If you thought blockchain was complicated before, meet Sui: it’s making Solana feel insecure and other Layer-1s need a nap. 😎

The world of Sui is bustling with developers, DeFi degens, and the sort of pragmatic opportunists who look at “real-world Web3 applications” and see an opportunity for actual use, not just elaborate proof-of-concept PowerPoints.

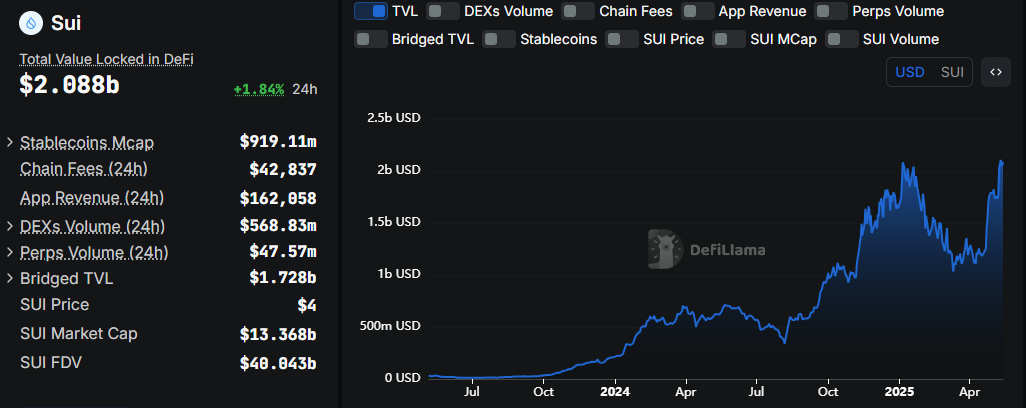

Sui TVL: Up, Up, and to the Right (Mostly)

According to DefiLlama—a fine institution, if your llama is into numbers—the total value locked (TVL) on Sui recently pogo-sticked to $2.1 billion. Sure, it’s down a smidge to $2.088 billion as of this typing, but anyone who’s stared at a crypto chart knows that’s basically a rounding error. It’s also a 17% rise from May’s ‘nobody loves me’ moment.

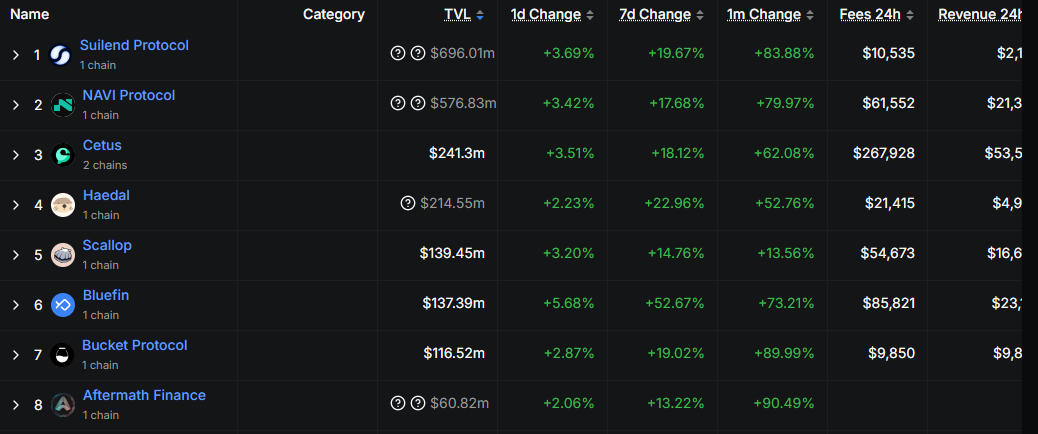

The real stars are Sui-based lending protocols, where TVL spiked almost 79% in a month. Why? Because people love incentives, strong yields, and the chance to pretend they’re a hedge fund manager while sitting in pyjamas. The poster child here is the NAVI Protocol, which fancies itself Sui’s loan shark (but legal, and without the need for a goon named Big Tony).

NAVI’s token, NAVX, scored a listing on Binance Alpha after debuting on OKX. This is the blockchain equivalent of getting invited to two parties in one week—by people who actually matter. NAVI took to X (the artist formerly known as Twitter) to shout about it with the gusto of someone who’s just found an extra chip at the bottom of the bag:

“NAVX listed on Binance Alpha! NAVX is picking up momentum. After the recent listing on OKX, the native token of the NAVI DeFi Ecosystem is getting its spotlight on Binance Alpha. NAVI brings groundbreaking DeFi on Sui to Binance Alpha users, with Lending/Borrowing, Liquid Staking, and Trading,” NAVI protocol celebrated, no doubt accompanied by interpretive dance (unconfirmed).

Binance chimed in, promising SUI ecosystem airdrops for active traders—because who doesn’t love free* money (*tax consequences may apply, please see your accountant, or your local wizard)?

“Low slippage on Binance makes NAVX a top choice for farming Alpha Points,” noted a Navi Protocol ambassador, who presumably farms alpha points in their spare time under the light of a full moon.

Bottom line: these listings are juicing NAVX’s liquidity and giving Sui’s DeFi scene the sort of glow-up that other blockchains write moody poetry about.

A Blockchain Walks Into a Bar… And Orders Real-World Applications

Elsewhere on Sui, it’s not just about shifting imaginary coins between wallets faster than a pickpocket at a wizarding convention. Real-world applications are cropping up, particularly in loyalty and commerce—a place where blockchain actually solves something that isn’t just a blockchain problem.

Mojito (best name for a Dapp if you ask me), moonlights as the infrastructure behind NFT marketplaces for the likes of Sotheby’s and Mercedes-Benz, presumably because “random JPEG peddler” didn’t test well with luxury brands. Mojito Loyalty has arrived, a gamified platform powered by Sui that lets brands offer rewards and on-chain engagement tools to users. No extra wallets, no third-party dashboards, no arcane hand gestures required. 🍸

Since Sui is faster and cheaper than arguing with a troll, Mojito can handle real-time user engagement at scale. Even Product Directors are getting excited (which is rare—normally they just ask for more slides):

“Mojito Loyalty is a strong example of what’s possible when Web3 infrastructure is built with user experience at its core…We’re excited to see more projects building on Sui adopt Mojito Loyalty… and set a new bar for what on-chain engagement can look like,” beamed Lola Oyelayo-Pearson of Mysten Labs, provoking spontaneous applause from at least one intern.

Mojito CEO Neil Mullins says the loyalty market could be worth $155 billion by 2029, which is almost enough to buy a small country, or at least bribe your way into a very good table at Davos. Mojito’s “white-label, customizable solution for Web3” is out to eat the lunch of legacy CRMs, and probably their dessert as well.

Launch partners like Cur8 are boasting about results—over 1,400 users finished missions and grabbed rewards in a few weeks. That’s 1,399 more than the average blockchain game.

Sui’s DeFi party is popping (see: NAVI), real-world partners are showing up (see: Mojito), and as TVL moves up, Sui is out to prove that if you blend scalability, low fees, and end-user experience, you wind up with adoption and not just a bunch of philosophers arguing about block size on Discord.

But, because nothing in crypto can ever make sense for more than three minutes, the price of SUI itself only moved up 0.86% in the past 24 hours. At $4.00, SUI remains stubbornly less volatile than your favourite meme coin—but at least you can say you were here before it was cool. 😏

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Pacers vs. Thunder Game 7 Results According to NBA 2K25

- Pacers vs. Thunder Game 1 Results According to NBA 2K25

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- League of Legends MSI 2025: Full schedule, qualified teams & more

- Basketball Zero Boombox & Music ID Codes – Roblox

2025-05-14 12:18