Well, well, well—Bitcoin just hit a rather impressive $111,000, only to show signs of stalling. And what do some investors do when they get the slightest whiff of hesitation? Naturally, they start screaming about a potential “Double Top” scenario.

But before we all go running for the hills, let’s slow down, shall we? According to some seasoned analysts, the idea that history is about to repeat itself is, frankly, a bit of a stretch. After all, this is 2025, not 2021, darling.

Why 2021’s Double Top Won’t Be Making a Comeback in 2025

Now, don’t get too excited. Some reports—oh yes, BeInCrypto is in the mix again—are trying to convince us that certain “divergence signals” suggest that Bitcoin could turn around in June and create a double-top pattern, leading to a potential 70% correction, much like the one in 2021.

However, analyst Stockmoney Lizards (fabulous name, isn’t it?) has a different view. He thinks this RSI-based divergence signal is about as reliable as your friend who always says they’ll show up at 7 but finally arrives at 9:30. He points out that in most instances, this indicator has been gloriously wrong.

“Want to know what I found? This thing has been dead wrong most of the time. 2015: ‘Divergence means top!’ – BTC went up 10x. 2017: ‘This divergence is different!’ – BTC kept pumping for months. 2019: ‘Finally confirmed!’ – Another 4x move incoming. The only time it actually worked was 2021. That’s 1 out of 5. So we’re supposed to sell everything based on an indicator that’s failed 80% of the time?” Stockmoney Lizards quipped.

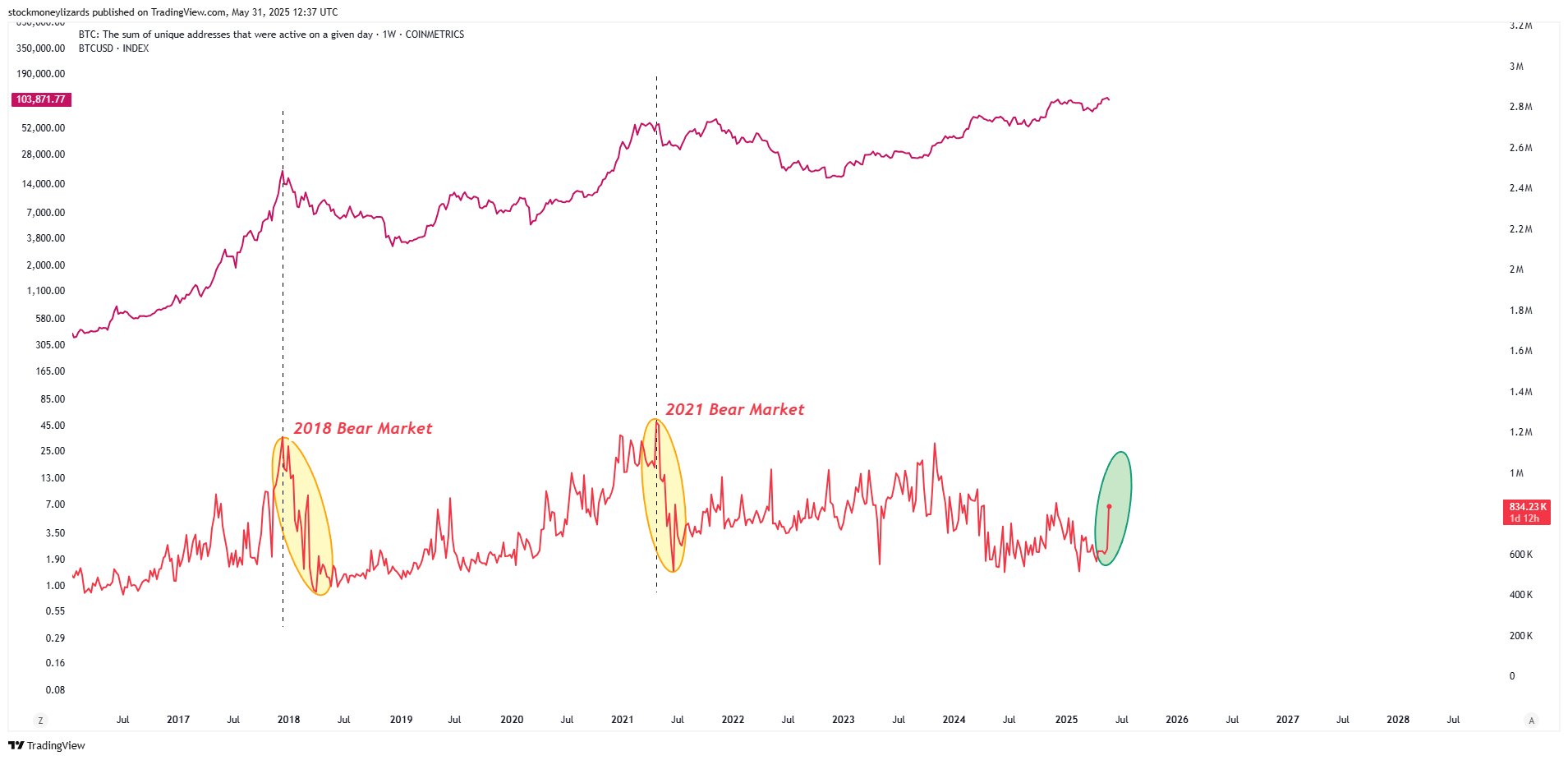

Aside from questioning the divine powers of technical indicators, Stockmoney Lizards also points to some positively overlooked signs. Like the surge in active wallet addresses—could it be that both retail and institutional investors are joining the Bitcoin party?

And let’s not forget the MVRV Z-Score, which is currently sitting low. Historically speaking, this suggests that Bitcoin is nowhere near its inflated peak and still has room to grow. How thrilling!

Then, Thomas Fahrer—the founder of ApolloSats—chimes in, waving the flag for fundamentals. He reminds us that the 2021 market suffered from several unfortunate events. There was the collapse of the Luna project (a well-known Ponzi scheme, no less), FTX selling “paper Bitcoin” (impressive), and the US Federal Reserve’s dramatic interest rate hikes. Truly a perfect storm for disaster.

But here’s where we leave the gloom behind. 2025, according to Thomas, is a completely different animal. The market now enjoys substantial support from Bitcoin ETFs, large corporations hoarding billions in Bitcoin, and some US states even building Bitcoin treasuries. A “structural shift,” as he puts it. How utterly modern!

Bitcoin is no longer just a whimsical toy for speculative gamblers. It’s becoming a trusted asset among institutions—so much so that calling it just another “bubble” seems rather quaint.

“The 2021 double top comparison is dumb,” Thomas Fahrer stated with a flair.

And it seems Stockmoney Lizards agrees. Both of them believe that institutional capital will be the wind beneath Bitcoin’s wings in 2025. Sure, the price chart might initially resemble 2021, but darling, let’s be real—market dynamics are as unpredictable as the weather in London. Best not to fret over a mere pattern.

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Lucky Offense Tier List & Reroll Guide

- Basketball Zero Boombox & Music ID Codes – Roblox

- Master the Pitch: Rematch Controls – Keyboard & Controller (Open Beta)

- Every House Available In Tainted Grail: The Fall Of Avalon

- How to use a Modifier in Wuthering Waves

2025-06-02 12:23