Circle’s USDC, like a determined sprout pushing through concrete, and Tether’s USDT, the old oak stubbornly rooted, remain the titans of the stablecoin forest. 🌳 In the year 2025, a year shimmering with digital promise (or perhaps just more digital noise 🙉), USDC shows signs of a vigorous spring, its volume and market share swelling like a river after a thaw. Yet, ah, the irony! It still trails behind USDT, the market leader, that behemoth basking in its own inertia.

This article, a humble offering to the data gods, examines key data on USDC from Kaiko’s latest pronouncements, evaluating USDC’s position in the stablecoin market – a market as competitive as a flock of pigeons fighting over a discarded crust. 🕊️

Can USDC, the upstart, truly unseat USDT, the established monarch, on the hallowed grounds of centralized exchanges? A question for the ages! (Or at least, for the next quarterly report.)

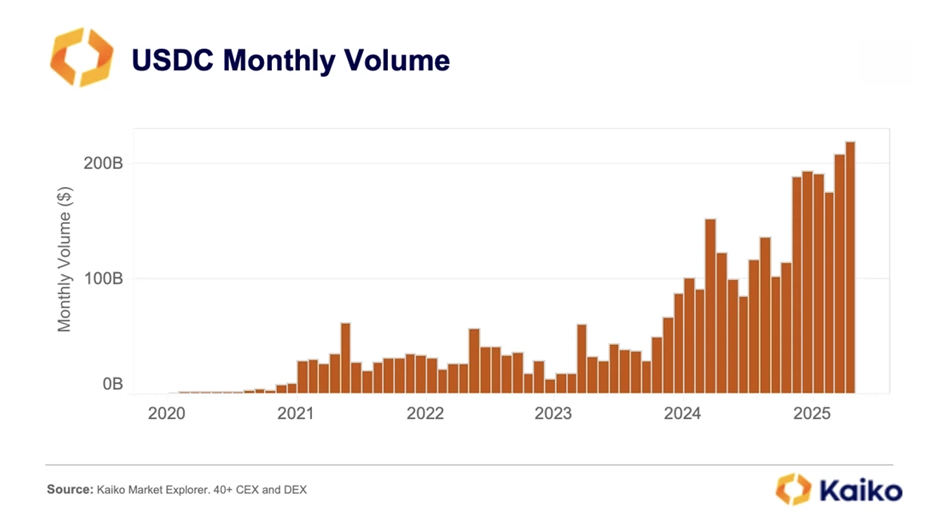

According to the scribes at Kaiko Research, USDC, in a burst of digital exuberance, reached a new record in trading volume: $219 billion in April 2025. A figure, mind you, more than double the $106.5 billion recorded in January 2024. Such growth! One almost suspects alchemy. ✨

Binance, that sprawling bazaar of crypto delights, played a crucial role. Thanks to a strategic agreement signed with Circle in December 2024, it accounted for over 57% of USDC’s global trading volume. A deal, no doubt, sealed with handshakes and promises whispered in the language of algorithms. 🤝

Kaiko’s data, those cold, hard numbers, indicate that USDC’s market share among stablecoins on Binance increased from 10% at the end of last year to nearly 20% today. A doubling! A triumph! Or perhaps just a statistical anomaly waiting to be corrected. 🤔

In contrast, USDT’s market share on Binance, like a fading star, decreased from 75% at the end of 2024 to approximately 60% today. The old guard falters! But is it a true decline, or merely a strategic retreat? 🤷

Two main factors, like twin pillars supporting a rickety structure, explain this impressive growth in USDC’s volume and share. First, the partnership with Binance, granting USDC access to a vast, teeming user base. A captive audience, one might say. 😈

Second, USDC benefited from the growing demand for regulatory-compliant stablecoins, especially in Europe, where the MiCA framework, that bureaucratic behemoth, is now in effect. Compliance! The price of admission to the grown-up table. 🍽️

“The deal is also highly profitable for Binance, with Circle paying over $60 million upfront plus ongoing incentives, while aligning with Binance’s compliance push under Europe’s MiCA rules.” – Kaiko reported. Ah, the sweet music of money changing hands! 🎶

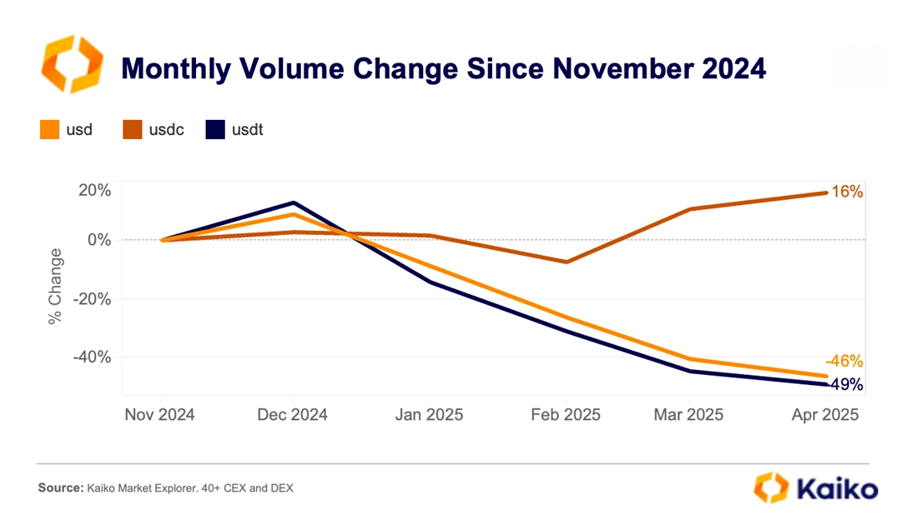

Additionally, when comparing the volume changes between USDC and USDT during the same period, USDC stands out as the stronger performer. A veritable digital athlete! 🏃♀️

Since November 2024, USDT’s monthly volume has dropped by 49%. A precipitous fall! In contrast, USDC’s volume has increased by 16%. A modest gain, perhaps, but a gain nonetheless. 📈

“While USDC is gaining momentum on centralized exchanges, Tether’s USDT is facing headwinds. USDT trading volumes on CEXs have dropped sharply… mirroring a broader contraction in USD-denominated trading activity. This decline reflects persistent risk-off sentiment, weaker retail engagement, and limited speculative appetite across crypto markets.” – Kaiko explained. A somber assessment! The market, it seems, is a fickle mistress. 💔

Despite USDC’s growth, it still has a long way to go before it catches up with USDT. As of May 2025, USDT’s market capitalization is $152 billion, 2.3 times higher than its market cap in July 2022. A mountain to climb! ⛰️

Meanwhile, USDC’s market cap is $60 billion, only 12% higher than its July 2022 level. A respectable increase, but hardly earth-shattering. 🌍

Tether, the company behind USDT, also reported outstanding profits. It earned $13 billion in 2024, compared to Circle’s $155 million over the same year. A vast disparity! The spoils of war, perhaps? 💰 In addition, USDT still dominates in off-exchange applications, especially in cross-border payments. The old ways die hard. 💀

USDC and USDT continue to be the top stablecoins. However, the stablecoin space could change quickly as new competitors emerge. Major financial institutions like PayPal, World Liberty Financial, Fidelity, Ripple, BlackRock, and Meta have entered the competition. The game, as they say, is afoot! 🕵️♂️

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- KPop Demon Hunters: Real Ages Revealed?!

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- Mirren Star Legends Tier List [Global Release] (May 2025)

- MrBeast removes controversial AI thumbnail tool after wave of backlash

2025-05-20 06:11