In a universe not so far away, three crypto stocks—Core Scientific (CORZ), Robinhood Markets (HOOD), and Strategy Incorporated (MSTR)—are causing quite the stir today. CORZ has decided to rise like a phoenix after appointing Elizabeth Crain to its Board, all while reinforcing its shift toward the mysterious realm of AI infrastructure. 🦄✨

Meanwhile, HOOD has confirmed a rather extravagant $250 million CAD acquisition of WonderFi, boldly expanding into Canada and preparing to go toe-to-toe with the likes of Wealthsimple. And let’s not forget MSTR, which has just splurged on 7,390 BTC for a staggering $765 million, bringing its total holdings to over 576,000 BTC, all while dodging a class-action lawsuit like a pro. 🎩💰

Core Scientific (CORZ)

Core Scientific (CORZ) closed yesterday with a modest gain of 0.65%—a number that would make a snail proud—and is already up 5% in pre-market trading, thanks to the appointment of the illustrious Elizabeth Crain to its Board of Directors. 🐌💨

Crain, with over thirty years of experience in investment banking and private equity, is like the Yoda of finance, having co-founded Moelis & Company and held senior roles at UBS. She will also Chair the Audit Committee, a position as crucial as a towel in a galactic hitchhiker’s journey, as Core Scientific continues its strategic shift toward AI-related infrastructure. 🤖

Her appointment, along with Jordan Levy’s ascension to Chairman, marks a pivotal moment for the company, enhancing its leadership team amid a broader transition in business focus and operations. Talk about a makeover! 💄

CORZ’s chart is showing signs of renewed strength, with a potential golden cross forming on its EMA lines—no, not a religious experience, just a bullish signal! Analyst sentiment remains overwhelmingly bullish—16 out of 17 analysts rate the stock as either a “Strong Buy” or “Buy,” with a one-year price target averaging $18.28, representing a 68.49% potential upside. 🚀

If momentum holds, the next key resistance level is $13.18, which could be tested in the short term. However, investors should keep an eye on support at $10.34; if it fails, the stock may retrace to $9.45 or even $8.49. It’s like a rollercoaster, but without the safety harness! 🎢

Robinhood (HOOD)

Robinhood has officially announced its $250 million CAD acquisition of Toronto-based WonderFi, signaling a major step in its Canadian expansion strategy. 🍁

The deal, which offers a 41% premium over WonderFi’s last closing price, will bring WonderFi’s 115-person team and established crypto brands—Bitbuy, Coinsquare, and SmartPay—under Robinhood Crypto’s umbrella. It’s like a crypto family reunion, but with more spreadsheets! 📊

The acquisition is set to close in the second half of 2025 and is expected to significantly bolster Robinhood’s crypto presence in Canada. 🥳

Robinhood Crypto executive Johann Kerbrat recently emphasized the company’s focus on tokenization and financial accessibility, highlighting how fractionalized assets like real estate can open up previously inaccessible markets to everyday investors. It’s like giving everyone a slice of the pie, but without the calories! 🥧

The company submitted a 42-page proposal to the SEC seeking a federal framework for tokenized real-world assets. It aims to bring traditional financial markets on-chain with legally recognized asset-token equivalence. Because why not complicate things further? 🤷♂️

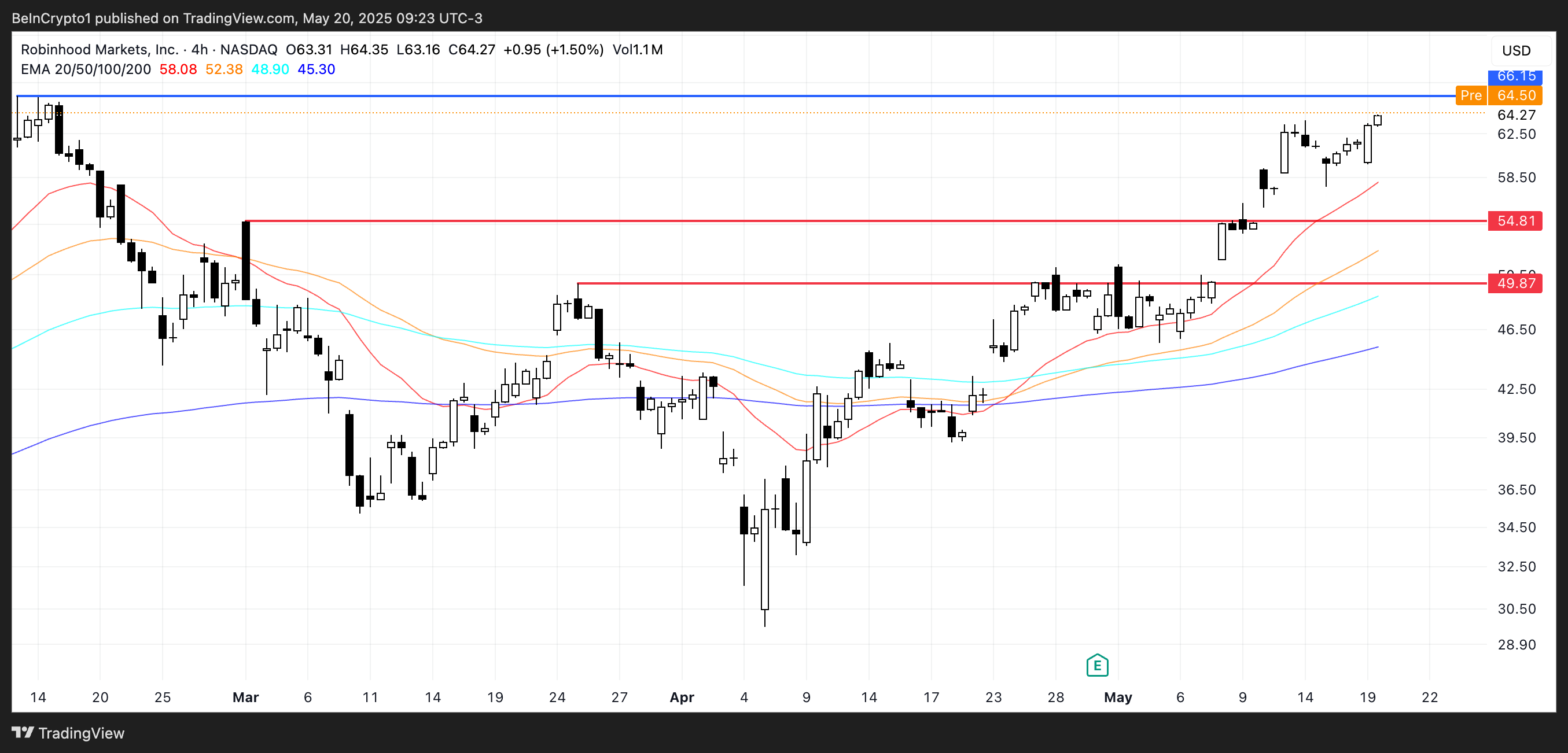

HOOD shares closed up 4% yesterday and are up slightly in pre-market trading, extending a remarkable 56% rally over the past 30 days. Technically, the stock’s chart shows strong momentum, with its short-term EMA lines clearly above the long-term trend—suggesting sustained bullish sentiment. 📈

The next key resistance sits at $66.15; a clean break above that could push HOOD into uncharted territory, surpassing the $70 mark for the first time and establishing new all-time highs. It’s like reaching the final level of a video game! 🎮

Strategy Incorporated (MSTR)

Strategy (formerly MicroStrategy) has added another 7,390 BTC to its corporate treasury, spending approximately $765 million as Bitcoin traded above $100,000. It’s like buying a yacht with Monopoly money! 🛥️

This latest accumulation brings its total holdings to 576,230 BTC—acquired for $40.2 billion—now valued at over $59.2 billion, reflecting an unrealized gain of roughly $19.2 billion. However, the aggressive Bitcoin strategy continues to attract scrutiny, like a cat in a room full of rocking chairs. 🐱

The company and its executives, including Executive Chairman Michael Saylor, have been hit with a class-action lawsuit alleging they misrepresented the risks tied to their Bitcoin-centric investment approach. Because who doesn’t love a good legal drama? 🎭

Strategy is still the largest corporate holder of Bitcoin, despite legal pressure. Its Bitcoin-first approach has inspired similar treasury strategies in Asia and the Middle East. Talk about setting trends! 🌍

MSTR closed yesterday up 3.4% and is down 0.47% in the pre-market. The stock is up nearly 43% in 2025. It is trading near key support at $404; if lost, it could fall to $383. It’s like a game of Jenga, but with money! 🏗️

If momentum returns, MSTR could rise to $437. Analyst sentiment is strong—16 out of 17 rate it a “Strong Buy” or “Buy.” The one-year average price target is $527, implying a 27.5% upside. It’s like finding a hidden treasure map! 🗺️

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Lottery apologizes after thousands mistakenly told they won millions

- Basketball Zero Boombox & Music ID Codes – Roblox

- KPop Demon Hunters: Real Ages Revealed?!

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-05-20 18:58