What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

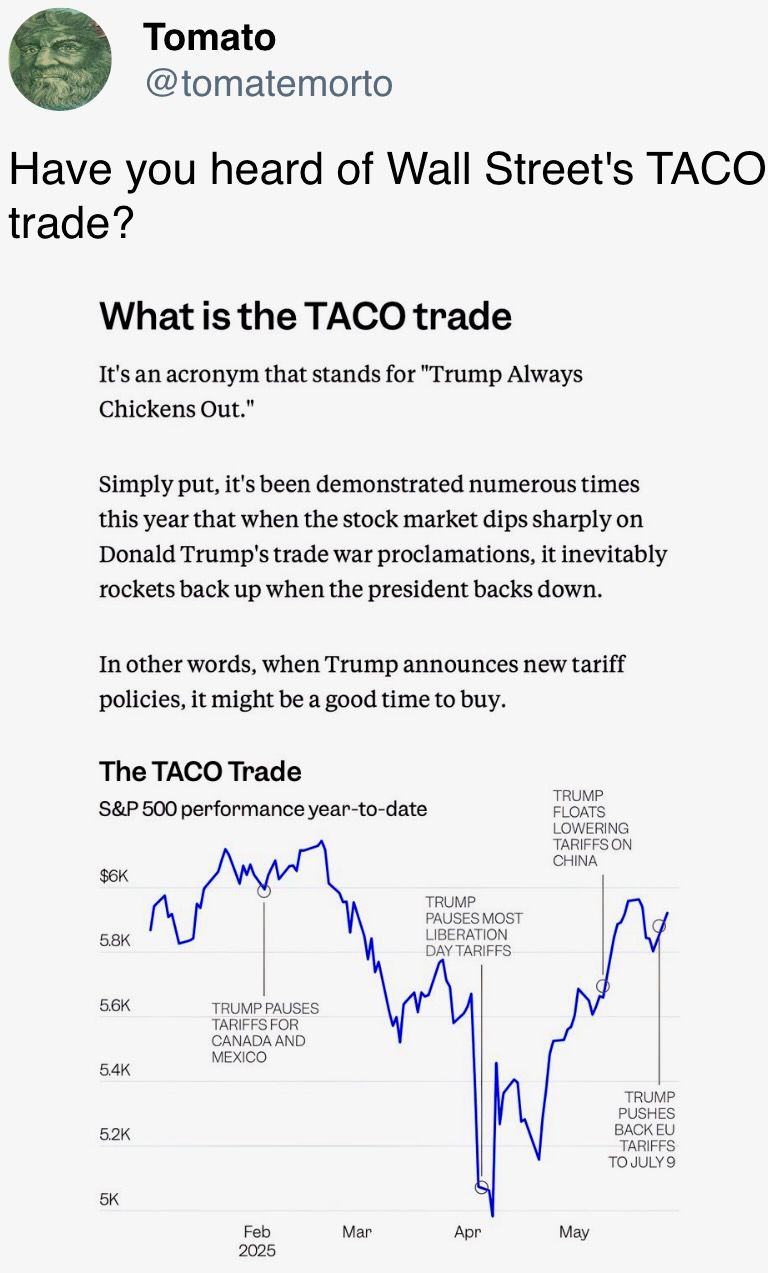

Ah, Bitcoin! The ever-elusive specter of wealth, rising like a phoenix from the ashes of despair, surged forth with vigor this fine Thursday morn, as a U.S. court, in its infinite wisdom, deemed President Donald Trump’s tariffs a mere folly of man. The air was thick with optimism, buoyed by the jubilant earnings of the AI behemoth, Nvidia. Who knew machines could be so generous? 🤖💰

Yet, as the sun shone brightly upon the cryptocurrency landscape, on-chain data whispered secrets of large wallets—those hoarding over 10,000 BTC—shifting from the embrace of buying to the cold, hard reality of selling. The largest cryptocurrency clung desperately to its record high, while exchange deposits hinted at a brewing storm of selling pressure. Volatility, it seems, is the name of the game, especially with Friday’s monthly settlement looming like a dark cloud. ☁️

And then there was Ether, the second-largest of the digital denizens, leaping to $2,780, the highest since the fateful day of February 24. A bullish signal, indeed! This week, it basked in the glow of SharpLink’s audacious $425 million Treasury plan. Meanwhile, U.S.-listed spot ether ETFs basked in a net inflow of $84.89 million on Wednesday, extending their streak to a remarkable eight days. Who knew finance could be so thrilling? 🎉

In the land of Canada, the investment firm Sol Strategies, in a bid to raise up to $1 billion, filed a preliminary prospectus to bolster its investment in the Solana ecosystem. Yet, the SOL token remained as flat as a pancake, hovering around $170. 🍽️

In the broader market, TON, PEPE, and FLOKI danced joyfully, while FARTCOIN, PI, and JUP nursed their wounds. Open interest in TON perpetual futures surged by 33%, reaching heights unseen since February 18. A tale of triumph and tragedy, indeed!

Meanwhile, the stablecoin issuer Circle, in a fit of caution, froze wallets connected to the Libra token, containing millions of dollars worth of USDC. Metaplanet, ever the opportunist, issued $21 million in bonds to finance further bitcoin purchases. Ah, the irony of seeking stability in a world of chaos! 🌀

In the traditional markets, whispers from investment banks suggested that Trump, ever the crafty strategist, had other tools at his disposal to sidestep the court’s ruling on tariffs. Yields on longer-duration Treasury notes ticked higher, hinting at the dollar’s strength. Stay vigilant, dear reader!

Token Talk

By Oliver Knight

- Markets on the Ethereum-based Cork Protocol remain in a state of suspended animation after Wednesday’s $12 million smart-contract exploit. A tragedy, indeed!

- The attacker, a modern-day Robin Hood of sorts, manipulated the smart contract’s exchange-rate function by issuing fake tokens, absconding with 3,761.8 wrapped staked ether (wstETH). Oh, the audacity!

- This exploit marked yet another assault on the decentralized finance (DeFi) industry, just days after the Sui-based Cetus Protocol lost a staggering $223 million to a similar fate. What a world we live in!

- TRM Labs estimates that a jaw-dropping $2.2 billion was stolen in crypto exploits and hacks in 2024. A veritable gold rush of mischief!

- Yet, Ether remains unperturbed, leading the market today on the back of renewed institutional interest and spot ETF flows. It is up 3.8% in the past 24 hours, while Bitcoin languishes with a mere 0.17% decline. Such is the fickle nature of fortune!

Derivatives Positioning

- TRX, XMR, ETH, LTC, and BNB led the charge in perpetual futures open interest. A noble pursuit!

- Funding rates for the major players, save for TON, signal a bullish sentiment, though nothing extraordinary. How mundane!

- On the CME, ETH’s annualized one-month futures basis topped 10%, while BTC lagged at a paltry 8.7%. A tale of two cryptocurrencies!

- Signs of caution emerged on Deribit, with front-end BTC skew flipping to puts and ETH’s call skew softening. Block flows on Paradigm featured demand for short-dated BTC puts. Caution, dear friends, is the mother of wisdom!

Market Movements

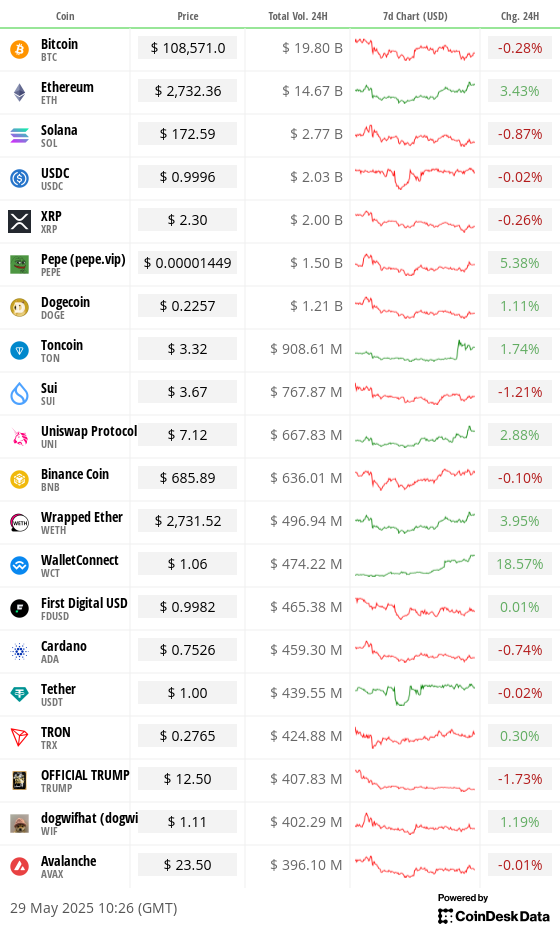

- BTC is up 1.15% from 4 p.m. ET Wednesday at $108,594.41 (24hrs: -0.29%)

- ETH is up 3.9% at $2,738.04 (24hrs: +3.63%)

- CoinDesk 20 is up 2.21% at 3,278.84 (24hrs: +0.66%)

- Ether CESR Composite Staking Rate is unchanged at 3.1%

- BTC funding rate is at 0.0057% (6.3006% annualized) on Binance

- DXY is up 0.12% at 99.99

- Gold is up 0.32% at $3,304.20/oz

- Silver is up 1.24% at $33.41/oz

- Nikkei 225 closed +1.88% at 38,432.98

- Hang Seng closed +1.35% at 23,573.38

- FTSE is unchanged at 8,724.05

- Euro Stoxx 50 is unchanged at 5,378.39

- DJIA closed on Wednesday -0.58% at 42,098.70

- S&P 500 closed -0.56% at 5,888.55

- Nasdaq closed -0.51% at 19,100.94

- S&P/TSX Composite Index closed unchanged at 26,283.50

- S&P 40 Latin America closed -0.76 at 2,599.53

- U.S. 10-year Treasury rate is up 6 bps at 4.54%

- E-mini S&P 500 futures are up 1.53% at 5,993.25

- E-mini Nasdaq-100 futures are up 2.03% at 21,814.25

- E-mini Dow Jones Industrial Average Index futures are up 0.96% at 42,576.00

Bitcoin Stats

- BTC Dominance: 63.71 (-0.06%)

- Ethereum to bitcoin ratio: 0.02517 (1.12%)

- Hashrate (seven-day moving average): 910 EH/s

- Hashprice (spot): $57.0

- Total Fees: 8.03 BTC / $868,310

- CME Futures Open Interest: 152,995 BTC

- BTC priced in gold: 32.8 oz

- BTC vs gold market cap: 9.30%

Technical Analysis

- The VIRTUAL token has topped the 38.2% Fibonacci retracement of the January-April crash. A moment of triumph!

- The breakout above the widely tracked resistance could entice more buyers, yielding a bigger rally. Hope springs eternal!

Crypto Equities

- Strategy (MSTR): closed on Wednesday at $364.25 (-2.14%), +2.43% at $373.09 in pre-market

- Coinbase Global (COIN): closed at $254.29 (-4.55%), +3.01% at $261.95

- Galaxy Digital Holdings (GLXY): closed at C$28 (-6.57%)

- MARA Holdings (MARA): closed at $14.86 (-9.61%), +4.04% at $15.46

- Riot Platforms (RIOT): closed at $8.38 (-8.32%), +2.86% at $8.62

- Core Scientific (CORZ): closed at $10.78 (-4.43%), +2.97% at $11.10

- CleanSpark (CLSK): closed at $9.11 (-7.61%), +3.62% at $9.44

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $17.27 (-5.32%)

- Semler Scientific (SMLR): closed at $41.32 (-4.77%), +2.95% at $42.54

- Exodus Movement (EXOD): closed at $25.94 (-25.35%), +11.6% at $28.95

ETF Flows

Spot BTC ETFs

- Daily net flow: $432.7 million

- Cumulative net flows: $45.31 billion

- Total BTC holdings ~ 1.21 million

Spot ETH ETFs

- Daily net flow: $84.9 million

- Cumulative net flows: $2.9 billion

- Total ETH holdings ~ 3.57 million

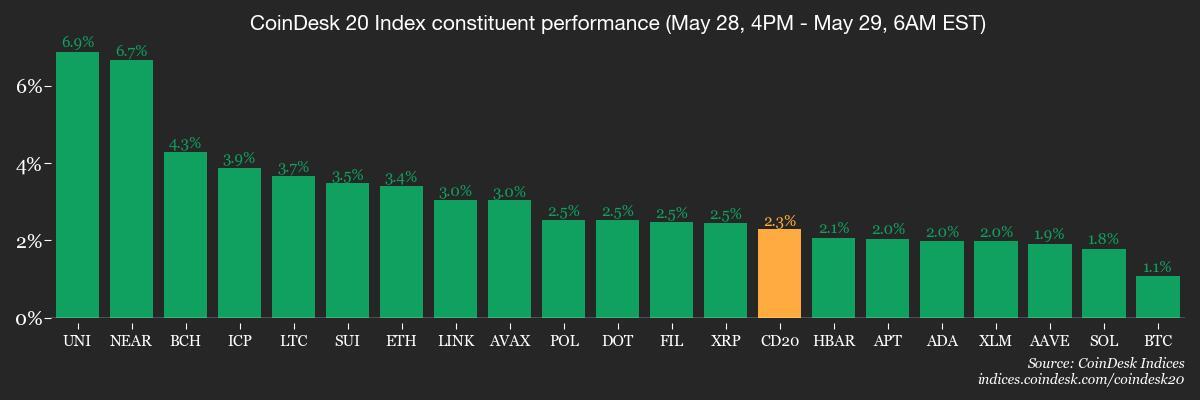

Overnight Flows

Chart of the Day

- The MOVE index, that fickle mistress measuring the volatility in U.S. Treasury notes, has dropped to the lowest level since March. A sign of the times!

- If it drops further, a continued decline is likely to ease financial conditions, greasing the wheels of the bitcoin bull run. How poetic!

In the Ether

Jamie Crawley, Siamak Masnavi contributed reporting.

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Should You Save Vidar Or Give Him To The Children Of Morrigan In Tainted Grail: The Fall Of Avalon?

- Basketball Zero Boombox & Music ID Codes – Roblox

- How to use a Modifier in Wuthering Waves

2025-05-29 14:45