What to know:

- The struggle of miners deepens as the network’s impenetrable math—oh, Fate, why?—reaches new bleak peaks, bleeding profits even as Bitcoin’s price, indifferent as the Holy Fool, sits unmoved upon its icy throne.

- Costs to drag a single, solitary BTC from the abyss now threaten to breach $70,000, a sum Dostoevsky himself would have wagered and wept over, up from a mere $64,000 (which, even for Raskolnikov, was no chicken feed).

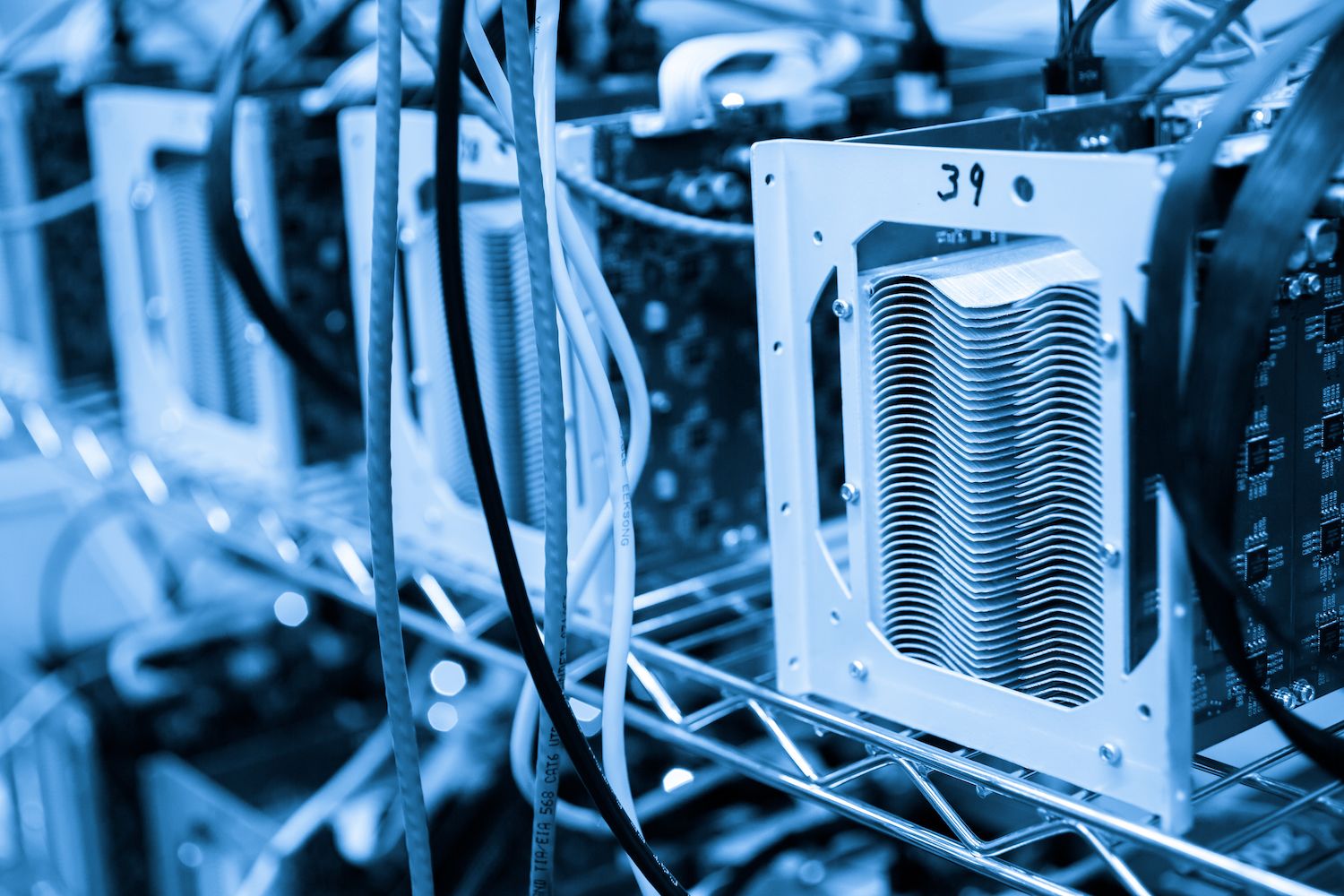

- Public mining houses—MARA, HIVE, et al.—expand their labyrinthine machinery, multiplying cold, humming hashrates in a desperate ballet of survival and existential dread.

The miners—oh, those poor monomaniacal souls—find themselves beset as the hashrate’s ceaseless ascent suffocates their margin. Per TheMinerMag, the network’s monstrous difficulty now stands at an absurd 126.98 trillion; one imagines Sisyphus grinning, scrolling through his Bitcoin wallet.

Transaction fees, once a glimmer of hope, have slid below 1% of block rewards. The hashprice screamed downward to a pitiful $52 per PH/s, only to twitch with the feeblest of rebounds, like a Dostoevskian hero reconsidering his strategy after gambling away his last kopeck.

Competition grows more ruthless; electricity more expensive—dare I say, like life itself? Production may cost $70,000 per BTC, which forces one to ponder: perhaps it’s not only existential despair that’s expensive these days.

Meanwhile, public miners hurtle onward: MARA Holdings ramped up its hashrate by 30% (a feat to impress even the ghosts of St. Petersburg), while HIVE added 32%—no doubt in a fit of feverish hope after igniting a new facility in Paraguay. Cipher Mining eyes an audacious 70% expansion in Texas, the bravest Don Quixote to ever duel a spreadsheet.

If you crave those top-tier ASICs, be ready to pay $10–30 per terahash—unless you’re also paying with your soul. Even then, you might wait two years to see your investment climb out of Dostoevsky’s cellar of woes…assuming electricity flows at a serene $0.06/kWh. Alas, Terawulf paid $0.081, burdening its fleet with hashcosts inflated by over 25%. The poor miners—one feels their pain, like a gambler perpetually dealt the knave of spades.

And what of the sacred connection between mining equities and bitcoin’s own price? Sundered! While IREN, CORZ, and BTBD glow in the green (what would Ivan Karamazov make of it?), Canaan and Bitfarms embrace the gloom, both down double digits—nearly as tragic as Prince Myshkin’s last heartbreak.

It appears investors now favor cold-eyed scrutiny of business models instead of worshipping at the altar of pure, unadulterated price. Progress, perhaps. Or maybe just another detour on the endless Russian winter of the crypto soul. 🌨️💰

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Stellar Blade Update 1.011.002 Adds New Boss Fight, Outfits, Photo Mode Improvements

- Stellar Blade x Nikke DLC: Full Walkthrough | How to Beat Scarlet + All Outfit Rewards

- Complete Steal A Brainrot Beginner’s Guide

- Lady Gaga Does the Viral ‘Wednesday’ Dance, Performs ‘Abracadabra’ and ‘Zombieboy’ at Netflix’s Tudum

- Lucky Offense Tier List & Reroll Guide

- League of Legends: Bilibili Gaming’s Epic Stomp Over Top Esports in LPL 2025 Playoffs

- How to watch BLAST Austin Major 2025: Stream, Schedule, Teams

- How to use a Modifier in Wuthering Waves

2025-06-16 22:14