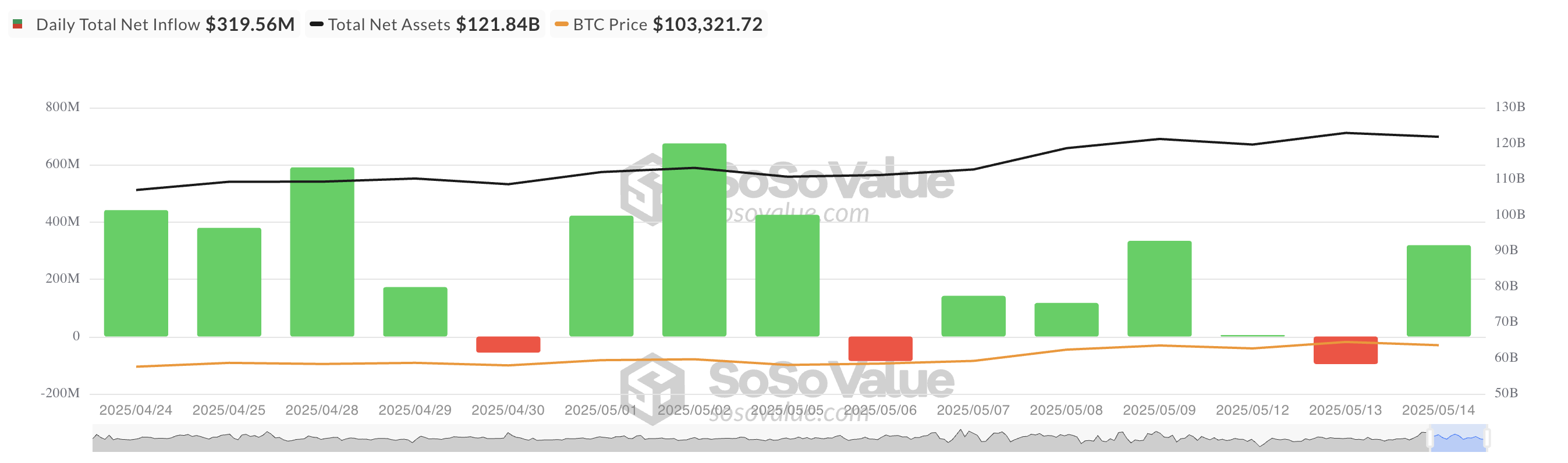

Wednesday rolls around, and suddenly, boom—over $315 million shoots into US-listed Bitcoin ETFs. Just yesterday it was outflows—$96 million running for the hills. Today? The herd’s stampeding in like there’s free brisket. 🏃💸

Investors are feeling bullish, which is funny because Bitcoin’s price actually dipped Wednesday. Little drop, everybody goes wild buying. Classic. Are people seeing numbers upside down now?

$319 Million Floods Into BTC ETFs, Because Why Not?

Not a single one of the twelve spot BTC-backed ETFs reported an outflow. Not one! According to SosoValue—not exactly the name you trust with your life, but still—these funds took in $319.56 million. Best day in weeks! Is it FOMO? Is it common sense? Do people even know?

Apparently, retail investors and institutional suits are both getting in because, hey, maybe buying Bitcoin on sale is the move? Or maybe everyone’s just copying everyone else. Yesterday’s “run for the exits” is today’s “buy the dip,” like it’s Black Friday in crypto-land.

BlackRock’s IBIT ETF scored the jackpot: $232.89 million in net inflow. The whole time it’s existed has brought in $45.01 billion—must be nice. Fidelity’s FBTC? Came in second with $36.13 million yesterday, total life haul: $11.65 billion. But who’s counting? (Seriously, who’s counting at this point?)

Bitcoin Price Slinks Down, But the Cheerleaders Haven’t Left

BTC lounging around at $102,413—a tiny 1% drop. Is anyone concerned? Nope, markets are still chanting for Team Bull even while prices sneak down the stairs.

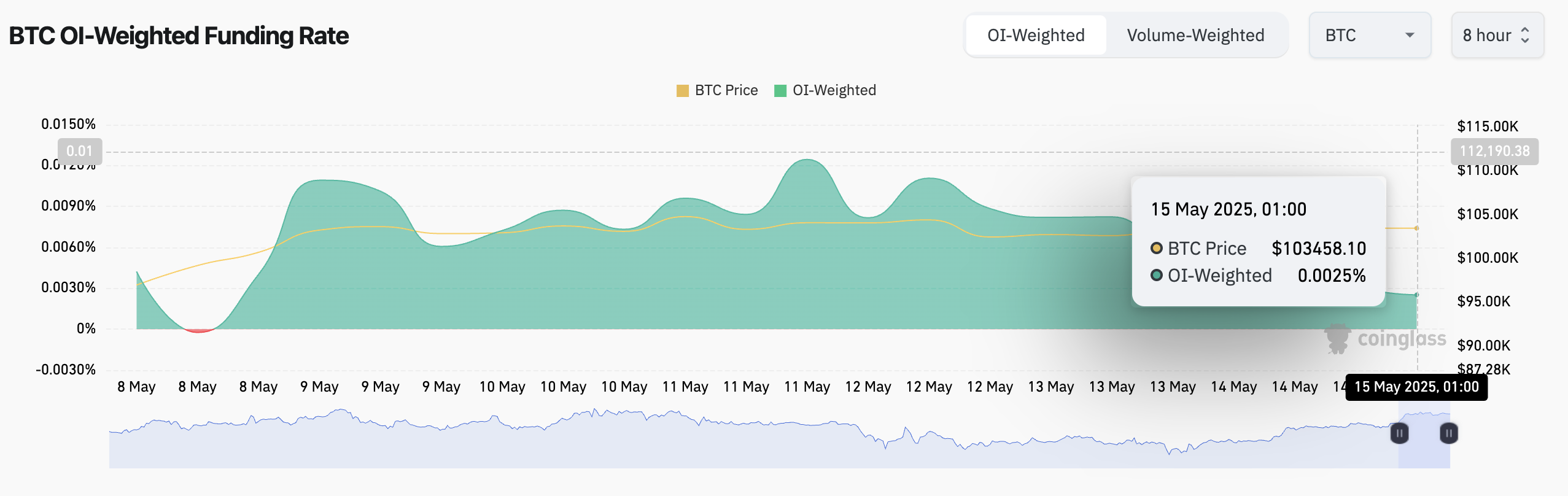

For nerds who care: the funding rate on perpetual futures is still positive—0.0025%—which means traders are actually paying more just to stay in those long positions. That’s commitment. Or maybe delusion. You pick. 😏

Funding rate: it’s this payment traders swap to make sure futures don’t go off la-la land compared to spot prices. If it’s positive? Longs pay shorts. So good news for the optimists out there—if you ignored your checking account long enough, you’d feel pretty bullish too.

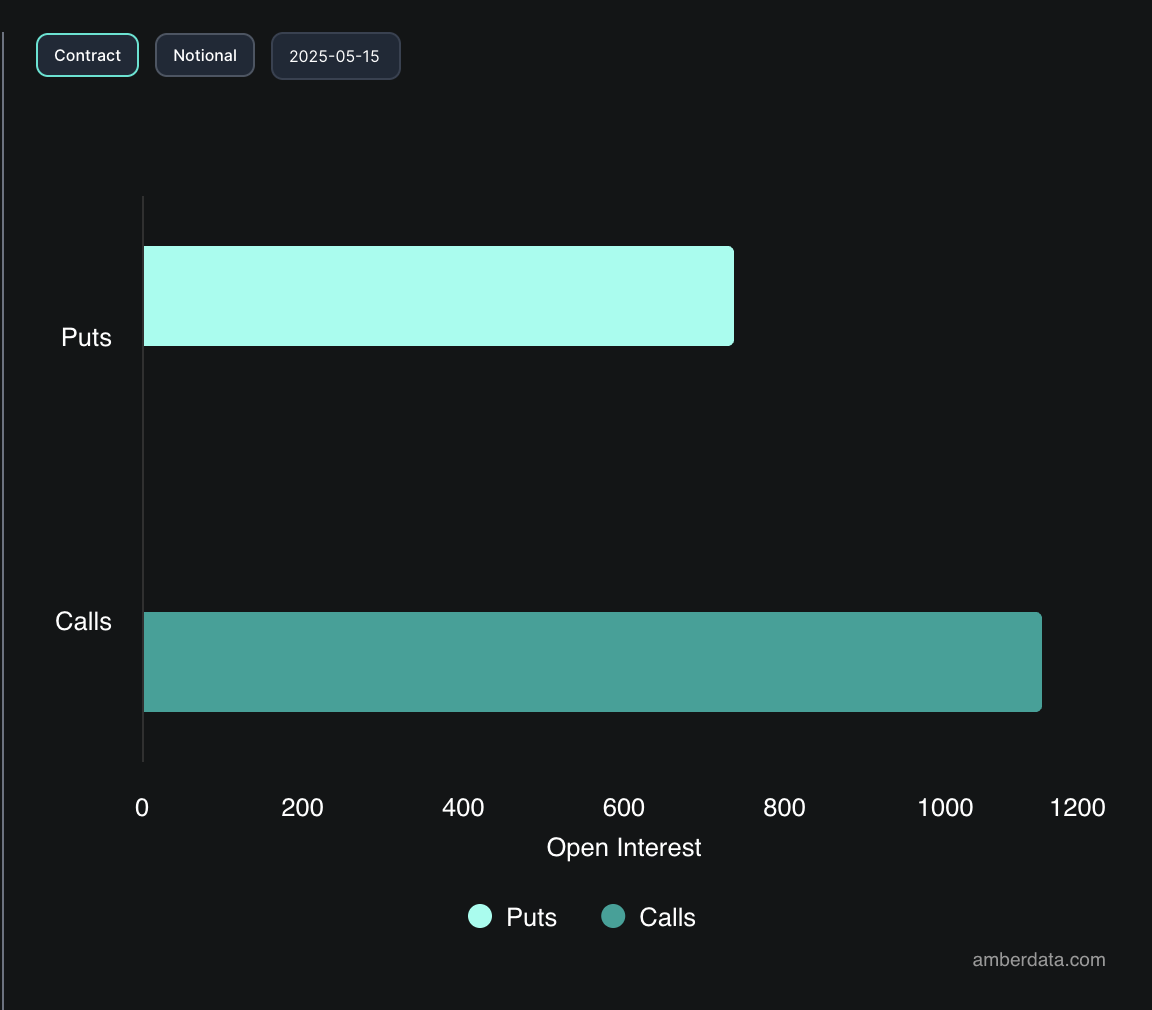

Options traders are chasing calls over puts, so clearly there’s more “to the moon” excitement. Or maybe they lost a bet—hard to tell with these people.

Bottom line: Big money is jumping in while Bitcoin’s on sale. Are they buying the dip or just buying themselves something to talk about at dinner parties? Either way, it’s a show. 🍿

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Mirren Star Legends Tier List [Global Release] (May 2025)

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Death Stranding 2 Review – Tied Up

- How to Cheat in PEAK

- Pacers vs. Thunder Game 1 Results According to NBA 2K25

2025-05-15 10:41