Well, folks, it seems Ethereum has decided to throw a party, and everyone is invited! 🎉 Data reveals that Ethereum spot exchange-traded funds (ETFs) are experiencing weekly inflows that are five times the recent average. Meanwhile, Bitcoin is over there, sitting in the corner, nursing a drink and wondering where all the excitement went. 🍸

Ethereum Spot ETFs Have Seen 154,000 ETH In Inflows This Week

In a recent post on X (formerly known as Twitter, because who doesn’t love a good rebranding?), the analytics firm Glassnode shared the latest gossip about the netflow related to US-based Ethereum spot ETFs. These “spot ETFs” are like the trendy new coffee shop that lets you sip on the experience without actually having to brew your own coffee. ☕

With a spot ETF, you can ‘invest’ in an asset without the hassle of actually owning it. It’s like saying you own a piece of the Mona Lisa because you have a postcard of it. In the world of cryptocurrencies, this is particularly appealing, as these ETFs trade on traditional platforms. Some investors would rather not deal with the digital asset exchanges and wallets—because who has time for that? 🙄

Spot ETFs are a relatively new concept, with Bitcoin’s version getting the green light from the US Securities and Exchange Commission (SEC) at the start of 2024, and Ethereum’s following suit in mid-2024. It’s like watching two siblings compete for their parents’ attention, and right now, Ethereum is winning. 🏆

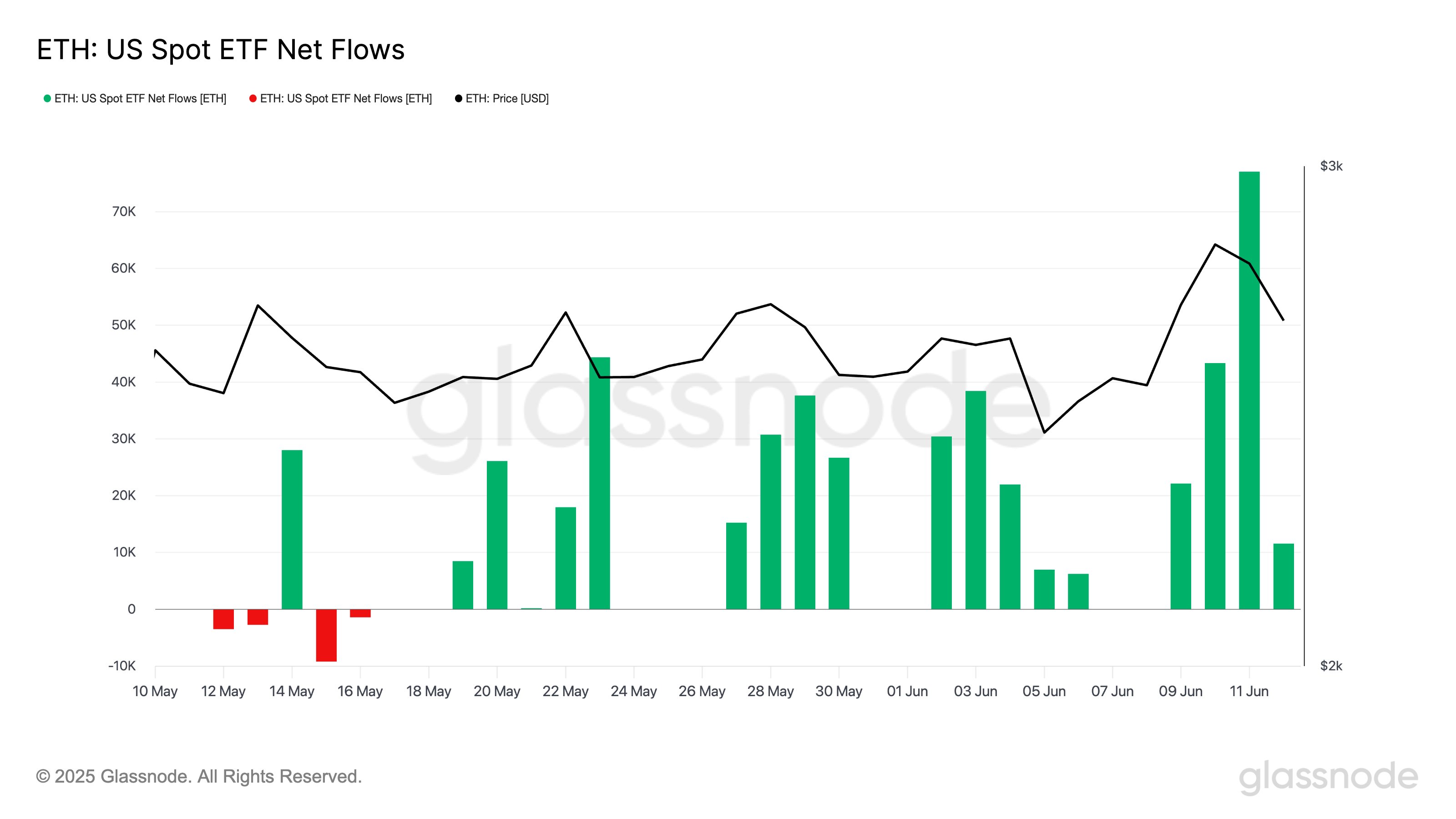

Below is a chart that shows how the netflows related to Ethereum’s spot ETFs have looked over the past month. Spoiler alert: it’s a lot of green! 💚

From the graph, it’s clear that Ethereum US spot ETFs have been raking in the cash for the last few weeks. Apparently, traditional investors are feeling a bit frisky and are eager to get their hands on some Ethereum. “This week alone, they’ve seen 154K ETH in inflows—5x higher than their recent weekly average,” notes Glassnode. For context: the biggest single-day ETH inflow this month was 77K ETH on June 11th. So, yeah, it’s a big deal. 📈

While Ethereum is riding high, Bitcoin seems to be having a bit of an identity crisis. The number one digital asset is looking a bit mixed, like a salad that forgot to include the dressing. 🥗

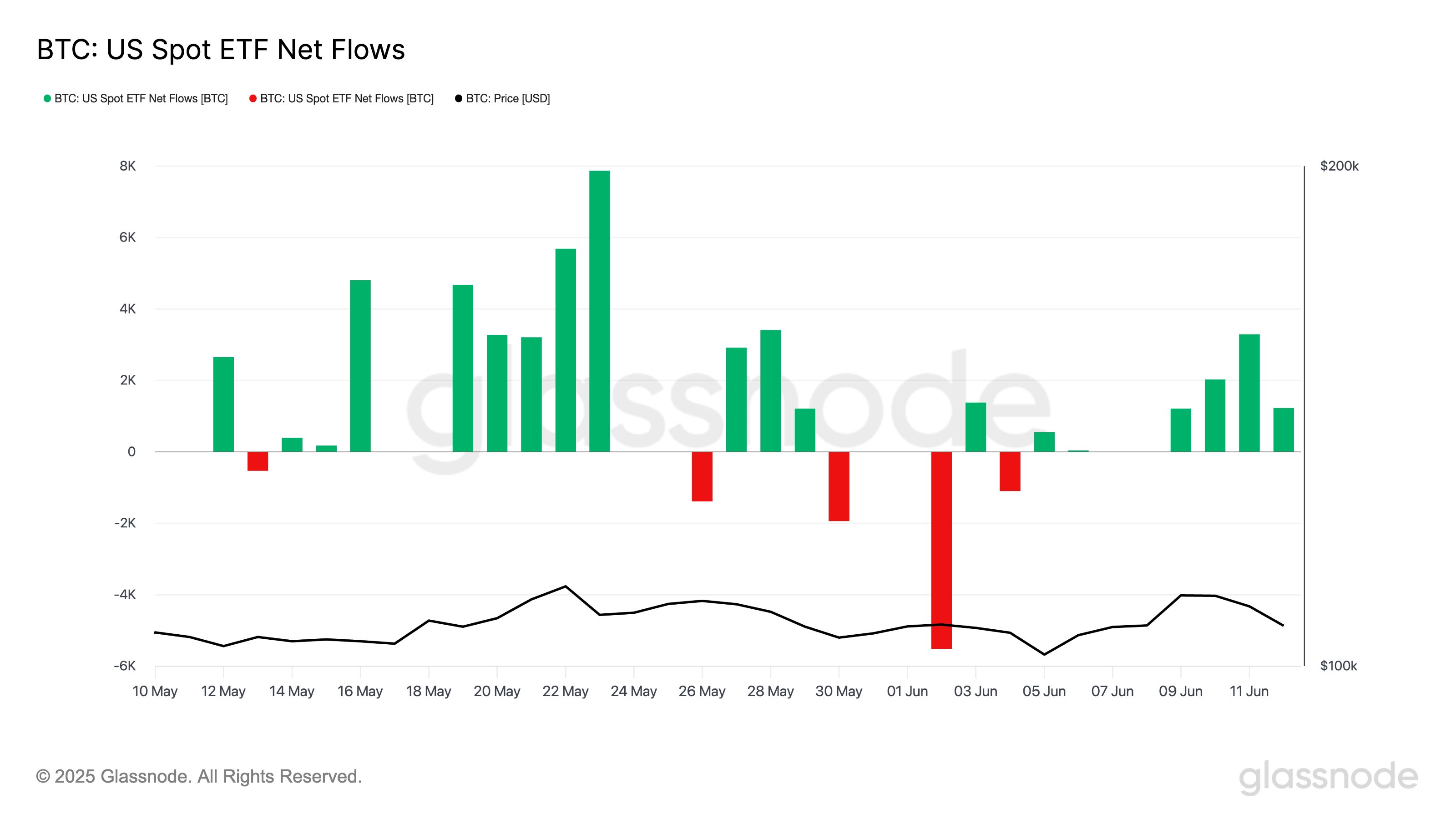

As shown in the above graph, Bitcoin US spot ETFs have also seen some positive netflows this week. However, the scale of the inflows is about as impressive as a lukewarm cup of coffee—only around 7,800 BTC has entered the ETFs. Sure, it’s above average, but it pales in comparison to the highs of May, when daily inflows peaked at 7,900 BTC. Talk about a fall from grace! 😬

Last week, Bitcoin spot ETFs even experienced a negative netflow. Ouch! It seems the momentum has slowed down for Bitcoin, while Ethereum is basking in the glow of success. 🌟

ETH Price

Despite Ethereum’s consistent ETF inflows, its price has still underperformed against Bitcoin over the past day, dropping to $2,540—a decline of 7% compared to BTC’s 2% loss. It’s like being the star of the show but still getting overshadowed by the opening act. 🎭

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Stellar Blade Update 1.011.002 Adds New Boss Fight, Outfits, Photo Mode Improvements

- Stellar Blade x Nikke DLC: Full Walkthrough | How to Beat Scarlet + All Outfit Rewards

- Complete Steal A Brainrot Beginner’s Guide

- Lady Gaga Does the Viral ‘Wednesday’ Dance, Performs ‘Abracadabra’ and ‘Zombieboy’ at Netflix’s Tudum

- Lucky Offense Tier List & Reroll Guide

- League of Legends: Bilibili Gaming’s Epic Stomp Over Top Esports in LPL 2025 Playoffs

- How to watch BLAST Austin Major 2025: Stream, Schedule, Teams

- How to use a Modifier in Wuthering Waves

2025-06-14 08:48