Ah, the week unfolded like a grand tapestry of human folly and ambition, as Bitcoin (BTC) soared to dizzying heights of $111,980. The air was thick with optimism, while the states of the Union danced around their investments like children in a candy store. Meanwhile, the Pi Network, bless its heart, tried to steal the limelight with its price surge, but alas, the spotlight is a fickle friend.

Herein lies a compendium of the week’s most riveting escapades in the crypto realm.

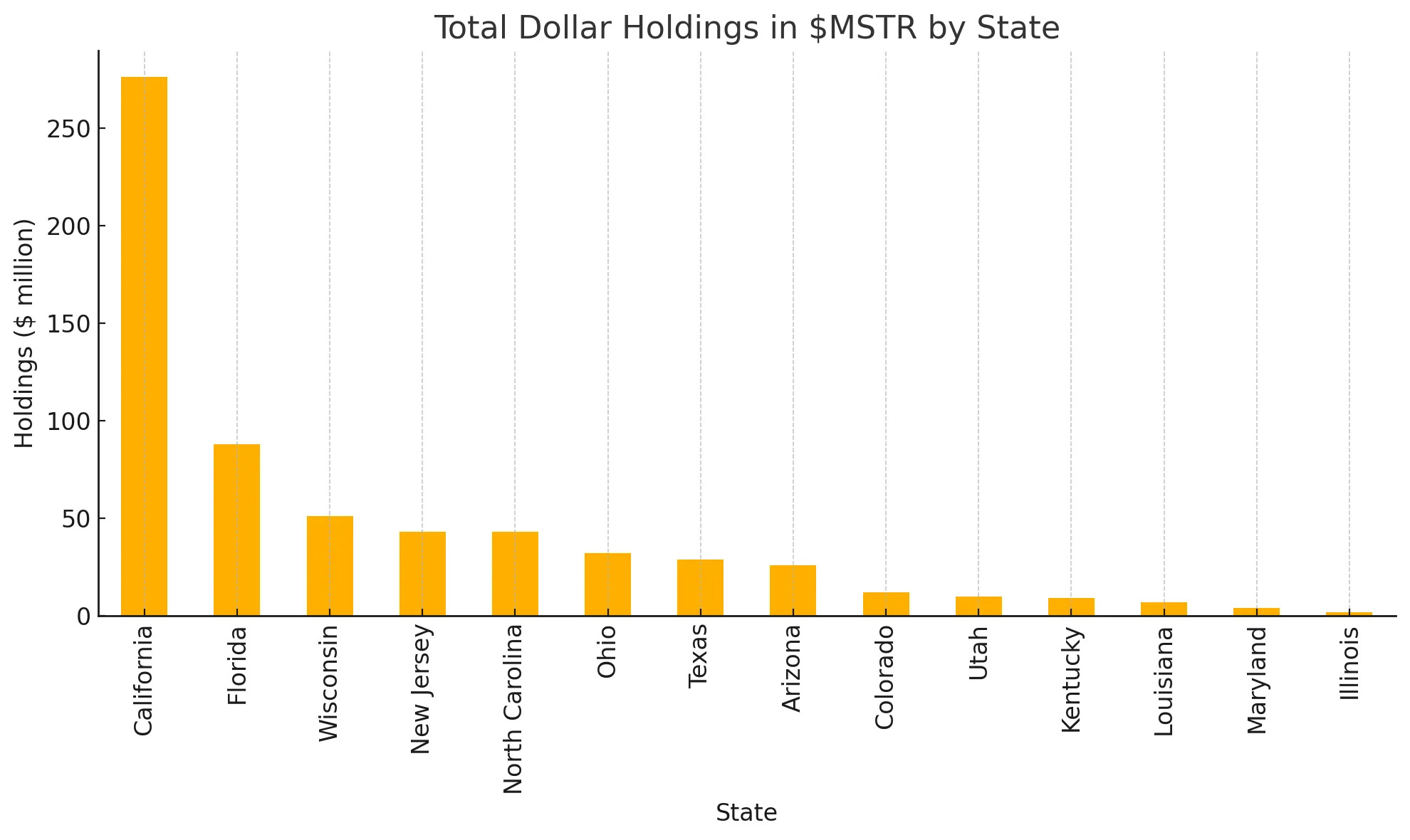

14 US States Disclose $632 Million Stake in MSTR

In a revelation that could make even the most stoic bureaucrat chuckle, 14 US states have collectively amassed a staggering $632 million in MSTR stock. BeInCrypto, the ever-watchful chronicler of our times, reported a 42% increase in these holdings during Q1 2025. Who knew states could be such savvy investors?

“14 US states have reported $632 million in MSTR exposure for Q1, in public retirement and treasury funds. A collective increase of $302 million in one quarter,” proclaimed Julian Fahrer, the founder of Bitcoin Laws, as if announcing a new flavor of ice cream.

Leading the charge was California, with its teachers and public retirement fund clutching $276 million in MSTR shares, followed closely by Florida, North Carolina, and New Jersey. Arizona, despite vetoing a Bitcoin reserve bill, decided to join the party and increase its MSTR holdings. Talk about mixed signals!

Utah and Colorado also joined the fray, with Utah’s holdings skyrocketing by 184%. Meanwhile, the Wisconsin Investment Board, in a move that could only be described as a financial game of musical chairs, sold off its entire $300 million stake in BlackRock’s Bitcoin ETF while boosting its MSTR position by 26%. Oh, the irony!

It seems Strategy, the corporate titan holding 576,230 BTC, has become the go-to for states seeking crypto exposure without the headache of direct ownership. Who needs the hassle when you can just ride the coattails of a corporate giant?

Pi Network’s 86 Million Token Withdrawal from OKX

Ah, the Pi Network! Since its open network launch in late February 2025, it has been the talk of the town. This week, Pi Coin (PI) made headlines with an 11% price increase, thanks to an 86 million withdrawal from the OKX exchange. A classic case of “hold on tight, folks!”

With OKX’s PI token balance dwindling to a mere 21 million, investors seemed to be holding their breath rather than selling. This bullish signal, often associated with confidence, was met with a mix of excitement and skepticism.

“This isn’t just a withdrawal—it’s a POWER MOVE by the Pi community. Scarcity is kicking in, and the market is feeling the heat!” a Pioneer exclaimed on X, as if announcing the arrival of a new superhero.

But, as is often the case in the world of crypto, the high was short-lived. Pi Coin’s value took a nosedive of 4.7% in just one day. At the time of writing, it was trading at $0.79. A rollercoaster ride indeed!

Yet, the Pi Network has faced its fair share of criticism, struggling to secure listings on major exchanges like Binance or Coinbase. Concerns about its token distribution, node centralization, and migration challenges have only added fuel to the fire. The drama continues!

Blum Co-Founder Vladimir Smerkis Arrested in Moscow

In a plot twist worthy of a Russian novel, Vladimir Smerkis, co-founder of the Telegram-based crypto project Blum, was arrested in Moscow on May 18. Accused of ‘large-scale fraud,’ his story is a cautionary tale for the ages.

“The Zamoskvoretsky District Court granted the investigator’s petition for the preventive measure of detention for Vladimir Smerkis, who was arrested in connection with a case of large-scale fraud,” local media reported, as if reading from a script of a tragic play.

In a swift move, Blum distanced itself from Smerkis, declaring he was no longer involved in the project. A classic case of “not my circus, not my monkeys.”

“We would like to inform our community that Vladimir Smerkis has stepped down from his role as CMO and is no longer involved in the development of the project,” Blum’s official statement read, as if trying to erase a bad memory.

Fred Krueger Predicts Bitcoin Could Reach $600,000 by October 2025

This week, Bitcoin took center stage, reclaiming its all-time high of $108,900 after a four-month hiatus. But the excitement didn’t stop there; it peaked at a new record of $111,980. Analysts are now predicting a bright future for Bitcoin, with mathematician Fred Krueger boldly forecasting a price of $600,000 by October 2025. Talk about aiming for the stars!

His prediction hinges on a series of speculative developments set to unfold on July 21, with BTC starting at $150,000. The stakes are high, and the drama is palpable.

“THE FINAL RUN: BITCOIN TO $600,000. Timeframe: 90 days — from Monday, July 21, 2025. Starting BTC: $150,000, Ending BTC: $600,000. Final Gold: $10,400. DXY: Collapses from 96 → 68. US 10Y Yield: Spikes to 9.2% before being ‘frozen’ by the Fed. SPX: Collapses 50%,” Krueger stated, as if reciting a prophecy.

The catalysts for this meteoric rise include a failed US Treasury auction, BRICS nations launching a Bitcoin-backed payment system, and a potential restructuring of the US dollar. The stage is set for a grand performance!

Texas Bitcoin Reserve Bill Passes Key House Vote

In the realm of regulation, Texas’s Senate Bill 21 passed its second House reading with a resounding 105-23 vote. Shortly after, it sailed through the third reading with a vote of 101-42. The bill aims to create a state-level Bitcoin Reserve, pending only Governor Abbott’s signature. Will he sign it? The suspense is palpable!

Governor Abbott, a known pro-crypto advocate, even posted about the Texas Strategic Bitcoin Reserve on his X account. The signs are promising!

“It’s happening. Texas Governor, Greg Abbott, will sign Texas’ Bitcoin Reserve into law. One of the richest states will be buying Bitcoin. Get ready!!!” crypto commentator Kyle Chassé remarked, as if preparing for a grand celebration.

With the Texas Senate session ending on June 2, the clock is ticking. If signed into law, Texas will join New Hampshire as the second US state to establish its own Bitcoin Reserve. The plot thickens!

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Lottery apologizes after thousands mistakenly told they won millions

- Basketball Zero Boombox & Music ID Codes – Roblox

- KPop Demon Hunters: Real Ages Revealed?!

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

2025-05-23 17:47