their umbrellas. ☔️

MSTR Foreve—Never Surprised!

At the precipice of Bitcoin’s corporate stronghold, MicroStrategy (MSTR), now whimsically dubbed “Strategy,” again dove into the digital abyss, acquiring 10,100 BTC funded through a staggering $979.7 million STRD preferred stock offering. Their treasure trove now boasts a ridiculous total of 592,100 BTC, worth over $63.3 billion, in a gesture echoing the eternal faith in digital gold—a bold invocation indeed! 💰

Will Bollinger Bands Signal a Boom?

A final flourish arises as a crucial indicator hints at a potential volatility spike—could the grand Bitcoin ascendance be nigh? As the ever-mysterious Bollinger Bands widen, they whisper promises of forthcoming seismic activity. A positive MACD histogram further fuels these ambitious hopes—a veritable almanac of future victories like those seen in late 2020 and late 2024. 🎇

But tread carefully; volatility can cut both ways. Just because the market’s pulse quickens doesn’t mean sunshine is assured; however, in this bullish realm, even the warnings seem to smile strangely upon us.

The Bottom Line

Oh, sweet world! Bitcoin once again bamboozles the naysayers. With BlackRock ruling the ETF domain, Trump wading in with his audacious hybrid concoction, Ether commanding attention in the options bazaar, and MicroStrategy clinging on for dear life—all while Bitcoin nonchalantly surveys the geopolitical pandemonium. It hovers 2% shy of history’s embrace. If you’ve spent sleepless nights pondering whether to clutch onto Bitcoin—oh, the odds favor you! The future looks blaringly bright. Keep your eyes peeled, and remember, Bitwise predicts a magnificent $200,000 by 2025! If that doesn’t ignite a spark of interest, what will? 🔥

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Stellar Blade Update 1.011.002 Adds New Boss Fight, Outfits, Photo Mode Improvements

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Stellar Blade x Nikke DLC: Full Walkthrough | How to Beat Scarlet + All Outfit Rewards

- League of Legends: Bilibili Gaming’s Epic Stomp Over Top Esports in LPL 2025 Playoffs

- Complete Steal A Brainrot Beginner’s Guide

- Lucky Offense Tier List & Reroll Guide

- How to use a Modifier in Wuthering Waves

- League of Legends MSI 2025: Full schedule, qualified teams & more

- Ultimate Half Sword Beginners Guide

2025-06-17 01:56