Well, well, well, look who’s jumping on the Bitcoin bandwagon. SolarBank Corporation, that oh-so-innovative renewable energy developer, has decided it’s time to add a bit of digital sparkle to their balance sheet by incorporating Bitcoin into their reserve assets. The Nasdaq-listed company has, quite dramatically, shifted gears in its financial strategy.

Ah yes, the latest craze – more and more businesses are adopting Bitcoin as their trusty shield against inflation and the ever-present threat of economic chaos. What could possibly go wrong? 😏

Bitcoin – The New Black in Corporate Asset Strategy

SolarBank, with all the grace of a debutante at a gala, has jumped into the growing trend of corporate Bitcoin adoption. It’s a move aimed at diversifying portfolios and protecting capital from the cruel, unrelenting devaluation of fiat currencies. Quite the financial renaissance, don’t you think?

In their announcement, SolarBank made it clear that Bitcoin is now their strategic asset of choice. The company hopes to bolster its financial position, especially as inflation keeps rising and currency devaluation is now all the rage. 🍸

“By accumulating Bitcoin, SolarBank hedges against currency debasement and inflation, while enabling access to institutional financing,” the company smugly declared. Well, at least they have a plan. 🙄

For those keeping score, SolarBank has developed over 100 megawatts worth of clean, renewable energy projects. Now, adding Bitcoin to the mix is their way of being all flexible and resilient – because, apparently, nothing says ‘economic stability’ like volatile cryptocurrencies.

But wait, there’s more! K33, another player in the digital asset world, has decided to follow suit, snapping up 10 Bitcoin in a bold treasury strategy. The audacity!

K33’s aim? To optimize returns and minimize risks tied to traditional market fluctuations. Let’s hope the volatility gods are feeling generous. 🤑

“We expect Bitcoin to be the best-performing asset in the coming years,” says Torbjørn Bull Jenssen, CEO of K33. “Our ambition is to build a balance of at least 1000 BTC over time.” Good luck with that, darling. 😉

SolarBank and K33 aren’t alone in this thrilling adventure – companies like GameStop, SharpLink, and a Spanish coffee chain (yes, really) have also jumped on the corporate Bitcoin bandwagon. It’s a veritable parade of digital assets, and the more the merrier, right?

But Wait! Standard Chartered Is Here to Be the Party Pooper

Ah, but there’s always one cloud in the sky, isn’t there? Standard Chartered Bank, ever the killjoy, has warned of the risks involved in the corporate Bitcoin trend. Apparently, rising institutional demand has sent Bitcoin’s price soaring, which could lead to a rather unpleasant crash if market conditions suddenly take a turn for the worse. Well, that’s not ominous at all, is it?

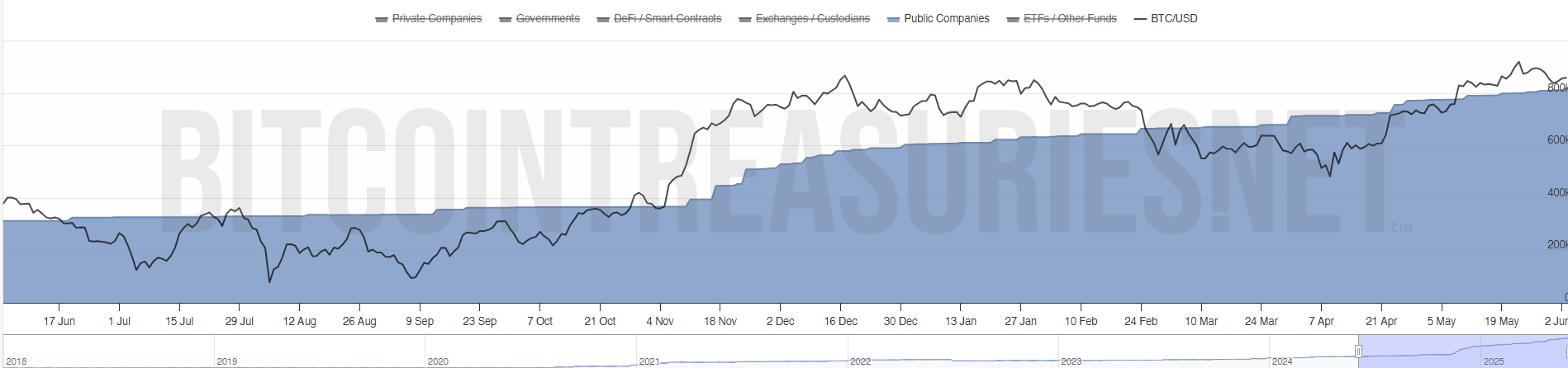

According to Standard Chartered, as of May, 61 publicly listed companies had adopted cryptocurrency as a treasury asset. Collectively, they held a whopping 673,897 Bitcoins – about 3.2% of the total supply. It’s almost like a digital gold rush. 🏆

But, of course, there’s a catch. The report cautions that due to Bitcoin’s volatile nature, companies could face some rather significant losses if the market decides to flip on them. How charming. 😬

And just in case you thought the risks were overblown, another recent report by BeInCrypto reminded everyone that holding altcoins as reserve assets could make things even more precarious. Just a little extra anxiety for your portfolio, darling. 😜

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Should You Save Vidar Or Give Him To The Children Of Morrigan In Tainted Grail: The Fall Of Avalon?

- Basketball Zero Boombox & Music ID Codes – Roblox

- How to use a Modifier in Wuthering Waves

2025-06-04 11:01