Ah, Ethereum, that digital marvel, continues its dance, a rather clumsy one, I might add, around the seemingly insurmountable wall of $2.7K. It reminds one of a peasant trying to scale the Tsar’s winter palace – much effort, little progress. And now, whispers of a double-top pattern… a most ominous sign, wouldn’t you agree? Like a poorly baked pie, it threatens to crumble.

The market, in its infinite wisdom (or perhaps infinite folly), seems to be suggesting a retreat, a strategic withdrawal, if you will, towards the $2.2K mark. A consolidation, they call it. As if rearranging the deck chairs on the Titanic could somehow change its fate. But who am I to judge? Perhaps a little consolidation is just what this digital beast needs before attempting another, likely futile, leap.

Technical Analysis

The Daily Chart

For a week now, Ethereum has been butting its head against the $2.7K barrier, the 200-day moving average, a line in the sand drawn by the market gods themselves. It seems the sellers, those dour-faced merchants of despair, are firmly entrenched at this level. One can almost hear their cackling as they unload their digital wares.

The upward momentum, that fleeting illusion of progress, has vanished. And now, this double-top formation looms large, a bearish omen if ever there was one. It speaks of profit-taking, of distribution, of the inevitable decline. A short-term corrective phase, they say, targeting $2.2K. A polite way of saying “prepare for a fall.”

This “healthy reset,” as they so optimistically call it, is supposed to attract new buyers, those naive souls who believe they can time the market. It’s meant to provide the “necessary momentum” for another assault on the $2.7K fortress. But let’s be honest, it’s more likely to provide them with a lesson in humility. Ethereum, like a stubborn mule, remains trapped between the 100-day and 200-day moving averages. A bullish breakout? Perhaps. But I wouldn’t bet my samovar on it.

The 4-Hour Chart

Looking at the shorter timeframe, the weakening bullish momentum is as plain as the nose on your face. An ascending wedge, a bearish reversal pattern, has formed. It’s like watching a slow-motion train wreck. The buyers are losing steam, the sellers are gaining ground, and the inevitable crash is just around the corner. And to add insult to injury, a bearish divergence between the price and the RSI indicator confirms the impending doom. Aggressive distribution, they call it. I call it common sense.

If Ethereum breaks below the $2.4K level, a pullback to $2.2K is almost guaranteed. Unless, of course, the market decides to be contrary, as it so often does, and stages an “unexpected breakout.” A short squeeze, they call it. A desperate attempt to defy gravity. But even if it happens, it’s only a temporary reprieve. The fundamental weakness remains.

Onchain Analysis

Ethereum continues to teeter on the edge, below that critical resistance range, leaving investors in a state of perpetual anxiety. Will it break out? Will it collapse? The price action alone offers little clarity, like trying to read tea leaves in a hurricane. But fear not, for the futures market offers a glimpse into the underlying sentiment, those hidden currents that drive the market’s ebb and flow.

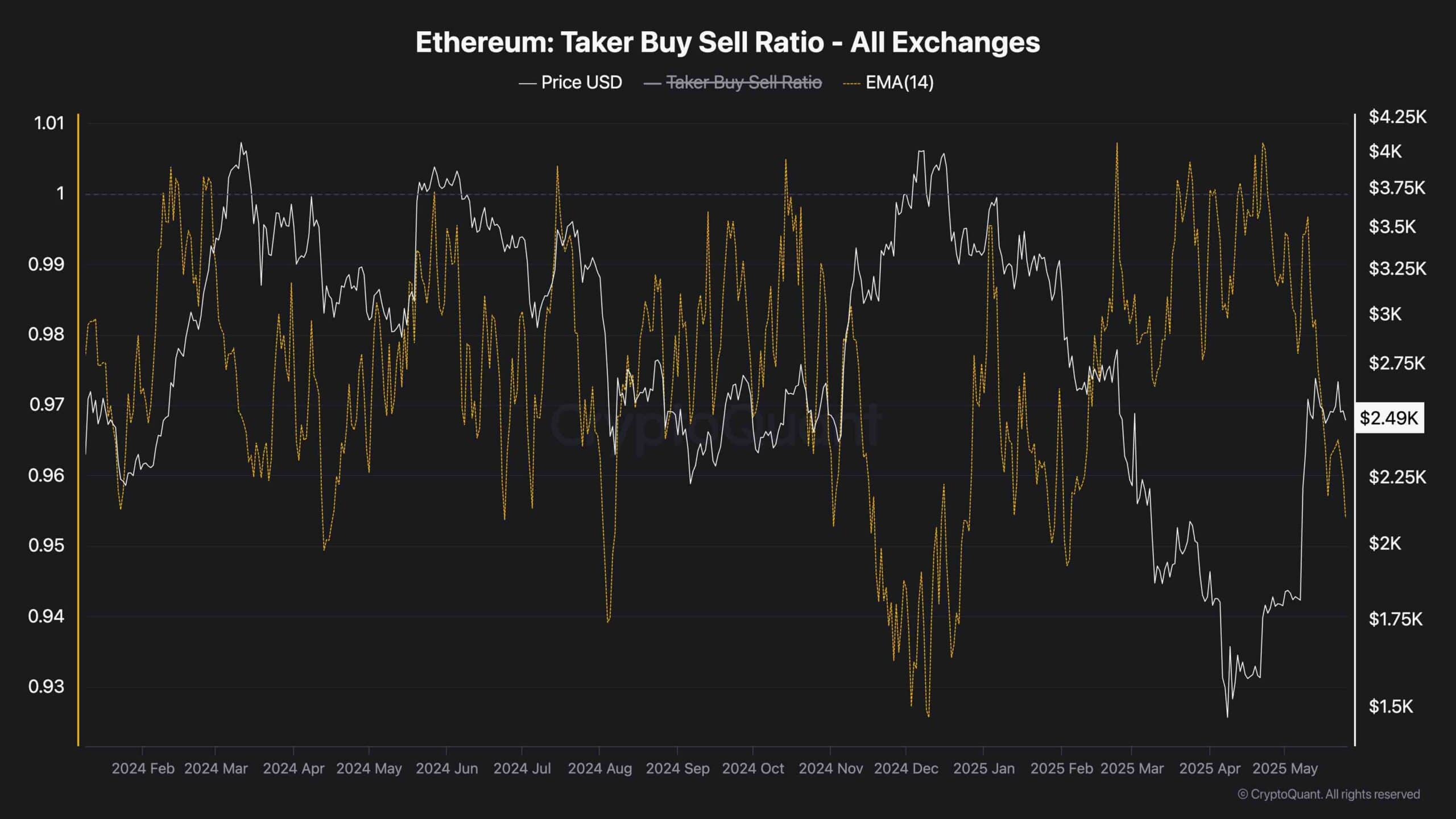

The ETH Taker Buy-Sell Ratio, a most intriguing metric, measures the balance between aggressive buyers and sellers. Aggressive orders, those executed at market price, reveal the true conviction of market participants. Or, at least, their willingness to gamble.

Recently, this ratio has taken a nosedive, indicating a surge in aggressive selling. The bears are back in control, it seems, triggering a wave of profit-taking and distribution. Ethereum, poor thing, is struggling to stay afloat. Like a leaky boat in a stormy sea.

If the selling pressure persists, a deeper correction is inevitable. The $2.2K support level is the likely target. But, and there’s always a but, if this selling is driven by “weak hands,” those easily spooked short-term players, it could be a mere consolidation before the next bullish surge. A “healthy” consolidation, they call it. As if the market cares about your health. 🙄

In short, Ethereum’s fate hangs in the balance. Will the selling momentum intensify, or will it exhaust itself in the face of growing mid-term demand? Only time will tell. But one thing is certain: the market, like life itself, is full of surprises. And often, those surprises are not pleasant. 🤷♂️

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Basketball Zero Boombox & Music ID Codes – Roblox

- Come and See

2025-05-25 12:46