In the recent weeks, Bitcoin has danced with fervor, breaking through resistance levels like a revolutionary bursting through the gates of oppression, reclaiming its six-figure valuation and reaching heights previously thought unattainable. The cryptocurrency, once a mere whisper in the shadows, now roars with the confidence of a lion, igniting a flicker of hope among its followers. Yet, as the flames of optimism flicker, a shadow looms—recent on-chain data suggests that perhaps, just perhaps, investors should temper their enthusiasm and don their helmets of caution.

Futures Surge, Spot Falls — Binance Data Signals Need For Caution

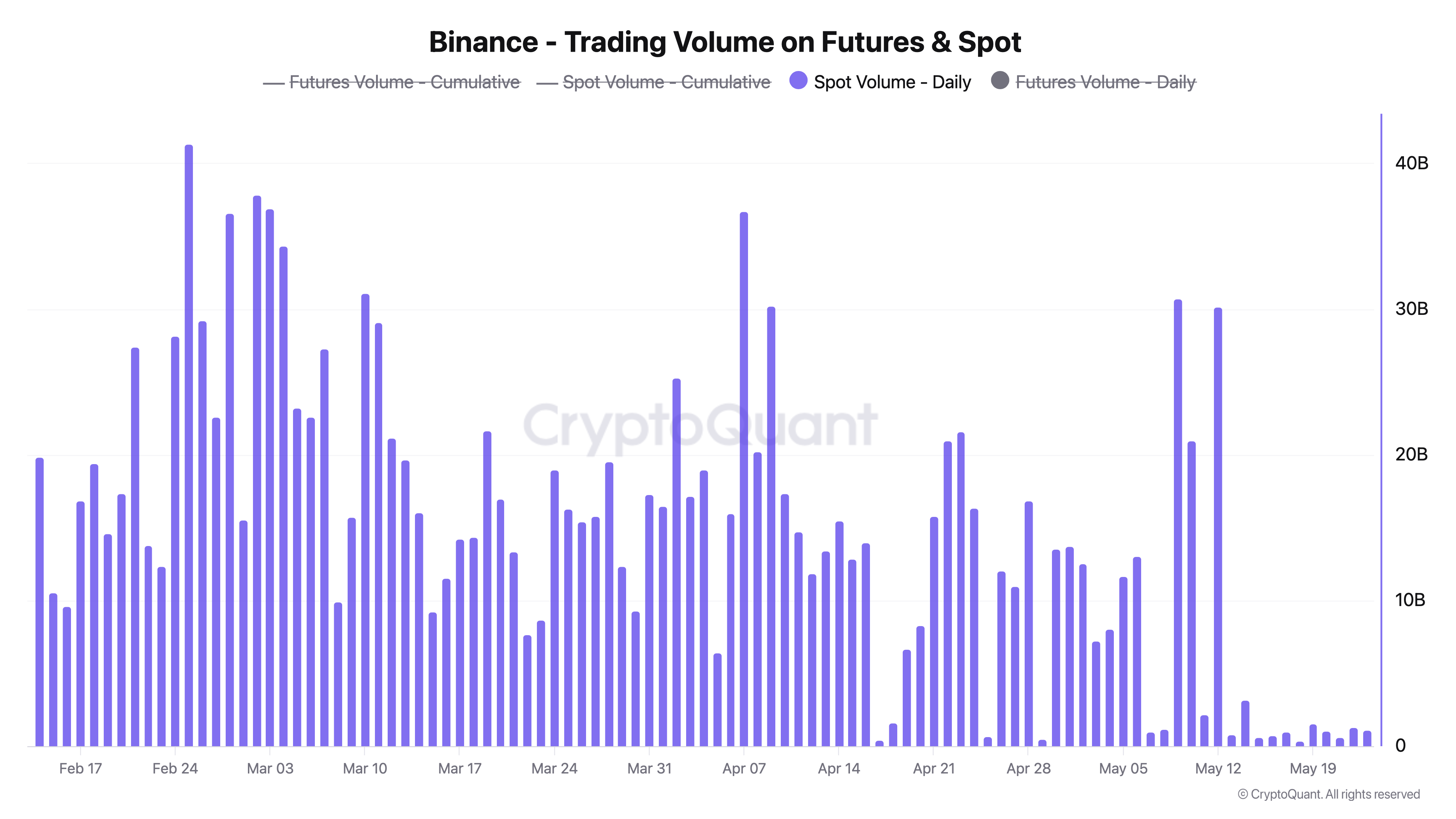

On the 24th of May, a sage of the blockchain, known as Darkfost, took to the digital ether of platform X to reveal a curious phenomenon: while the Bitcoin futures market on Binance has seen a slight uptick in trader activity since the 5th of May, the spot market has withered like a forgotten flower in a desolate field.

This observation, akin to a scientist peering through a microscope, hinges on two metrics: the Daily Binance Future Trade Volume and the Trading Volume on Futures and Spot. These metrics, as their names imply, are the lifeblood of trading activity on the world’s largest exchange, revealing the pulse of the market.

When the Future Trading Volume metric swells, it suggests a burgeoning appetite for short-term wagers on BTC, as if traders are placing bets on a horse race rather than investing in a stable steed. Conversely, a low value indicates a reluctance among futures traders to gamble on Bitcoin’s immediate trajectory.

In the realm of the spot market, a high value reflects a long-term faith in Bitcoin’s promise, while a low value signals a waning belief, as if investors are whispering doubts into the wind.

According to the oracle Darkfost, the surge in futures activity juxtaposed with the decline in spot market engagement has birthed an imbalance in market dynamics. This disarray hints at a rise in speculative trading, where investors are driven more by the thrill of risk than by a steadfast belief in the cryptocurrency’s future.

Darkfost warns that this inclination to gamble on Bitcoin’s short-term fluctuations may amplify volatility, especially when these bets lack the solid foundation of strong spot demand. “This increase in risk-taking renders the trend more fragile,” he cautions, “and calls for heightened vigilance before one dares to make investment decisions.”

Bitcoin Price At A Glance

As I pen these words, the price of BTC hovers around $107,770, reflecting a modest 0.2% increase in the past 24 hours. According to the oracle CoinGecko, the flagship cryptocurrency has risen over 4% in the past week, a glimmer of hope in a world fraught with uncertainty.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- KPop Demon Hunters: Real Ages Revealed?!

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Basketball Zero Boombox & Music ID Codes – Roblox

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- Come and See

2025-05-25 16:18