There are moments on the financial frontier that even the most seasoned speculator might rather spend idly in the garden with a very dry martini and some waspish gossip. Yet, here we are, fixated once more on Bitcoin, the digital asset most capable of stirring both dreams of elysium and nightmares of insolvency. In the past twenty-four hours, Bitcoin pirouetted with the grace of a debutante at her first and last ball, briefly plummeting beneath the $104,500 line only to dramatically right itself above $106,000—proof, if any were needed, that algorithms have a taste for theatre.

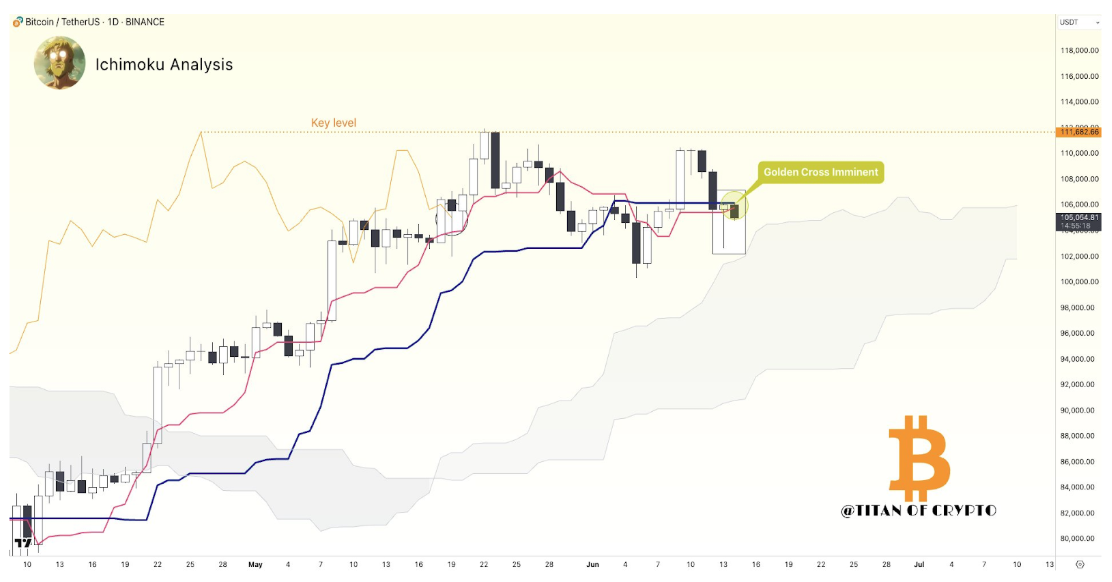

A technical drama unfolds: on the revered fields of the Ichimoku chart—a name sounding suspiciously like a lethal aperitif—Titan of Crypto, analyst and possible collector of esoteric figurines, has observed Bitcoin inching tantalisingly close to confirming a “golden cross.” This technocratic augury, celebrated by chart enthusiasts and cultists alike, promises bullish delights within days. If only the markets had the decency to coordinate with our holiday plans!

Ichimoku Cloud: The Weather Forecast for Your Money 💸

Titan of Crypto, taking to X (which used to be Twitter, until it became a meta-joke), assures us that the daily price closing above the Tenkan line is akin to a captain spotting land—encouraging, albeit likely obscured by fog or the occasional missile. The Tenkan—sometimes piously called the ‘conversion line’—purports to reveal trend strength, although believers would likely find similar conviction in a fortune cookie. Now, the stars seem to be aligning for a fabled golden cross, that sacred moment when the short-term average triumphs over its beefier, long-term adversary. Very much the underdog story of the season, and—should it hold—one of technical analysis’ more reliable mood swings.

Midway through this melodrama, Bitcoin broods at a suspiciously round $105,000. The script, according to those who worship chart patterns, leads us up to a flirtation with $111,600. Yet, just as fortune appears ready to smile, the chaos of geopolitics—the perennial villain—looms. One tremor from the Middle East, and all technical seduction might be brushed aside faster than you can say “risk off.”

Image From X: Titan of Crypto. One can only hope Titan dresses suitably for such events.

The Brave, the Weak, and the Whales 🐋

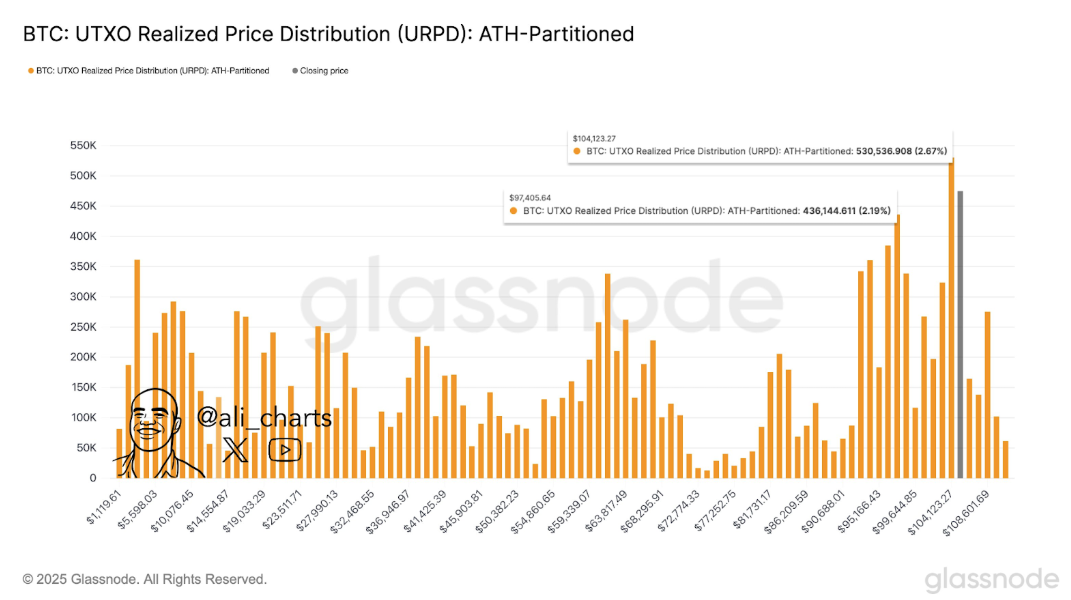

Everyone fancies themselves a bull until market data ruins their tea. Analyst Ali Martinez, hardly a stranger to cold splashes of realism, has declared $104,124 the line in the sand for Bitcoin—a point at which so many have entered, it resembles the coatroom at Eton just before a thunderstorm. This is not a number plucked from the ether, but the locus of pronounced UTXO activity (which, for the uninitiated, is jargon designed to baffle your in-laws at dinner).

Should Bitcoin tumble, the path downward to $97,405 is about as hospitable as a budget airline’s baggage policy. The URPD chart unhelpfully confirms what many already fear: there’s precious little support between $104,000 and $97,000. Translation: if the price dips, expect it to fall with the subtlety of a collapsing soufflé.

Image From X: Ali_charts. Marvel at the complexity; despair at the implications.

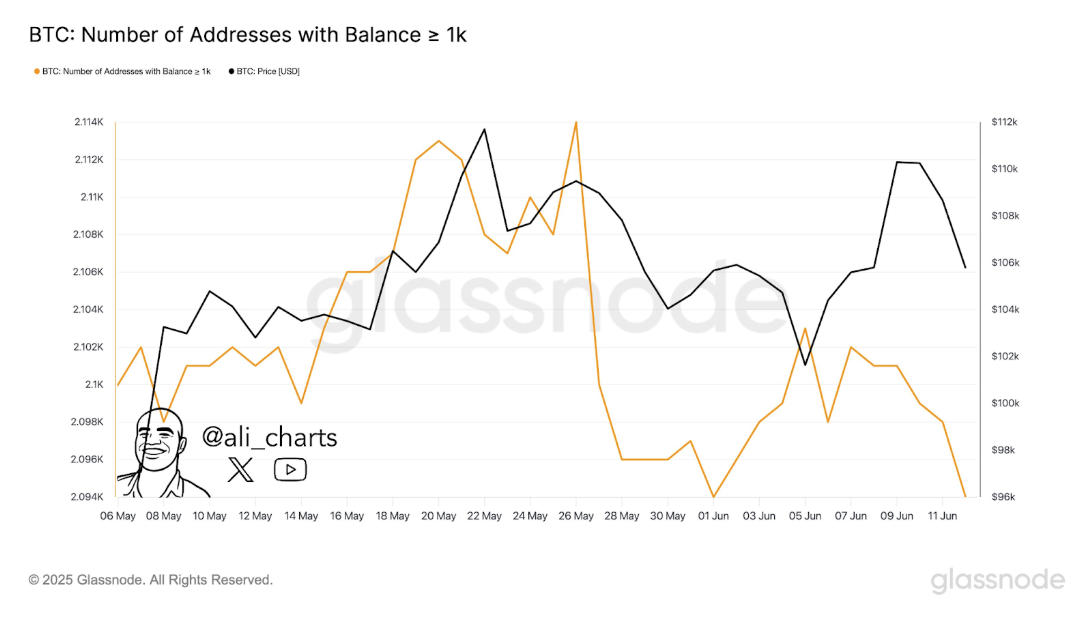

Now for the aquatic aristocracy—whales. On-chain data whispers that the deepest-pocketed veterans, those lords of liquidity holding over 1,000 BTC, have taken up the great pastime of reducing exposure. This noble retreat started right after Bitcoin’s champagne-popping at $111,800 (May 22, mark your calendars: it may feature in future cautionary tales). After Bitcoin’s failed advance on $110,000, whales started to quietly slip away to wherever digital titans retire—Miami, presumably, or the blockchain equivalent of Monte Carlo.

Image From X: Ali_charts. Consider it a heat map of existential dread.

Result: those with 1,000+ BTC have shrunk from 2,114 to a humbler 2,094. At time of writing, Bitcoin trades at $105,505—a sum neither here nor there, but certain to inspire arguments at dinner parties and nervous laughter at cocktail bars the world over.

In sum, the golden cross beckons, the clouds gather, the whales flee, and Bitcoin stage-manages the spectacle. Will the curtain fall with drama or farce? As ever, the audience is advised to keep one hand on the exit and the other on the gin.

Read More

2025-06-15 17:48