- Cetus Protocol hacked, causing $260M loss affecting Sui blockchain.

- Sui’s TVL hits $2.2B, showing strong DeFi growth despite recent exploit.

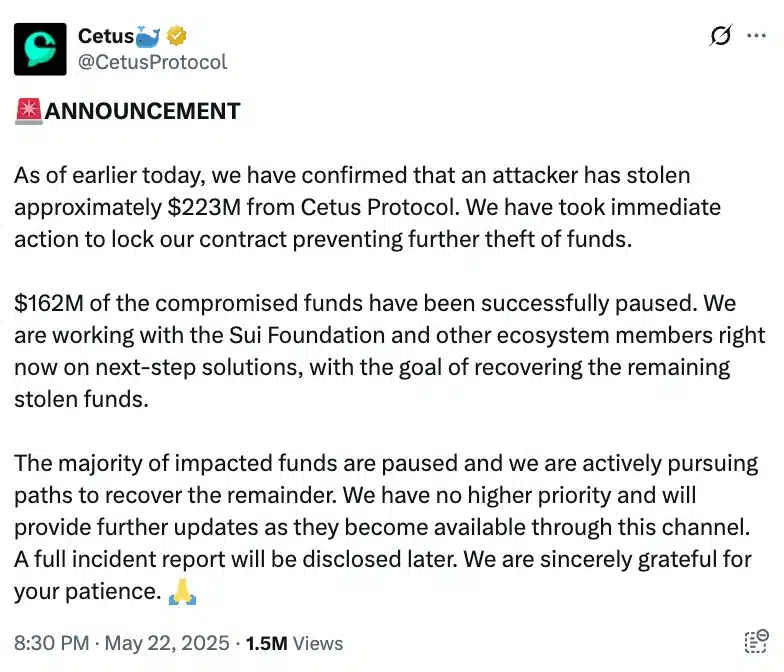

It appears that the leading decentralized exchange and liquidity platform on the Sui blockchain, Cetus Protocol, has allegedly experienced a significant security incident. The reported losses from this breach are estimated to be between $223 million and $260 million.

An unexpected issue, leading to a significant drop of approximately 15% in SUI’s value to $3.90, has created ripples throughout the entire system.

It noted,

Right now, we’re looking into the situation. We’ll share more details about it as soon as our investigation is complete.

During the ongoing investigation, the cryptocurrency community has united, as notable figures in the field such as Binance‘s CZ have expressed their backing for the affected network amidst this challenging period.

Details of the Cetus Protocol hack

Based on findings from Lookonchain, it appears that the recent hack on the Sui’s Cetus DEX can be linked back to a specific wallet labeled as “0xe28b50.

It appears that this particular address has been connected to the suspected hacker who orchestrated the breach, and it currently possesses over 12.9 million SUI tokens, which equates to roughly $54 million in value.

It added,

The hacker is swapping the pilfered assets into US Dollar Coin (USDC) and moving them over to Ethereum network for exchanging into Ether (ETH). Approximately 60 million USDC has been transferred across chains so far.

Widespread impact

Preliminary findings suggest that the culprit took advantage of the Cetus Protocol through the introduction of false tokens like BULLA, which they used to distort pricing models and reserve values within the system.

The individual skillfully maneuvered the balance of assets within liquidity pools by introducing small amounts of liquidity, thereby enabling them to drain actual assets such as SUI and USDC.

Or,

By adding minimal resources to the liquidity pools, the attacker effectively orchestrated a scheme to withdraw real assets like SUI and USDC.

In response, the Cetus team has halted the affected smart contract to prevent further losses.

Due to the consequences of the breach, the Haedal liquid staking platform that operates on the Sui network has temporarily halted its haeVault function. This action was taken because the compromised Cetus liquidity pools are essential for the operation of this feature.

Haedal said,

As a dedicated crypto investor, I prioritize your safety above all else. Rest assured that haeVault will be back online only when all potential risks have been addressed and the system is fully secured for your protection.

After the exploit occurred, various tokens linked to the Cetus Protocol experienced significant declines, with holdings such as LBTC and AXOL almost losing all of their value due to a steep decrease in worth.

Over the course of only six hours, other tokens like LOFI, HIPPO, and SQUIRT experienced a sharp drop of nearly 80%.

Within six hours, there was a significant fall – approximately 80% – for the tokens LOFI, HIPPO, and SQUIRT.

Or: In just six hours, we observed a steep decline of around 80% in the tokens LOFI, HIPPO, and SQUIRT.

Each of these options conveys the same meaning but uses slightly different wording to maintain variety and readability.

Steps taken by Cetus’ team

In the midst of chaos, Cetus managed to freeze approximately $162 million worth of impacted assets, according to the latest information provided in an X update.

Furthermore, the protocol is collaborating with the Sui Foundation and significant ecosystem allies in tracing and retrieving the missing funds that were previously stolen.

Price actions of Tokens on the Sui blockchain

Although there were significant drops in tokens associated with the Sui network – such as CETUS falling almost 30%, HAEDAL decreasing by over 5%, and SUI itself losing more than 7% – the overall perspective for the network remains hopeful.

Or:

Despite the steep fall observed in tokens linked to the Sui network, with CETUS dipping nearly 30%, HAEDAL slipping over 5%, and SUI itself plummeting more than 7%, the outlook for the network as a whole remains encouraging.

Despite SUI trading at levels significantly lower than its January highs, the platform has managed an impressive milestone by locking in a record-breaking $2.2 billion Total Value Locked (TVL) on its blockchain, as of May 22nd.

This staggering 222% increase in annual growth indicates a robust and resilient DeFi ecosystem, implying that Sui’s fundamental solidity could withstand the current market turbulence, hinting at sustained investor confidence.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Lottery apologizes after thousands mistakenly told they won millions

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Umamusume: Pretty Derby Support Card Tier List [Release]

- J.K. Rowling isn’t as involved in the Harry Potter series from HBO Max as fans might have expected. The author has clarified what she is doing

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- Mirren Star Legends Tier List [Global Release] (May 2025)

2025-05-23 14:30