So, you want to activate your brokerage? Well, buckle up! It’s all about connecting to the vast ocean of liquidity pools and trading venues—kind of like SIPping from a firehose of financial instruments, prices, and matching orders. 🎯

You have two choices: partner with some liquidity provider with a fancy name, or build a bridge—a literal bridge! No, not a bridge to Narnia, but a technological marvel that routes your orders under specific conditions. Fancy adjusting your crypto liquidity bridge to access just the right currency pairs, risk limits, or execution styles? Of course you do! Because who doesn’t want all the bells and whistles? 🔧💸

This tool isn’t just flexible; it’s the Swiss Army knife for scaling—letting you control and expand your trading empire. Ready? Let’s plunge into this magic tech and see how it makes your competitors cry in their cornflakes.

Key Takeaways

- Crypto liquidity bridges link exchanges and brokers with multiple providers—making prices better and trading smoother. 🎉

- Platforms use these whiz-bang tools so they don’t have to butter up countless liquidity providers—they just connect to one super-connector!

- Think of it like a big, happy family that pulls assets, quotes, and order books from everywhere and throws them into one big pot. Soup’s ready! 🍲

Under the Hood: How Crypto Liquidity Bridge Tech Works

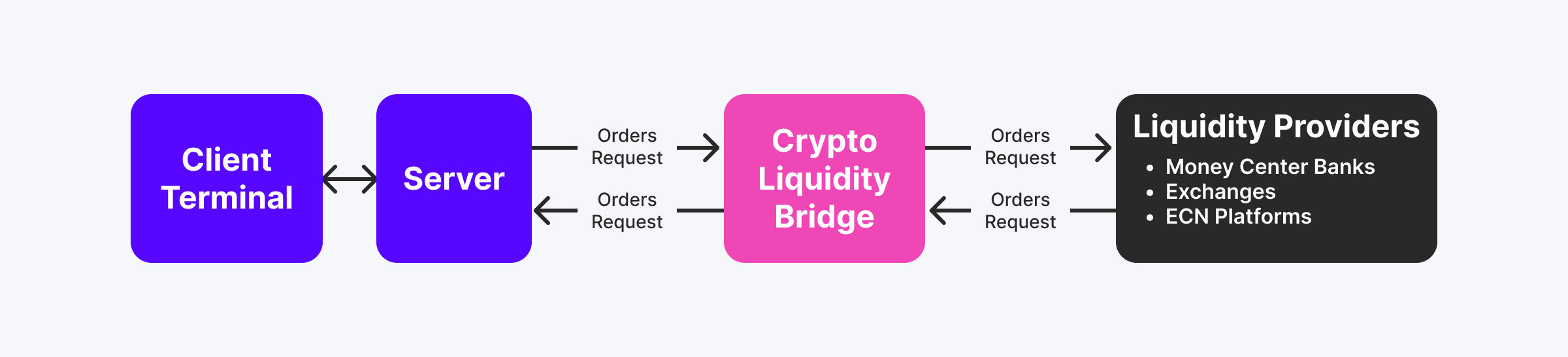

Imagine a technology that’s the traffic cop for your trading dreams—connecting multiple liquidity providers like a boss. These bridges allow assets and prices to flow freely between market makers, pools, and your humble brokerage. Think of it as an all-you-can-eat buffet of liquidity on steroids. 💪

It’s the middleman you never knew you needed—unclogging the market, speeding up execution, and letting you customize everything from risk limits to liquidity access—like a menu where you choose your own adventure. 🚦

In crypto, where prices jump around like frogs on a hot plate, and liquidity is scarce, this bridge tech saves your skin. It routes flows smartly, based on real-time prices, delays, or the whims of your internal rules—like having a GPS for your trades. 🗺️

And yes, brokers can tweak it to their liking, turning the dials for maximum profit and minimum headache. Because in this game, control is king—and a good bridge is the throne. 👑

Aggregation & Distribution—The Dynamic Duo

Aggregation is like collecting ingredients from many kitchens—pooled together for a hearty stew, while distribution is serving that stew to your hungry clients—minimizing slippage and making spreads as tight as your budget at a flea market. 🥘

Consolidate prices and volumes from multiple sources into one tidy feed—you get one coherent picture instead of a chaotic jumble. Then sprinkle that liquidity back out to clients, ensuring liquid markets regardless of where the assets come from. It’s like having a magic wand—poof, liquidity everywhere!✨

Liquidity Bridges vs Crypto Bridges: The Tale of Two Techs

Here’s where it gets fun: a crypto liquidity bridge is about merging prices across markets, helping brokers access the deep stuff. They’re like the Uber drivers of the trading world—getting assets from point A to B smoothly. 🚗

Meanwhile, crypto bridges are the magic portals—blockchain protocols that transfer tokens between different chains—think of it as teleportation for your coins. 🧙♂️

The Heart of the Matter: Components of a Liquidity Bridge

This complex beast combines tech wizardry and market sorcery—speeding up data flow, balancing supply and demand, and keeping everything ticking like a Swiss watch. ⏱️

Liquidity Providers

Big players like asset managers, OTC platforms, and financial giants feed the bid-ask quotes, keeping the marketplace bustling with opportunity. They make sure your order book isn’t a ghost town. 👻

Market Makers

These guys buy and sell to keep liquidity alive—like the community greengrocer who always has apples. Some use algorithms—automated market maestros—reacting faster than you can say “spread narrowing”. 🥳

Brokerages

They leverage these bridges to get instant access to institutional liquidity—no messy deals with exchanges required. More profits, fewer headaches. It’s like outsourcing your plumbing! 🚰

Exchanges

Utilize bridges to enhance order execution—launch hot new pairs or make markets in less-traded assets. It’s the secret sauce for attracting traders and boosting volume. 🍔🍟

Who’s in the Club? Users of Crypto Liquidity Aggregation

This tech isn’t for hobbyists—it’s for the big boys: institutional brokers, hedge funds, and professional trading desks. They get all the perks without lifting a finger. The retail trader benefits indirectly—like enjoying the buffet after the chef cooked it. 🍽️

How Does an Aggregation Bridge Work? A Day in the Life

When you hit ‘buy’, the bridge snatches prices from all connected sources faster than a cheetah on Red Bull. It then uses smarts—routing your order to the best price, maybe splitting it if it’s smart to do so. Think of it as a top-tier DJ fading between tracks for the perfect mix. 🎧

- A pricing engine: judges the best quotes.

- A smart order router: the maestro conducting the symphony.

- Connectivity protocols: the super-fast internet that keeps everything humming.

Supports protocols like FIX API and WebSocket—meaning your trades are as quick as a lightning bolt. ⚡

Features That Make You Go ‘Wow’

Multi-Source Aggregation

Connects to centralized markets, liquidity providers, ECNs—all in one big network. It’s a financial traffic jam of efficiency. 🚦

Smart Order Routing

Routes orders to the best venue based on real-time data—like a GPS for your trades. Dividing your order when needed, for better fills. Because why settle for less? 🏎️

Custom Markups & Spreads

Adjust your pricing on the fly—skip the bland menus, serve up tailored spreads that make your competitors jealous. 💅

Real-Time Risk Tools

Keep your trading safe with risk controls built right in—like having an alarm system for your portfolio. No more surprises—just smooth sailing. 🌊

APIs for the Modern World

Connect via FIX, REST, WebSocket—whatever suits your fancy. Integration made easy—like snapping Lego blocks together. 🧱

Different Ways to Gather Liquidity—Because One Size Doesn’t Fit All

Price-Level Aggregation

Merges entire order books from various providers—think of it as bringing all your friends to one massive party. 🎉

Preferred by giants who demand transparency and depth.

Quote-Based Aggregation

Grabs real-time quotes instead of full books—faster, leaner, like slapping a sticker on the best price. Perfect for quick traders. 🏃♂️

Smart Order Routing

Analyzes prices and splits your order, delivering the best fills across venues. It’s like having a personal shopper for crypto! 🛍️

Weighted/Preference-Based

Assigns priorities to liquidity sources—your favorite providers get the first shot. Dynamic or static, it’s the VIP pass of routing. 🎟️

The Ups & Downs—And the Caveats

Perks

- Orders executed at the best prices—who doesn’t love a good deal?

- Access to mountains of liquidity—no more desert-like order books.

- Less technical burden—less headache, more money! 💰

- Customization—make it your own playground.

- Scalability—grow big or go home.

Risks & Challenges

- Latency issues—slow connections are the evil twin of success.

- Dependence on vendors—like dating only one provider, beware the heartbreak.

- Flow toxicity—bad traffic can choke your system.

- Regulatory watch—don’t get caught with your pants down.

- Complex setup—be ready for some sleepless nights.

Showcase: B2CONNECT—The Heavyweight of Liquidity Bridges

Meet the brawler in crypto liquidity: B2CONNECT, by B2BROKER. It’s the robust, go-anywhere, do-anything solution—like the Swiss Army knife of the digital age. 🔧🔫

Connects brokers, exchanges, OTC desks, and liquidity pools—over 50+ providers at your fingertips. Want to assign your own routing logic or create exotic instruments? Done! Want it integrated with MetaTrader? Like butter! 🧈

It’s multi-asset, multi-platform, and multipurpose—covering crypto, indices, commodities, you name it. It’s the bridge that makes your competitors wish they had one. 🚀

Supported Platforms & Protocols

Compatible with MetaTrader 4/5, cTrader—whatever you fancy—and chats happily with top-tier providers like Binance, Kraken, Coinbase, and countless others. All with ultra-low latency. Because slow is the enemy! ⚔️

Final Words: The Future Is Liquidity Bridges

If you want your trading infrastructure to run like a well-oiled machine—dancing to the tune of deep liquidity, smart routing, and customization—liquidity bridges are your new best friends. They turn chaos into order, volatility into profit, and make your trading empire truly unstoppable. 💥

FAQ: The Curious Minds Want to Know

Who needs these bridges? Only the giants—exchanges, brokers, and institutional players—who crave deep liquidity and efficient execution. The retail traders cheer from the sidelines, unaware they’re benefiting indirectly. 😂

Are they expensive? Depends. But consider the cost of missed opportunities and slippage—these bridges can pay for themselves fast.

Are they better than old-school providers? Absolutely! They gather the best of many worlds—better prices, lower spreads, and smarter routing. 💡

How do they get market prices? By talking to exchanges, OTC desks, and LPs—faster than gossip spreads in a small town. They get real-time data, aggregate it, and serve it hot. 🔥

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Lucky Offense Tier List & Reroll Guide

- Basketball Zero Boombox & Music ID Codes – Roblox

- Every House Available In Tainted Grail: The Fall Of Avalon

- Master the Pitch: Rematch Controls – Keyboard & Controller (Open Beta)

- How to use a Modifier in Wuthering Waves

2025-05-29 15:40