Bitcoin continues to show a technical upward trend, as demonstrated by noticeable buyer enthusiasm following the recent price sweeping near the $100,000 level.

If the price surpasses $111K, it’s probable that a strong upward momentum will follow. Yet, keep in mind that there might be short-term fluctuations and possible resistance points as the price moves through this crucial level.

Technical Analysis

By ShayanMarkets

The Daily Chart

Bitcoin (BTC) has just broken through an important liquidity barrier near $100,000, causing a powerful and rapid increase in price that indicates a substantial influx of buyers entering the market. This sudden rise propelled the cost to its highest point ever at $111,000, suggesting a resurgence of bullish sentiment.

In the region above the previous all-time high ($111K), there’s a significant spot for institutional and intelligent investors to focus their liquidity. Given that bullish sentiment remains strong, if buyers can break through this level, a sudden upward surge, possibly triggered by a short squeeze, might occur.

However, this zone also overlaps with a likely area of profit-taking and increased supply, which may temporarily slow or cap upward momentum. While a bullish breakout appears imminent, a minor pullback or short-term correction cannot be ruled out. At present, BTC remains range-bound between $100K and $111K, with the breakout direction likely determining the next macro trend.

The 4-Hour Chart

On the shorter time scale, there’s been significant buying activity near the $100K mark for Bitcoin, causing it to surge past a freshly constructed bullish pennant formation. This leap suggests that the existing uptrend is still in progress.

Right now, the price trend is nearing a significant 4-hour Resistance Zone, a point where sellers might return to the market. If buyers successfully regain control of this region and maintain their strength, Bitcoin may quickly surge towards price exploration and potentially establish a fresh All-Time High (ATH).

That said, a short-term rejection or a pullback to retest the breakout level is still a viable scenario before the next leg up. For now, Bitcoin is consolidating within a tighter $105K–$111K range on the 4-hour chart. This consolidation phase could serve as a launchpad for the next impulsive rally.

On-chain Analysis

By ShayanMarkets

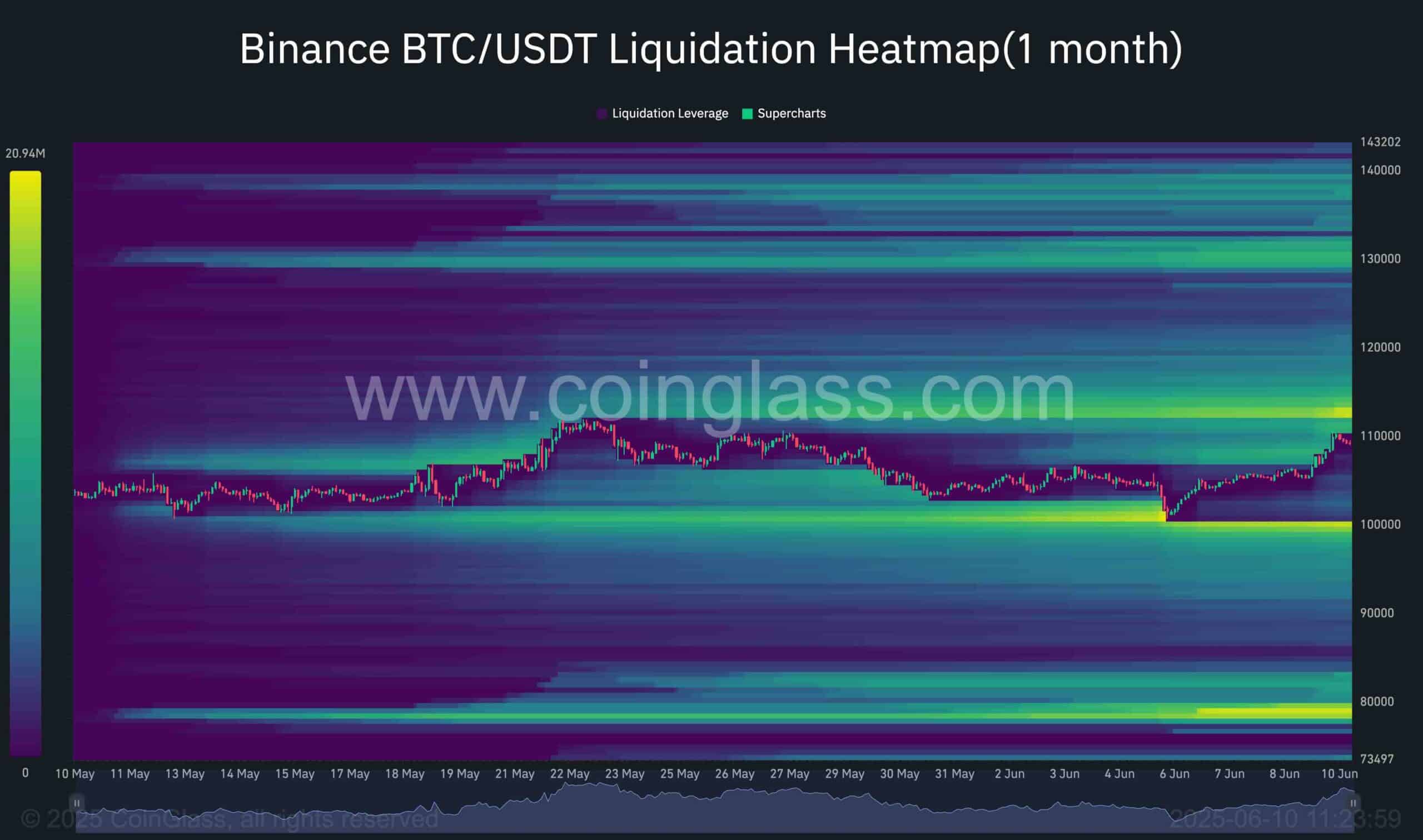

Looking closely at the Bitcoin futures market, specifically the Binance BTC/USDT liquidation map, provides valuable clues about possible future price fluctuations, as Bitcoin nears its record high of $111K.

The data shows two significant groups of liquidity concentrations: one lies above the $111K mark and another is just under $100K. These regions are close to the current price and could be strategic spots where sophisticated investors might target the liquidation of overextended retail trades. A clear breakthrough either limit may lead to a chain reaction of liquidations, intensifying the market trend in that direction.

Given the prevailing bullish sentiment and broader market structure, a breakout above the $111K resistance appears increasingly likely in the mid-term. Such a move would not only confirm market strength but could also fuel momentum toward a fresh all-time high.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Goal Sound ID Codes for Blue Lock Rivals

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- KPop Demon Hunters: Real Ages Revealed?!

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- Umamusume: Pretty Derby Support Card Tier List [Release]

2025-06-10 16:28